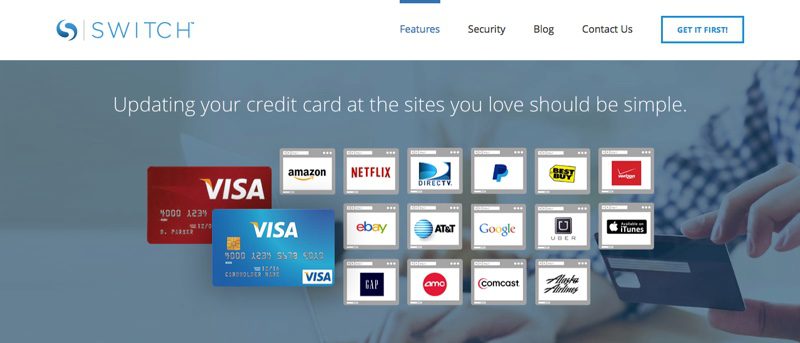

SWITCH, a Seattle-based startup that makes it easy to manage your online payment information, has raised $400,000 in funding from angel investors. The company, which made its Finovate debut at FinovateSpring last year, now boasts $1.9 million in total capital.

Chris Hopen, SWITCH co-founder and CEO, called his technology the “first of its kind, credit card updater for online accounts.” SWITCH makes it easy for card holders to update their payment methods at online merchants and e-commerce sites, as well as for subscriptions and recurring repayments like cable and utility bills. It also helps card issuers get new and replacement cards to cardholders faster, and provides issuers with analytics and data on card usage to better understand their competition. Hopen highlighted the benefit this analytics component provided for issuers, saying “If I’m in 10,000 wallets, I want to know who my top five competitors are in those wallets, so I can do something about increasing my profile and getting more sites using my card.”

SWITCH was founded in 2014 by Chris Hopen and David Pool. The company demonstrated its technology at FinovateSpring 2016, and has 10 employees. SWITCH opened early access to its free, credit card updating service in February.

Presenter: CEO Chris Hopen, founder

Presenter: CEO Chris Hopen, founder