This article is sponsored by VASS Intelygenz.

Successfully integrating AI into core business services isn’t a straightforward approach—this requires strategic foresight into AI and how it best aligns with business, regulatory compliance, and operational efficiency.

Putting this into action and delivering AI solutions can drive real impact, especially for those in the financial industry. At VASS Intelygenz, we personalize services for our customers, automate their manual operations, and improve efficiencies. We work through the whole AI project lifecycle, conceptualizing, developing, deploying, and maintaining custom AI solutions that solve real business problems. All of which are reshaping how financial institutions operate by enhancing their client interactions and uncovering new market opportunities.

However, AI is not as simple as flipping a switch. According to a Gartner research, only 15% of AI solutions deployed by 2022 will be successful, let alone create ROI positive value. The path from implementation to achieving measurable ROI can feel complex and daunting. Identifying the right solutions, navigating the complexities of AI, and ensuring AI initiatives deliver measurable ROI have often led financial institutions to a standstill when it comes to their AI implementation.

With over two decades of expertise in machine learning and AI, we’ve helped financial institutions unlock the potential of AI to deliver real business value. Here, we outline three key lessons to keep in mind as you start your AI implementation process.

1. Align AI With Your Business and Change Management Strategy

The most successful AI initiatives start with a clear alignment to your business goals. Instead of jumping into technology innovations, identify the core challenges your organization is facing and determine how AI can address them. Are you looking to reduce operational costs? Improve customer retention? Prevent fraud? Only then should you consider which AI solutions will address these challenges.

Actively involve key stakeholders, including leadership and operational teams, during the implementation phase. This collaborative approach ensures that everyone understands the strategy, leading to smoother implementation and better ROI.

It’s integral that you invest in training and communication to help employees adopt AI tools with confidence, so they become champions of the technology rather than resistors.

2. Make Sure to Implement AI Safely

While the potential of AI-powered solutions in finance are vast, the risks are equally significant. Financial organizations deal with highly sensitive information and operate in tightly regulated environments. Implementing AI safely is non-negotiable.

The finance industry is a signifier of importance when it comes to balancing innovation and compliance. AI systems within finance that automate credit scoring or detect fraudulent activities must adhere to strict regulations and industry-specific requirements. Before adoption, ensure that your AI solutions meet ethical guidelines, operational standards, and legal compliance.

Another critical consideration is explainability. Stakeholders, from board members to customers, need clarity on how AI systems get to their conclusions. Choose solutions that incorporate transparency tools, such as explainable AI models, so you can maintain trust while also fulfilling regulatory requirements.

3. Have Confidence in Proof of Concepts (PoCs)

AI is advancing rapidly, and businesses that hesitate to move beyond pilot projects risk missing out on its full potential. To maximize ROI, you must scale your first steps into AI with a fully integrated, organization-wide solution.

While pilot projects allow you to test AI solutions on a small scale, their impact remains limited without transitioning to full-scale deployment. Leading organizations are fast-tracking this process, transforming successful PoCs into actionable, large-scale AI systems. This shift enables businesses to get ahead of their competition, enhance profitability, and reduce costs.

Implementing AI successfully into your financial organization involves more than just an interest in emerging technologies. It requires alignment with your unique business strategy, identifying your challenges as well as having ROI in the forefront of your mind.

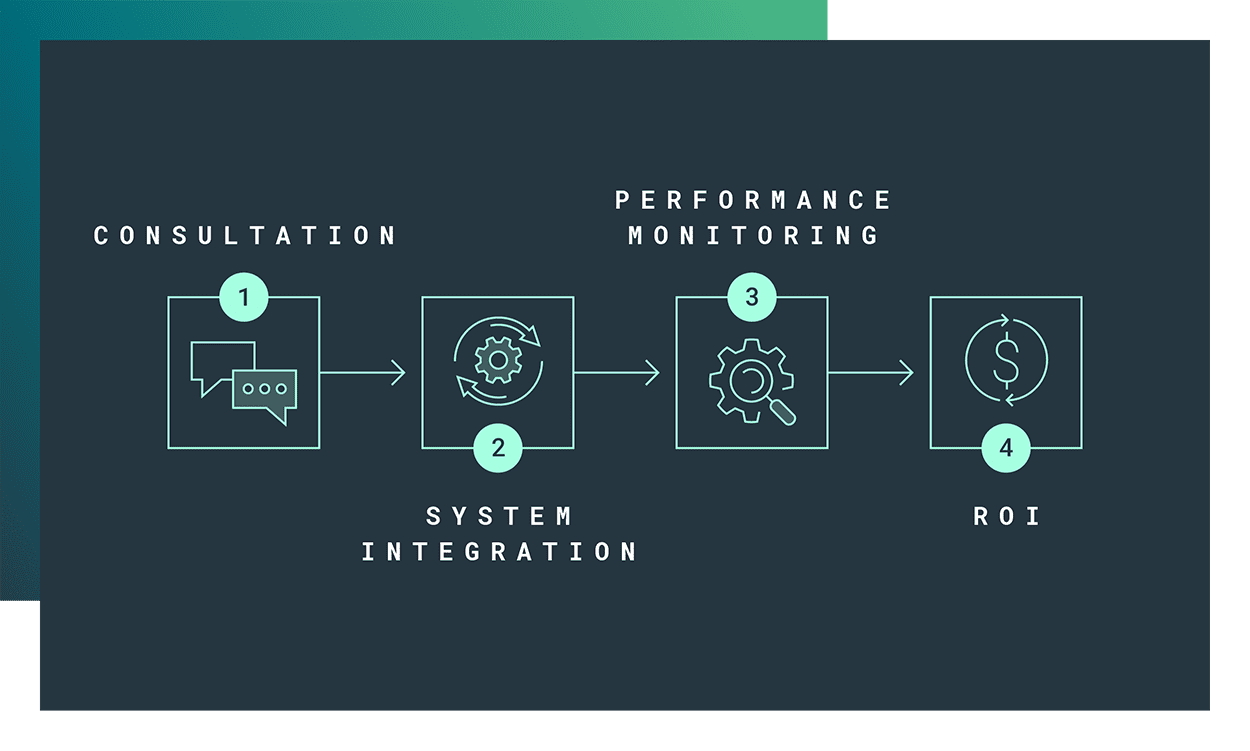

At VASS Intelygenz, we bring over 20 years of experience to the table, with a proven process that streamlines AI adoption, from scoping opportunities to rapid experimentation, so you can unlock value quickly and deliver ROI faster. We’re committed to helping financial institutions unlock the true potential of AI.

Want to learn more about this topic? Join us at our presentation at FinovateSpring on May 7th at 2:45pm to explore real-life examples and strategies for implementing transformative AI. Find out more here.