As Finovate goes increasingly global, so does our coverage of financial technology. Finovate Global: Fintech News from Around the World is our weekly look at fintech innovation in developing economies in Asia, Africa, the Middle East, Latin America, and Central and Eastern Europe.

Sub-Saharan Africa

- Ten African subsidiaries of Societe General to benefit from enhanced payment processing capabilities courtesy of new partnership with HPS.

- South African challenger bank TymeBank moves toward a formal launch in late February.

- The IMF blog reviews the prospects for fintech innovation in Sub-Saharan Africa.

Central and Eastern Europe

- Fintech Futures interviews Pavel Novak, CEO of Czech Republic-based P2P lender, Zonky.

- iSignthis acquires Lithuania-based banking software provider, Baltic Banking Services (BBS).

- Partnership between Yandex.Checkout and Tinkoff Bank supports direct payments to online stores by way of Tinkoff’s app and online banking offering.

Middle East and Northern Africa

- Abu Dhabi Commerical Bank (ADCB) goes live with its PFM app, MoneyBuddy, which uses technology from Strands.

- Dubai-based neobank Xpence prepares for launch.

- Saudi Arabia banking regulator opens regulatory sandbox to test fintech solutions.

Central and South Asia

- State Bank of India to help finance digital invoice discounting marketplace, Invoicemart.

- The Daily Star considers the “promise of fintech” for Bangladesh.

- Reliance Realty announces plans for a fintech center in Navi Mumbai, India.

Latin America and the Caribbean

- PYMNTS.com looks at the Mexican government’s efforts to leverage fintechs to help make it easier and less expensive for Mexicans living abroad to send money home.

- Brazilian SME lender Adianta raises $2.18 million ($8 million reals) in round led by DGF Investimentos.

- Colombian fintech Open Vector signs memorandum of understanding (MoU) to support development of open banking in South America.

Asia-Pacific

- Ant Financial to acquire UK currency exchange firm, WorldFirst in $700 million deal.

- Singapore’s United Overseas Bank (UOB) to debut its digital bank, TMRW, in Thailand.

- Visa announces plans for an innovation center in South Korea.

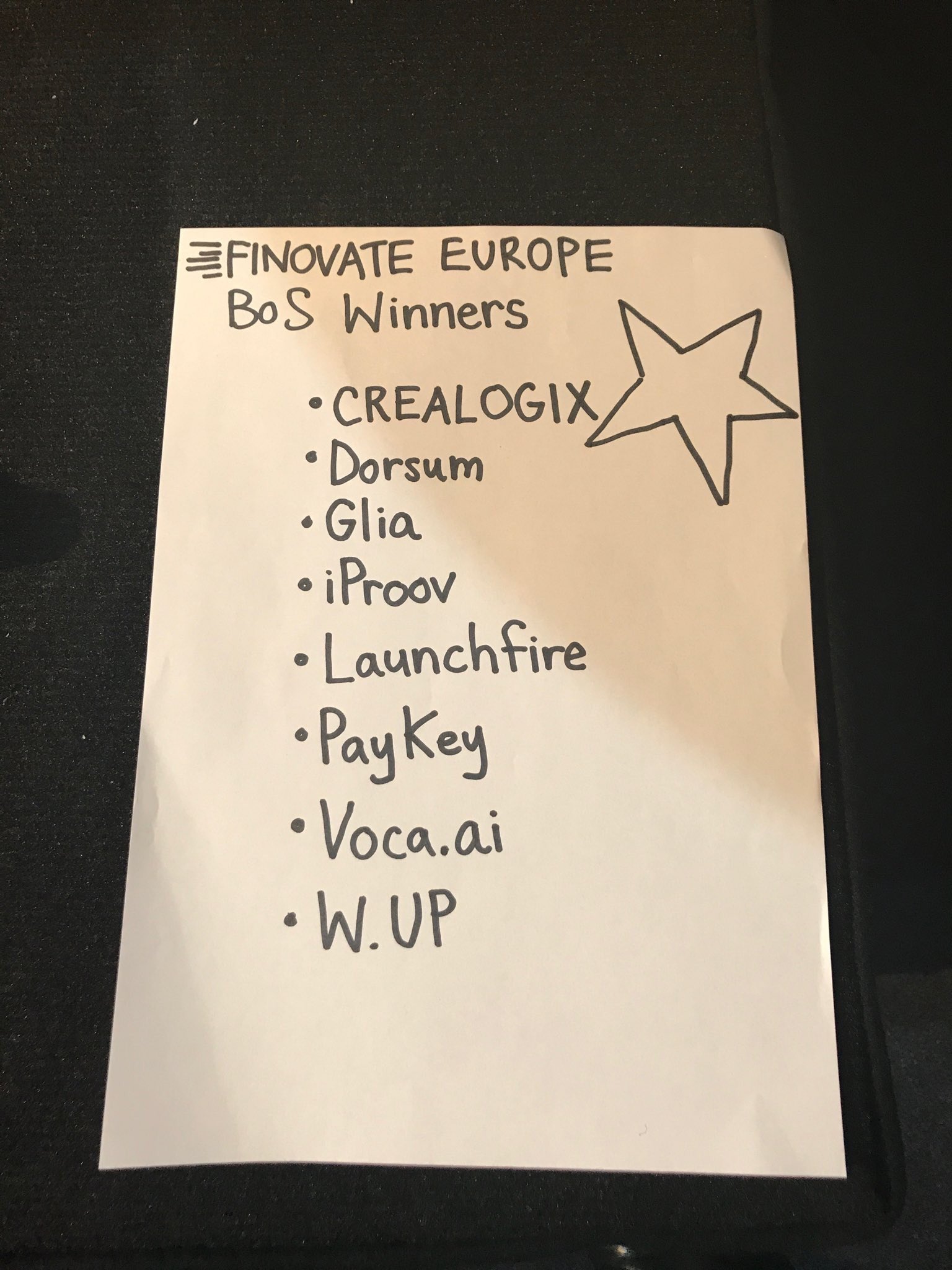

iProov

iProov PayKey

PayKey