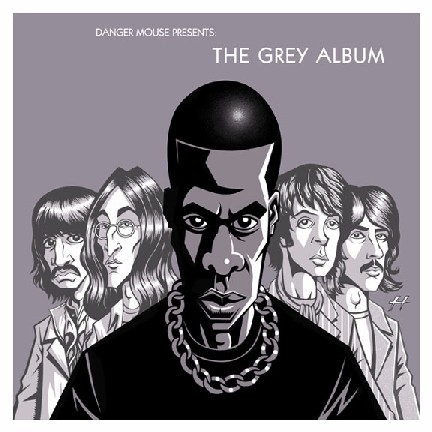

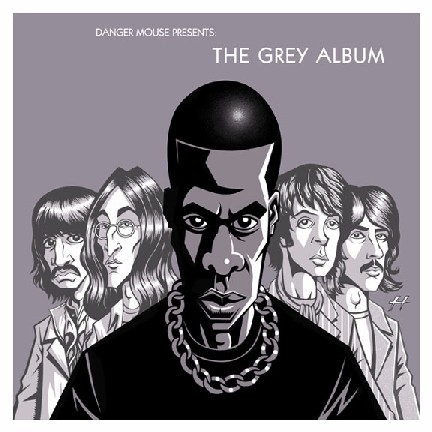

In the musical world, a mashup combines music from one song with lyrics from another, often mixing two very different genres. One of the more famous examples is the Grey Album by DJ Danger Mouse that put words from Jay-Z's Black Album on top of chords from The Beatles White Album.

In the musical world, a mashup combines music from one song with lyrics from another, often mixing two very different genres. One of the more famous examples is the Grey Album by DJ Danger Mouse that put words from Jay-Z's Black Album on top of chords from The Beatles White Album.

Programmers have their own definition: combining content seamlessly from two different sources.  For example, Kayak <kayak.com> is a powerful travel site that pulls price quotes out of hundreds of websites and displays them in tabular format and locates them visually on a Google Map (click on the inset to see a Las Vegas hotel search).

For example, Kayak <kayak.com> is a powerful travel site that pulls price quotes out of hundreds of websites and displays them in tabular format and locates them visually on a Google Map (click on the inset to see a Las Vegas hotel search).

In online finance, we have seen mashups from Yodlee, uMonitor, and others that marry account information from a number of sources to create an aggregated view. But the most successful financial mashup yet is PayPal, which put an email/Web interface in front of two established electronic payment mechanisms, ACH and MasterCard/Visa.

Who will launch the next successful mashup? There is quite a bit of activity in the payments space, many trying to mimic PayPal's success using a cell phone interface. For example Obopay and TextPayMe (NetBanker, April 26), and BillMyCell from Black Lab Mobile <blacklabmobile.com>.

Another company, BillMonk <billmonk.com> has created a Web-based system of sharing expenses designed for the work-hard, play-hard urban singles set. Users can send expenses to be shared to their account at BillMonk using text messages, and then log in later to finalize the payment split and let everyone know who owes what (see example right). The company doesn't yet facilitate the actual payment, but they are looking for a partner to power the financial transactions.

Another company, BillMonk <billmonk.com> has created a Web-based system of sharing expenses designed for the work-hard, play-hard urban singles set. Users can send expenses to be shared to their account at BillMonk using text messages, and then log in later to finalize the payment split and let everyone know who owes what (see example right). The company doesn't yet facilitate the actual payment, but they are looking for a partner to power the financial transactions.

We're still not convinced the market for "splitting expenses among friends" is big enough to sustain one, let alone four service providers (see NetBanker, April 26). But we ARE sure the enterprising founders of BillMonk will find a niche somewhere in the payments space.

We're still not convinced the market for "splitting expenses among friends" is big enough to sustain one, let alone four service providers (see NetBanker, April 26). But we ARE sure the enterprising founders of BillMonk will find a niche somewhere in the payments space.

BillMonk has added more new features to its bill-sharing platform in the past four months than most companies implement in four years. It reminds us of the pace at another small payments company that we were watching closely six years ago as they morphed from a closed PDA-to-PDA payment system to the primary platform for eBay buyers (see Online Banking Report #54 for a view of PayPal in the early days).

To get an idea of the pace at BillMonk, read a few entries from their blog <billmonk.wordpress.com>. Then realize that this is not the work of a vast team of programmers, PR agents, and marketers. It's just two guys in a Seattle apartment who are also answering customer queries, paying the bills, building the website, taking out the trash, and talking to reporters (see the profile in the Seattle Times, April 24).

Action Items

My advice for financial institutions:

- Hire these guys

- If that's not practical, then behave like them; constantly improving your website and to the extent you control it, your online banking and bill pay system

I will bring you an update on the company as soon as I can corner one or both of the founders in a coffee shop.

—JB