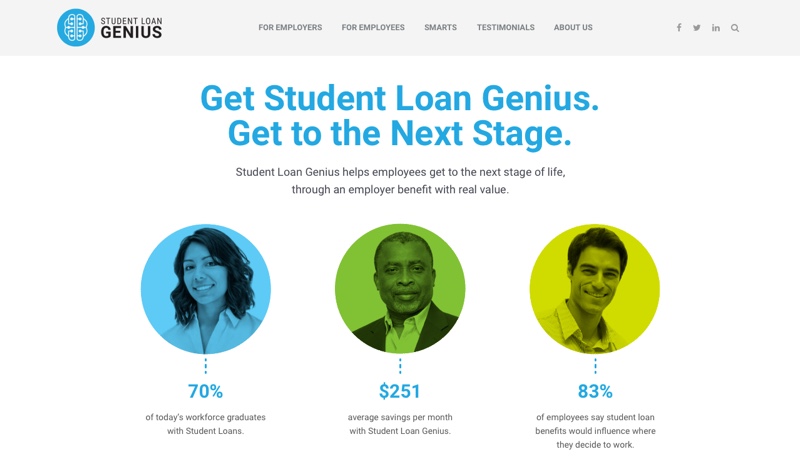

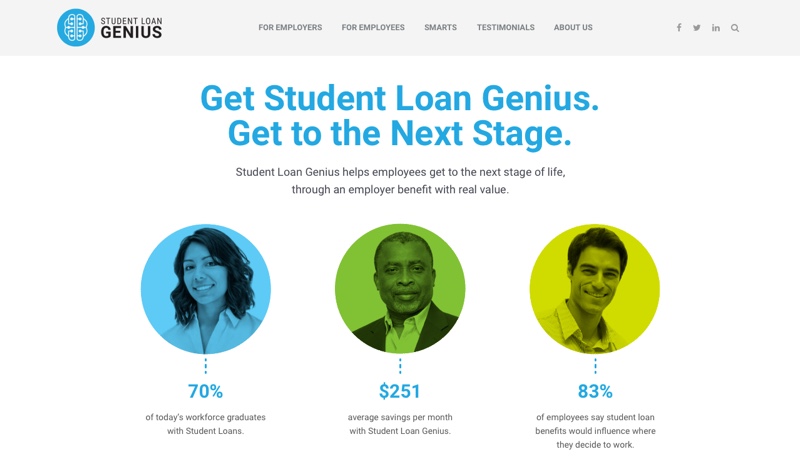

A generation ago, employers were enlisted in the movement to help employees save for their retirement. Today, Student Loan Genius is inviting employers to do the same thing when it comes to millennial workers and student loan debt. The Austin, Texas-based startup has built a platform that allows employers to match their employee’s student debt payments, as well as help them manage the balance between paying off debt and saving for retirement.

“We are working with great organizations like Teach for America, Twilio, BP3 in Austin to help shave off tens of thousands of their student loans,” Student Loan Genius founder and CEO Tony Aguilar said. Aguilar, who was the first person in his family to go to college, is also the first person in his family to be saddled with potentially crushing student loan debt. He even carries the amount—$100,000—etched on a business card.

Left to right: Co-founders Emiliano Villarreal and Tony Aguilar demonstrated Student Loan Genius’s Genius Match 401k Contribution feature at FinovateSpring 2016 in San Jose.

