How they describe themselves: We make a financial institution’s mobile and online-based financial services related to consumer checking relationships perform better in two ways. First, we improve the financial productivity (fee income, overall relationship profitability, retention and customer growth). Second, we enhance these financial services by providing in-demand consumer benefits that are so relevant to customers, they gladly pay a fee to have them. Our solutions have generated nearly $500M in customer-friendly (non-overdraft related) fee income and grown and retained billions in checking and relationship deposits.

How they describe their product/innovation: Every financial institution needs more fee income. The challenge is how to get more without ticking off customers. Thoughtlessly slapping a new fee on an existing traditional service isn’t the answer (remember the $5 debit card fee debacle). BaZing, through its mobile and online delivery platforms, smartly provides consumer-demanded benefits so relevant and appealing, customers gladly pay for it. How much? On average, about one-third of your consumer checking relationships will pay nearly $75 per year. BaZing brings customer-friendly, non-overdraft related fee income like no other retail banking service. BaZing is the new cha-ching!

Product Distribution Strategy: Through financial institutions & through other fintech companies and platforms

Contacts:

Bus. Dev., Press, & Sales: Mike Branton, Managing Partner, [email protected], 919-349-2001

How they describe themselves: Think Finance’s technology and analytics platform powers online financial products that bridge the gap between payday loans and credit cards. These products, offered directly by Think Finance or through banks and non-bank lenders, have provided $3.5B in credit to 1.5M consumers. Think Finance is privately held and is backed by some of Silicon Valley’s most respected venture capital firms including Sequoia Capital and Technology Crossover Ventures. The company was named No. 2 on Forbes’ America’s Most Promising Companies list for 2013.

How they describe their product/innovation: elastic is a new line of credit product for employees that is linked to payroll systems. The software-driven solution seamlessly integrates with payroll software platforms, reducing the cost and risk of providing cash advances. The savings are passed on to employees in the form of lower costs as compared to overdraft fees and alternative emergency cash products. Once an employer signs up, the employee manages the rest of the process online. elastic provides flexible and affordable payment options and loans can be repaid via direct deposit using the payroll system.

Product Distribution Strategy: Direct to Consumer (B2C), Direct to Business (B2B), & through financial institutions

Contacts:

Bus. Dev.: Kathy Boden Holland, EVP Corporate Development

Press: Kelly Ann Doherty, Corporate Communications Director, [email protected], 817-546-2650 & Emily Serafin, ICR Account Director, [email protected], 646-277-1245

Sales: Marcus Oldelehr, elastic VP Bus. Dev.

How they describe themselves: Tinkoff Credit Systems was founded by Oleg Tinkov, a renowned Russian entrepreneur in 2006. He was later joined by financial investors, Goldman Sachs (2007), Vostok Nafta (2008), Baring Vostok (2012) and Horizon Capital (2012).

TCS is Russia’s leading provider of online financial services. In April 2011, the Bank issued its first million credit cards, in April 2012 — its second million, and in January 2013 – third million. According to Central Bank statistics, on March 1, 2013, the Bank took third place in terms of its non-delinquent credit card portfolio (RUB 53.2B or over $1.7B), with a market share of 7.4%. Net profit to IFRS in 2012 amounted to $122M.

How they describe their product/innovation: The customer can apply online or by phone for a credit card, debit card or to make a deposit. She simply has to complete the application on the Bank’s website and the next day the Bank’s representative (‘smart courier’) will meet her at her place of choice to sign documents and to deliver the card. This facility is not only a mind-bogglingly good. The implementation of this innovation took the following steps:

1) we established a nationwide courier system specifically for our online deposit programme

2) we extended the courier delivery programme to credit cards

3) as we honed the service, we developed our own technologies and software

4) TCS now operates one of the biggest courier companies in Russia

Product Distribution Strategy: Direct to Consumer (B2C)

Contacts:

