FinovateAsia 2017 is almost here! And we can’t wait to show you the new features we’ve added to this year’s event.

In addition to our signature, 7-minute live technology demonstrations on Tuesday and Wednesday, FinovateAsia will also include keynote addresses and panel discussions. Topics covered range broadly from P2P lending and payments, mobile banking, wealth management, and the rise of artificial intelligence. We will also take a look at some of the leading fintech accelerators and incubators in Asia in a special showcase on Wednesday.

So if that sounds like a great opportunity to learn more about fintech in the Far East, here are a few last minute details to ensure you are able to make the most of your time at FinovateAsia this year.

First, know that FinovateAsia 2017 is a two-day fintech conference featuring some of the most innovative companies and technologies developing and marketing solutions for the Asia-Pacific market. With more than 450 attendees and more than 30 presenting companies, each day will feature a combination of both live fintech demonstrations as well as keynotes and panel discussions. Our single track format means you will be able to see every minute of every presentation. Check out our agenda for more information on what’s coming.

Second, this year FinovateAsia will be held at the JW Marriott, Pacific Place, 88 Queensway, Hong Kong. Easily accessible via public transportation, including rail, the JW Marriott is a world-class venue located in the heart of Hong Kong.

The conference takes place on Tuesday, November 7 and continues through Wednesday, November 8. Registration begins at 8:00 on Tuesday, and the program begins at 9:00 with Welcome Remarks. There are two live demo sessions on Day One – the first beginning at 10:40 and the second at 13:30 – two keynote addresses and four panel discussions.

On Wednesday, Day Two, registration begins at 8:00, with Welcome Remarks at 8:45. The accelerator showcase starts the program at 9:10, followed by our first keynote of the day. The first live demo session on Wednesday begins at 11:10 and the second at 13:30. Day Two will feature a total of three panel discussions. See our agenda for more details.

Last but not least, be sure to join our FinovateAsia community on our event app. Search for “Finovate” at your preferred app store, download the app, and use the same email address you used to register for the conference to login. The FinovateAsia app provides access to the agenda, more information about our demoing companies, as well as our speakers, sponsors, and partners. You can also use the app to reach out to your fellow attendees, make connections, and schedule meetings. If you have any trouble with the app, please email us at [email protected] or ask one of our Finovate staffers at the registration desk at the venue.

Remember FinovateAsia tickets are still available. If you’re interested in learning how innovative fintech companies are leveraging exciting technologies like artificial intelligence, the blockchain, machine learning and more, then FinovateAsia is the place to be this week. So be sure to pick up your ticket and save your spot. We’re looking forward to seeing you here in Hong Kong!

FinovateAsia 2017 is sponsored by: Invest Hong Kong, CeleritiFintech, Lleida.net, and Barlings Capital.

FinovateAsia 2017 is partners with: 500 Startups, Agorize, Aite Group, Asia Cloud Computing Association, BankersHub, BayPay, Banking Technology, BeFast.TV, BigData-MadeSimple.com, BlockExplorer, Breaking Banks, Byte Academy, CB Insights, Celent, Conventus Law, EbankingNews, FemTech, Financial IT, FINOLAB, Fintech Association of Hong Kong, Fintech Finance, Fintech News Hong Kong, FinTechTime, Forrester, Headcount, Holland Fintech, Hong Kong Economic Times, The Hong Kong Foreign Financial Institutions Association, IBS Intelligence, Innovate Finance, Insight Alpha, LexisNexis Risk Solutions, Mercator Advisory Group, NexChange, The Nilson Report, Ovum, The Paypers, Plug and Play, PR Newswire, Regulation Asia, RFi Group, Singapore FinTech Association, SME Finance Forum, Swiss Finance + Technology Association, WHub, and World Fintech Association.

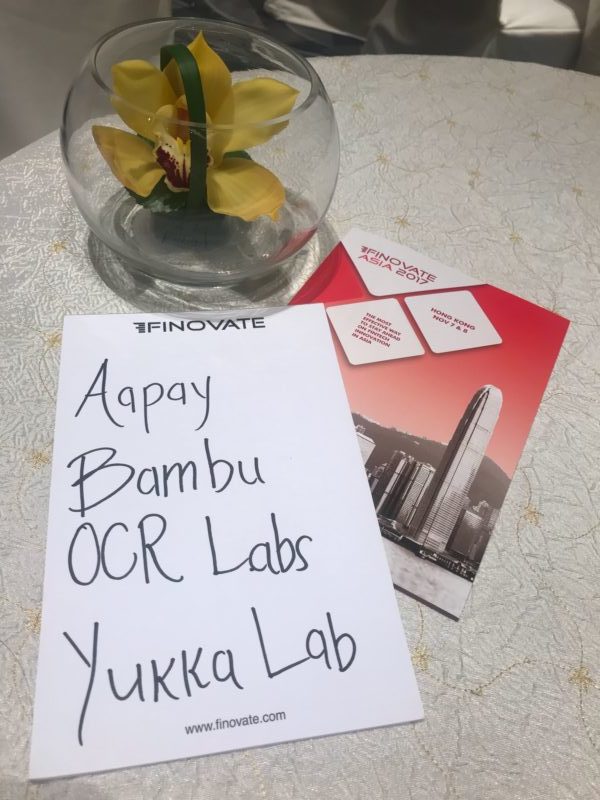

AApay Technology

AApay Technology OCR Labs

OCR Labs YUKKA Lab

YUKKA Lab