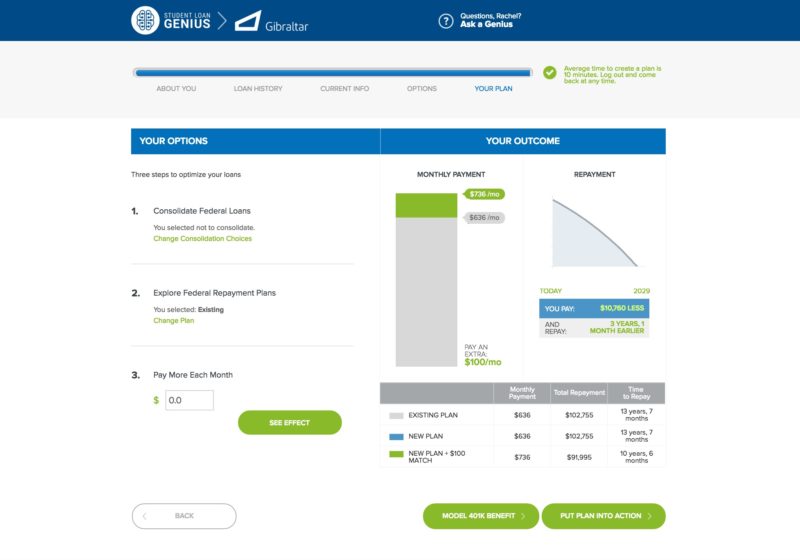

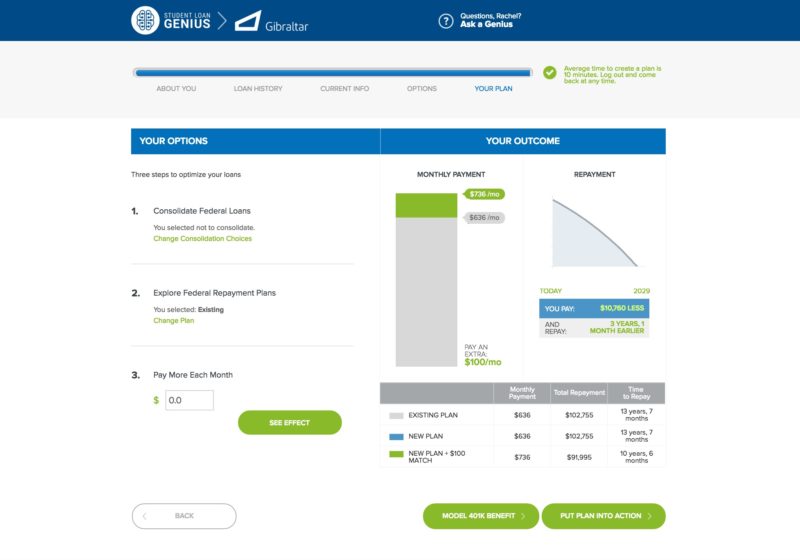

The Student Loan Genius solution is straightforward. Clients create an account on its website and answer a set of questions to provide basic information to see what possible repayment programs may be available (i.e., veterans discounts, better terms based on higher credit score, etc.). The platform pulls data from outstanding student loans from various loan servicers and uses algorithms to determine the optimal repayment plan. The plan also projects forward so the student can see the difference in savings between repayment alternatives.