Bus. Dev. & Sales: Artem Yamanov, Head of Bus. Dev., [email protected]

Press: Oleg Anisimov, Director of Marketing, [email protected], +79859239245

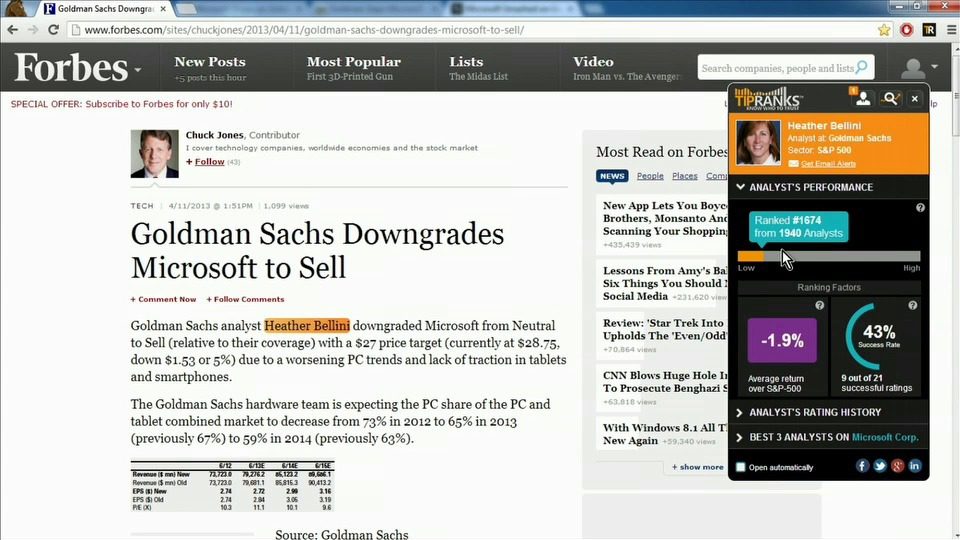

How they describe themselves: TipRanks is the first cloud-based service utilizing Natural Language Processing (NLP) algorithms to aggregate and analyze financial data online. TipRanks’ proprietary technology and ranking methodology allows individuals providing financial advice to be evaluated and ranked in relation to their peers based on statistical credibility and consistency. Users will be empowered with multiple technologies that convert/translate financial advice into simple, real-time reports. Through continual development of premium services that provide on-demand financial information, TipRanks will bring unprecedented measurement and clarity to the profession and will become an instrument of financial accountability.

How they describe their product/innovation: TipRanks is an independent cloud-based service that collects, sorts, and presents unbiased, comparative metrics about stock recommendations published online from financial experts. TipRanks categorizes this advice by a combination of two key factors: the ability of a recommendation to generate excess profit above the S&P-500 and the percentage of times recommendations outperform the S&P-500. These metrics help communicate in real-time the accuracy and credibility of individuals providing such advice. It allows the individual investor to decide who to trust.

Product Distribution Strategy: Direct to Consumer (B2C), Direct to Business (B2B), through financial institutions, through other fintech companies and platforms, & licensed

Contacts:

Bus. Dev.: Tomer Turgeman, Director of Bus. Dev., [email protected], +972 528 252222

Press: Kevin Johnson, Account Manager, The Cline Group, [email protected], 610-538-6700 x1625

Sales: Uri Gruenbaum, CEO, [email protected], +972 54 7700039

How they describe themselves: Toopher accelerates business growth and creates greater user confidence with the most usable, most secure multifactor authentication solution available. Additionally, Toopher’s suite of both external and internal products increases employee productivity and the security coverage within the organization. Toopher delivers its invisible solution by pairing enterprise class security with the location awareness of mobile devices. This optimizes UX as Toopher learns users’ normal behaviors and can automate those actions going forward, removing the needless hassle from everyday routines. Doing so creates a solution that users actually want to use, driving adoption, which increases revenue and user stickiness, while reducing fraud costs.

