Here’s part 2 of the sneak peek of the companies that will demoing at

FinovateSpring May 8 and 9 in San Francisco. Each company provided a short summary of the innovation they will debut on stage. We

published 23 last week and we will complete the preview next week.

__________________________________________________________________________

InvestorBee puts data at consumers’ fingertips so they can make smart, confident investments.

- It’s fact, not opinion. Users can tap into the database to learn from the experiences of nearly 1.5 million investors.

- It’s an investment health check. Users can compare their portfolios and multi-asset products with fact-based, relevant benchmarks to understand whether they receive fair value.

- It’s simple investing without guesswork. Users can choose an objective risk-based strategy to track that’s right for them in a few easy steps.

Users extract wisdom from the crowd to make better, simpler investment decisions – all for free at InvestorBee.

Innovation type: Investing, marketing, PFM

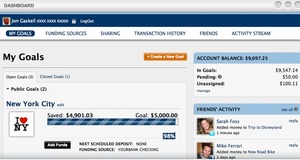

iQuantifi takes you way beyond budgeting! It helps you reach all your financial goals and tells you exactly how you can do it. No estimates. No calculators. Just solid advice and the power to do it all online.

Innovation type: Banking products, investing, PFM

Historically, investing in securities has been

a difficult proposition for retail investors,

mainly due to the lack of access to competitive products and the absence of user-friendly financial education tools.

This problem is exacerbated in emerging markets, where financial markets tend to be less developed.

Kuspit offers retail investors an online platform to learn about investing, apply what they’ve learned, and invest in the same platform. All of this is available in an easy and progressive manner, while sharing ideas with the community.

Innovation type: Investing, online, PFM

The current infrastructure to deliver capital to Main Street businesses is broken. It’s simply too expensive for banks to manually analyze and underwrite a small loan – whether it is $10,000 or $100,000. As a result, banks make fewer loans, and creditworthy small businesses are denied the capital they need to grow.

On Deck has created an efficient, effective and proven solution to this fundamental problem. By leveraging new digital sources of data, any institution can increase its small business lending through the On Deck platform, delivering funding decisions in minutes rather than weeks.

Innovation type: Lending, payments, small business

PaySimple is launching an innovative platform for banks to set up their own private-labeled version of cloud-based receivables automation. With this platform, banks of all sizes can easily bring to market a sticky value-added offering to attract and retain small business members, while adding a new revenue stream.

PaySimple will demonstrate how banks can set up custom-branded software in a few simple steps and how small businesses can immediately benefit from a system that combines payment acceptance across channels integrated with customer management.

Innovation type: Online, payments, small business

Portfolio Football is a first-of-a-kind application that addresses the need for financial planning and literacy through gamification. Portfolio Football plays on the popularity of American Football and the adoption of fantasy sports into the lives millions. It makes financial management competitive, fun and easy to understand, while providing users with a powerful tool for personal finance and portfolio management. It’s a true “game changer.”

Innovation type: Investing, Online, PFM

With 80% of Americans between the ages 20-40 now using social media and playing social games, how can financial institutions reach their customers in new ways?

Introducing SaveUp – an innovative program that uses game mechanics to reward good financial behavior. When users save money and reduce debt, they earn credits to play for prizes like cars, travel, and cash up to $2 million.

Financial institutions can use a customized SaveUp experience to help their customers make better financial decisions, increase engagement, and cross-sell products. Current FI partner campaigns have conversion rates of up to 44%.

Build a deeper relationship with your customers while helping them succeed.

Innovation type: Marketing, rewards

SoMoLend makes investing in your online community simple, affordable, and social. SoMo is an online platform that uses patent-pending lending technology executed within a hyper-localized geographic scope to connect small business borrowers with individual and organizational investors.

SoMo’s user-friendly technology allows business borrowers to raise capital from friends and family, customers and community supporters as well as from Facebook, Twitter and LinkedIn connections. Investors lend money directly to borrowers through the SoMo platform, which then packages the loans and sells them as notes, bypassing banks and credit-card issuers.

Innovation type: Investing, lending, small business

Thomson Reuters is pleased to introduce their new App Store solution that enables access to the latest innovative capabilities and tools for use across the digital enterprise. Thomson Reuters’ solution makes it easy for financial institutions and third-party developers to create and integrate pioneering market monitoring and investing apps.

By seamlessly enabling the combination of Thomson Reuters content, firm’s customer account data and firm’s internal and other data sources, Thompson Reuters is helping institutions leverage the providers of financial content. This delivers a differentiated experience for their customers while lowering both development costs and time to market.

Innovation type: Investing, marketing, mobile, online, PFM

Approximately half of the world’s population are cash-preferred consumers (unbanked, underbanked, teens or privacy-concerned) and have no bank account or limited access to traditional financial services. eCommerce merchants have not had a way, until now, to monetize this segment of consumers simply missing out on the substantial revenues they represent.

ZipZap will unveil the latest innovations in global cash transaction solutions for eCommerce merchants. CashCade ensures no more lost revenue from card-based transactions being declined, while CashPayment enables consumers worldwide to make payments for online purchases at offline locations using cash.

Innovation type: Back office, payments

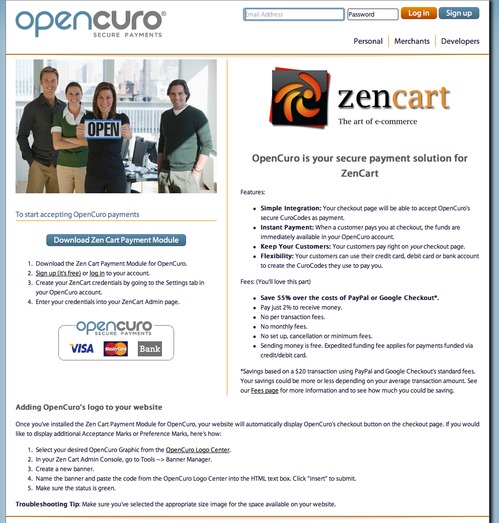

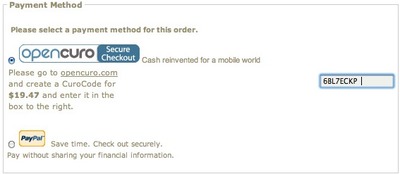

OpenCuro in minutes.

OpenCuro in minutes.