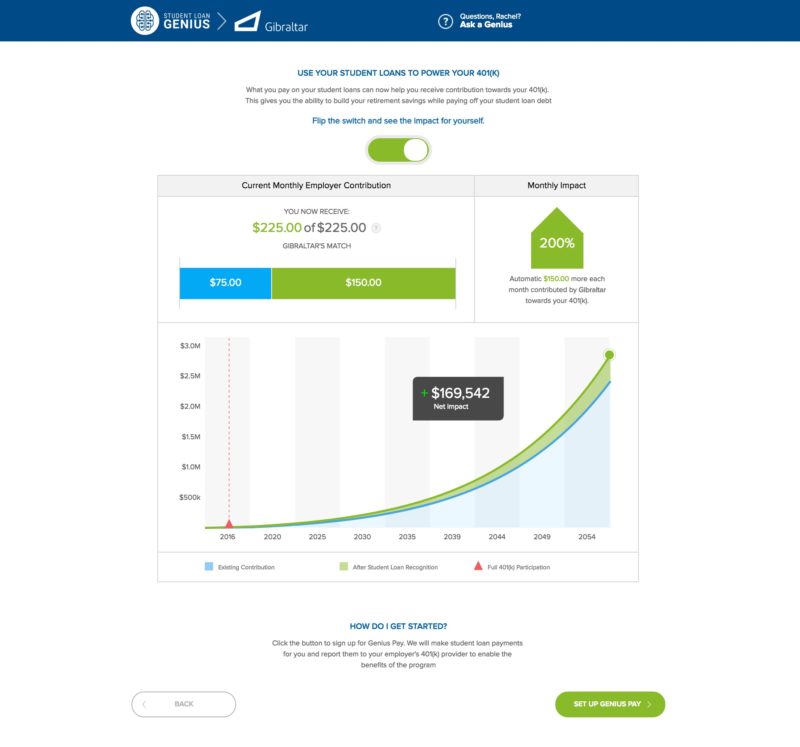

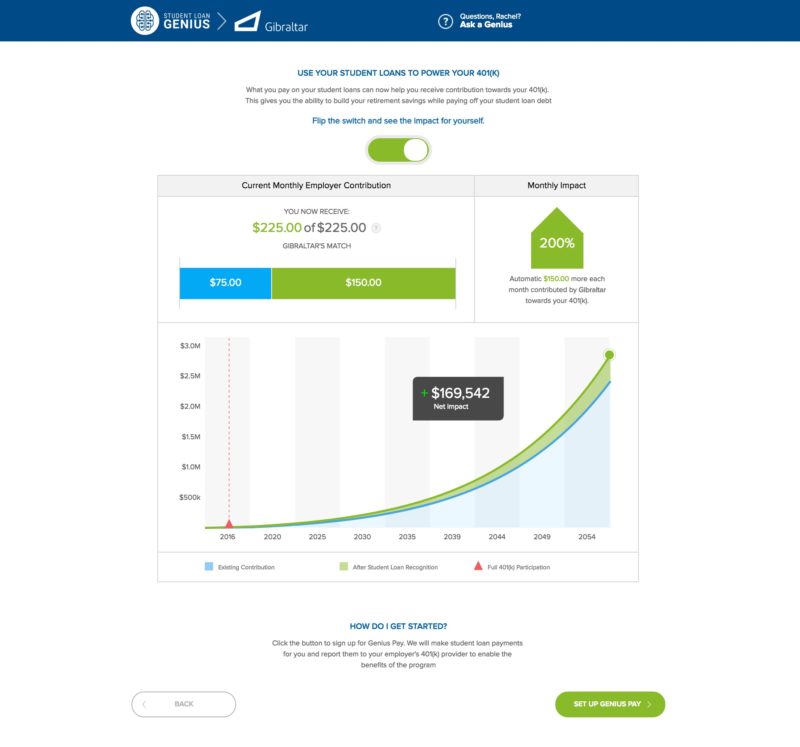

At FinovateSpring, Student Loan Genius unveiled its Genius Save feature. This feature helps clients manage the challenge of trying to repay debt and save at the same time. Genius Save, as Aguilar explained it, allows companies to attach a student loan benefit to their 401(k) contribution. This enables young workers in particular to focus on paying back debt as quickly as possible, while not losing out on the benefits of saving for retirement as they begin earning an income. “With the flip of a switch,” Aguilar said of his hypothetical millennial employee during his FinovateSpring presentation earlier this year, “she’ll have an additional $170,000 at retirement just by doing what she does every single month: pay her student loans.” Student Loan Genius estimates an average annual savings of more than $3,000 with its platform.

Student Loan Genius is in the process of rolling out pilot projects with financial services companies like Prudential. Just this week Student Loan Genius announced a new partnership with TrendKite, a PR analytics firm that will offer the Student Loan Genius benefit to all of its employees and their immediate family members. “For us, taking care of our team means reaching outside of our office walls and doing whatever we can to make [our employees’] lives better,” VP of People at TrendKite Jennifer Cantu said. “When we saw the data, we knew student loan benefits were a requirement, not an option.”

Company facts:

- Founded in 2013

- Headquartered in Austin, Texas

- Employs 14

- Investors include Gibraltar Ventures, Kapor Capital, Capital Factory, and Village Capital

- Provides benefits to 45 organizations in the United States

We spoke by phone with Student Loan Genius Director of Marketing and PR Jovan Hackley during FinovateSpring 2016 and followed up with a few questions by email.

We spoke by phone with Student Loan Genius Director of Marketing and PR Jovan Hackley during FinovateSpring 2016 and followed up with a few questions by email.