How they describe their product/innovation: Toopher’s authentication suite accelerates business top-line and bottom-line growth by creating greater user confidence and productivity. Toopher enables businesses to tap into new markets and to seize competitive differentiation within existing markets. Toopher uses the location awareness of users’ mobile devices to create invisible, strong, out-of-band two-factor authentication. As such, Toopher is the most usable, most secure multifactor authentication solution available. Additionally, Toopher applies the same technology, infrastructure, and IP to optimize and secure the payment authorization process. As a result, Toopher can be paired with credit/debit accounts and mobile payments to reduce fraud, while simultaneously increasing UX.

Product Distribution Strategy: Direct to Business (B2B), Channel Partnerships, and Licensing

Contacts:

Bus. Dev. & Sales: Mark Perry, VP Sales, [email protected]

Press: Laura Beck, PR, [email protected]

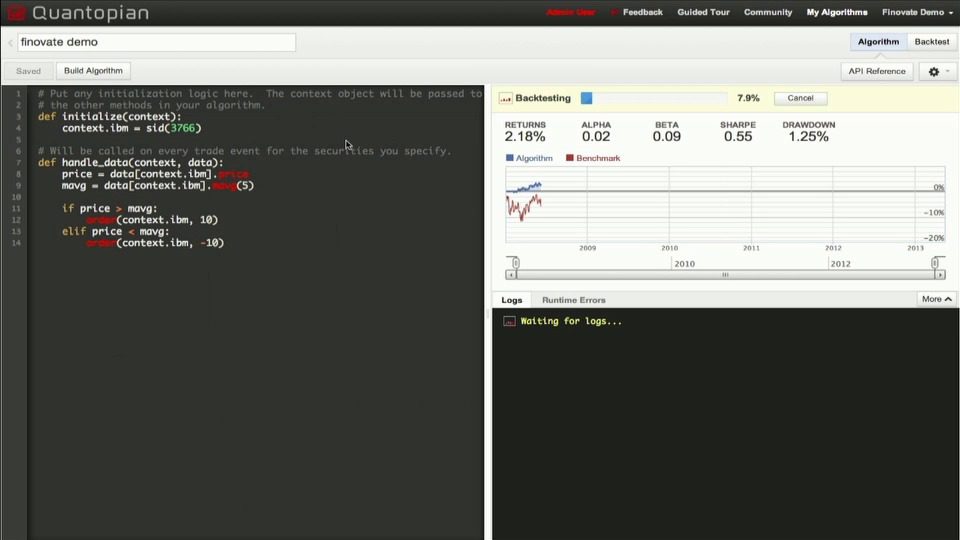

How they describe themselves: Quantopian is building the world’s first browser-based algorithmic trading platform, giving quants the tools and support they need to learn, create, explore and reap the benefits of quantitative finance. With Quantopian, users can be operational in minutes rather than months. Quantopian provides robust foundational technology for creating algorithms, delivers unfettered access to a decade’s worth of trading data for backtesting and allows users to import external datasets into the platform. Quantopian is also an engaged community where people can discuss concepts, processes and performance and learn from peers and experts. The result: Better ways to understand – and profit from – quantitative trading.

How they describe their product/innovation: Quantopian Live Trading allows quants to trade on their algorithms directly from the Quantopian platform using only their browser. Native to the cloud, Quantopian Live Trading combines historical data, algorithm simulation, external and live market data, brokerage integration and algorithm development into a seamless browser-only workflow. Algorithms can go from historical backtesting, to simulated real-time trading, to live trading with the click of a button.

Contacts:

Bus. Dev. & Sales: [email protected]

Press: Steve Vittorioso, Sr. Account Executive, [email protected], 781-966-4100

How they describe themselves: Realty Mogul is a marketplace for investors to pool money online and buy shares of pre-vetted investment properties like apartment buildings, office buildings and retail centers; it’s crowdfunding for real estate.

