The Finovate Debuts series introduces new Finovate alums. Today’s feature is PayItSimple, which demonstrated its point of sale financing solution at FinovateFall 2014.

With PayItSimple, customers use their existing credit card to divide an expensive purchase into multiple, smaller payments over time.

PayItSimple automatically bills the charges to the customer’s credit card each month. Unlike most financing products, PayItSimple is interest-free and the customer does not need to wait to receive the product, as with layaway.

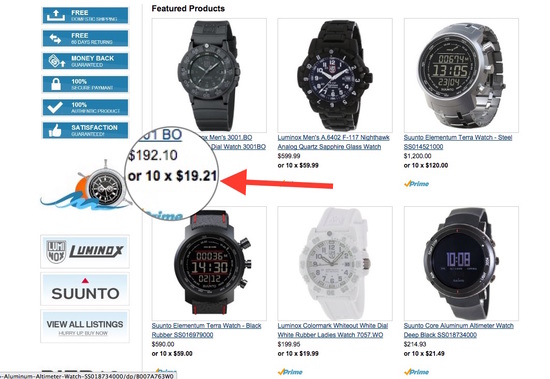

The PayItSimple option at checkout shows consumers the maximum number of installments allowed. In the case below, the customer pays $120 per month for 10 months instead of $1,200 up front.

Stats

- 12 employees

- $4.3 million in funding

- Founded August 2013

Secret sauce

Merchants do not take on any risk associated with allowing customers to pay over time. The initial authorization from the customer’s credit card company guarantees the full amount.

PayItSimple’s technology automatically processes the customer’s payments over time. It also handles the authorization.

Consumer use

PayItSimple is fast, with no need to apply or fill out paperwork. Users simply choose their payment schedule and then purchase just like a regular credit card transaction (see below).

Benefits for end customers:

- Provides the ability to buy expensive items when they may not have cash up front

- Makes purchases interest free

- Does not come with layaway delays

- Can pay by credit card to collect card rewards

- Does not require a credit check, making the process as fast as a regular transaction

Merchant use

By listing products with a more digestible price (see below), goods are more appealing and the small installments are affordable for more customers.

Merchant benefits:

- Higher conversion rates

- No additional risk

- Average ticket price increases

- Higher customer satisfaction

- Full payment received at time of purchase

- No need to change payment gateway

Merchants can either embed PayItSimple’s code into their website or use its API for a seamless checkout experience.

The fine print

While the customer pays no fees or interest, there is a small fee to merchants.

Also, not all credit card holders are eligible to use PayItSimple, but the approval rate is over 95%.

PayItSimple is also available for mobile interfaces and for brick-and-mortar stores. Its official U.S. launch was at FinovateFall 2014.

Fenergo wins Outstanding Achievement in International Growth award from Irish Software Association.

Fenergo wins Outstanding Achievement in International Growth award from Irish Software Association.