Finovate: What problem does Student Loan Genius solve?

Jovan Hackley: Our Genius Platform helps companies and employees significantly reduce the nation’s nearly $1.3 trillion in student loan debt that the Congressional Budget Office projects will double to $2.4 trillion by 2024.

Finovate: Who are your primary customers?

Hackley: Our primary customers are companies and our users are their employees with student loan debt.

Finovate: How does the Student Loan Genius platform tackle the problem of student loan debt?

Hackley: The Student Loan Genius Platform is the only holistic solution for helping employees pursue freedom from student loan debt. The platform includes:

- Genius Advisor [enables] online tool access and one-on-one advising to help employees find the best repayment plan and scenario for their goals.

- Genius Pay lets employees make student loan payments directly from payroll

- Genius Match allows employers to make a direct contribution toward paying down an employee’s student debt.

- Genius Save helps employees increase their funds/401k by using their student loan payment as a trigger.

Overall, the benefit helps employers attract and retain top talent and helps employees pay down student loans.

Finovate: Do you have a favorite feature of the platform?

Hackley: My favorite part of our technology is Genius Save, which not only helps build wealth, but also shows employees the long-term impact of reducing their student debt.

Finovate: What in your background gave you the confidence to take on this challenge?

Hackley: Our CEO is a former financial planner who helped millennials achieve financial wellness. The spreadsheets, insights, and presentation he developed were the foundation for helping the thousands of users we work with today.

Finovate: What are some upcoming initiatives from Student Loan Genius that we can look forward to over the next few months?

Hackley: Over the next few months, we’ll be sharing how some of the largest companies and partners are leveraging student loan benefits to create financial wellness. This is in addition to a few new platform/benefit enhancements.

Finovate: Where do you see Student Loan Genius a year or two from now?

Hackley: Our aim is to be the student-loan benefit-provider for companies across the nation and a key player in creating the legislative progress that ends the personal financial crisis of student [debt] that faces millions of Americans.

Check out the demo video from Student Loan Genius

The irony is that mobile devices excel at both of these functions, without the cost and inefficiency of paper. All that is needed is an intermediate layer. And that layer is Walletron. “There is a new communication channel in these wallets,” Baird said. “[It’s] very easy for brands to get up and running. [And] billing data is all Walletron needs.”

The irony is that mobile devices excel at both of these functions, without the cost and inefficiency of paper. All that is needed is an intermediate layer. And that layer is Walletron. “There is a new communication channel in these wallets,” Baird said. “[It’s] very easy for brands to get up and running. [And] billing data is all Walletron needs.”

Achanta comes to Neustar after working as Chief Data Officer for Walmart since 2014 where he was responsible for enterprise-wide data and analytics delivery and platforms. Before that, Achanta served as SVP, global head of analytics and big data at AIG; vice president of enterprise data services at Capital One; and VP, global product development and delivery for Experian. Achanta has a bachelor of science in computer science and systems engineering from Andhra University; and MBAs from the National University of Singapore and the UCLA Anderson School of Management. In his role as chief data and analytics officer for Neustar, he will report to company CEO and president, Lisa Hook, who called Achanta “uniquely qualified to lead Neustar’s data science innovations.”

Achanta comes to Neustar after working as Chief Data Officer for Walmart since 2014 where he was responsible for enterprise-wide data and analytics delivery and platforms. Before that, Achanta served as SVP, global head of analytics and big data at AIG; vice president of enterprise data services at Capital One; and VP, global product development and delivery for Experian. Achanta has a bachelor of science in computer science and systems engineering from Andhra University; and MBAs from the National University of Singapore and the UCLA Anderson School of Management. In his role as chief data and analytics officer for Neustar, he will report to company CEO and president, Lisa Hook, who called Achanta “uniquely qualified to lead Neustar’s data science innovations.”

We spoke by phone with Student Loan Genius Director of Marketing and PR Jovan Hackley during FinovateSpring 2016 and followed up with a few questions by email.

We spoke by phone with Student Loan Genius Director of Marketing and PR Jovan Hackley during FinovateSpring 2016 and followed up with a few questions by email.