How they describe their product/innovation: Realty Mogul is demoing the full transaction life cycle of an investment from account creation through electronic documentation to funding via ACH. We are also demoing what it looks like to be an active investor and how to monitor investments via a dashboard.

Contacts:

Bus. Dev.: Jilliene Helman, CEO, [email protected]

Press & Sales: Justin Hughes, CMO, [email protected]

How they describe themselves: Refundo is an innovative and driven group of financial services veterans whose mission is to provide low and moderate-income households with high-quality, affordable access to financial services. According to the FDIC, 68M+ individuals in the U.S. do not have traditional bank accounts and rely greatly on “alternative financial services,” which tend to cost a lot more. We share the struggles of this community because we’re from these communities. We are passionate in our endeavor to develop meaningful and powerful technologies designed to disrupt the status quo and change the way we think about banking.

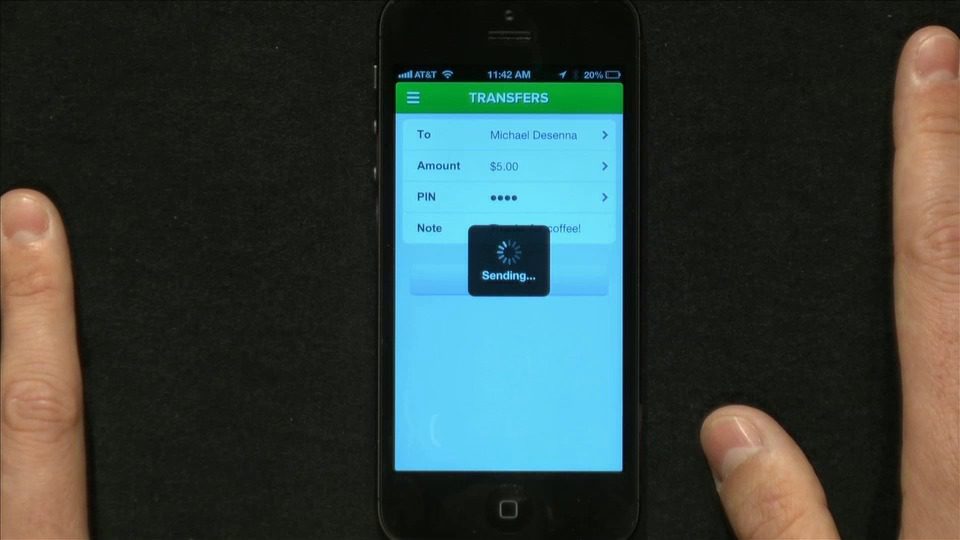

How they describe their product/innovation: Refundo’s Mobile App creates an opportunity to transition millions of underbanked and unbanked households into the financial mainstream by enabling them to open an FDIC-insured bank account using just a smartphone. The Mobile App features account balance, debit MasterCard, transaction history, and a network of tens of thousands of ATMs and deposit locations across the US, and more. From the beginning, the Mobile App was designed to deliver the best user experience, security, and convenience in mobile banking.

Contacts:

Bus. Dev. & Press: Daphne Veras, Marketing Director, [email protected], (o) 908-445-5544 x3102, (m) 908-463-7706

How they describe themselves: SeedInvest is an equity-based, crowdfunding platform that connects accredited investors to high-quality start-ups and small businesses seeking funding. SeedInvest’s mission is to help entrepreneurs and investors leverage the disruptive power of the Internet to make connections and speed up the process of raising capital. The company provides accredited, angel investors access to high-quality, curated opportunities in a myriad of industries across the entire country. SeedInvest was founded in 2012 by former professional investors and entrepreneurs Ryan Feit and James Han and is located in the heart of New York City’s entrepreneurial community.

How they describe their product/innovation: SeedInvest is demonstrating its state-of-the-art equity-based, crowdfunding platform and a number of groundbreaking features including:

- Due Diligence Dashboard

- Virtual Diligence Session

- Permissions-based Dataroom

- Diligence Board

- Simple Invest

- Instant Identity Check

- Legal Docs Execution

- Streamlined Funds Transfer

- Virtual Boardroom

- Virtual Board Meetings

- Easy Reporting

- Quick Signatures

Contacts:

Bus. Dev. & Sales: Ryan Feit, CEO & Co-Founder, [email protected], 646-291-2161 x700

Press: Chris Capra, Managing Director, [email protected], 212-922-5885

How they describe themselves: Signifyd harnesses the power of the Social Graph to help e-commerce businesses fight fraud. By bridging the gap between the online identity presented by the user and the real-life person he or she claims to be, Signifyd’s platform provides merchants with an Accept or Decline decision on transactions. If an Accepted transaction turns out to be fraudulent, Signifyd takes the liability for it – think of it as insurance for e-commerce. As a full-service payment validation platform, Signifyd is in use by many Small Businesses and companies on the Fortune 100 and Internet Retailer Top 500 list.

How they describe their product/innovation: Today, Card-Not-Present merchants are liable for fraud chargebacks. As brick-and-mortar businesses move online, their losses increase. The techniques used by fraudsters are evolving quickly, forcing merchants to become experts on device fingerprinting, IP Geo-Location, NAP Checks, BIN lookups and social spoofing. Signifyd abstracts this away by connecting all the data needed to screen a transaction and looking at the identities involved holistically. With Signifyd, merchants get a one-stop solution, from automated scoring to manual review, even without any internal history on the customer. And with Guaranteed Payments, Signifyd takes the liability in the case of a mistake.

Contacts:

Bus. Dev. & Sales: Michael Liberty, Co-Founder & COO, [email protected]

Press: Rajesh Ramanand, Co-Founder & CEO, [email protected]

How they describe themselves: Founded in 2012, TipRanks is a leading provider of financial accountability solutions with a singular goal of giving power back to the individual investor. By making performance data regarding financial advice easily available and highly visible to the investing public, TipRanks will ensure accountability, objectivity, and transparency within the business of stock picking and analyst reports. TipRanks is proudly unaffiliated with any investment firm.

How they describe their product/innovation: TipRanks is the first online co-browser that aggregates, scrutinizes, and ranks digitally published stock recommendations. TipRanks’ Financial Accountability Engine™ transparently provides the individual investor unbiased information about the reliability, accuracy and track record of those who provide sell-side advice. TipRanks’ free, cloud-based technology provides unprecedented measurement and clarity to the worldwide financial advice domain. It lets the investor decide who to trust.

Contacts:

Bus. Dev. & Sales: Uri Gruenbaum, CEO, [email protected], +972-54-770-0039

Press: Kevin Johnson, Account Supervisor, The Cline Group, [email protected], 610-538-6700 x1625

How they describe themselves: Tradeslide offers any independent trader of futures, foreign exchange and CFDs (stocks, indices, commodities) a rigorous, public, independent assessment of invest ability – a 0-100 TS Score.

Traders are free to take their TS Score wherever they go, including conversations with potential employers, Social (Twitter, Linkedin, etc.), investors, etc. To reach invest-ability, Tradeslide offers the TS Challenge – a gamified learning process where traders compete to develop the skills that make up a solid trader (risk management, discipline, etc.), in the right order, one badge at a time.

How they describe their product/innovation: We develop algorithms that analyze traders’ decisions with a goal: to rule out luck as a source of performance. This analysis allows us to infer that traders achieving non-random positive returns are worthy of investors’ capital – aka investable. The applications of this analysis are broad: including free diagnostic tools allowing traders to grow their skill, rating/certification service allowing our traders to credibly pitch to investors. More interesting applications based on processing the market data supplied by our users will follow soon.

Contacts:

Bus. Dev., Press & Sales: Juan Colon, CEO, [email protected]