As 2018 moves into the rearview and 2019 starts to take shape, financial services innovation shows no signs of slowing. At this rapid pace, there has to be at least one category of innovation per letter of the alphabet: A is for artificial intelligence, B is for blockchain, C is for compliance, D is for digital identity, E is for ethereum, F is for financial inclusion, and so on twenty more times. That’s a lot to keep up with.

Finovate’s mission has always been to cut to the core of innovation. We cover fintech for you by reviewing hundreds of services and solutions from across the fintech spectrum, then distilling them into 65+ demos featuring exciting technology with real-world applications. In just two days, you see what’s new, trending, accepted, and contentious.

The demoing companies that will take the stage in February at FinovateEurope reflect financial technology as of today and down the road. We hope you join us for this journey! Tickets to FinovateEurope are available online. Save £700 when you book before this Friday, November 30.

First wave of demoing companies announced

24sessions IQ allows financial services companies to have better banking conversations and maintain compliance using effortless video chat and artificial intelligence.

LEONUS blockchain-based banking digital platform supplies fast easy, modular and secure digital bank deployment without affecting legacy systems through the simplicity of a modular approach and the immutability of blockchain.

ApPello Loan Factory and ApPello Digital Lending Portal simplify the long and expensive credit process for retail, corporate banks, financial institutions and peer large industrial (non-financial) companies using a digital platform which allows 3rd party companies to develop additional features or submodules.

Aqubix‘s KYC Portal solves the operational challenge of due diligence with a state of the art end-to-end solution focused on automating the operational nightmare in such processes.

Avaloq‘s marketplace solves the innovation dilemma for fintechs, banks and bank clients using the avaloq.one ecosystem – “double marketplace.”

Blinking created a reliable, trustworthy, and secure way of creating, handling and confirming client digital identities for banks, telecoms, health providers and insurance companies by using blockchain technology and giving end-users complete control over their private data.

BlueRush, a customer-centric platform, works to address the poor engagement and conversion rates for leading financial institutions with proprietary interactive personalized video software.

Cantab Predictive Intelligence‘s loan approval engine provides profitable and quick lending to customers who are not clients of the bank, with no credit history for retail banks.

CREALOGIX‘s TimeWarp — a unique, interactive and powerful tool — addresses the lack of predictive decision making for all bank customers using cutting-edge UX design and AI technology.

CybiWealth offers a simple international investing solution for forward-thinking individuals.

Dateio solves the hassle associated with today’s loyalty programs for retail customers and banks using in-house developed technology and know-how.

Denizen — a borderless platform for banking — deals with the hassles of international banking for world travelers, expats, immigrants and other global populations using a real time, truly global bank without extra fees.

Dorsum‘s My Wealth mobile app uses a hybrid approach to answer the needs of the new type of investor for wealth managers and investment providers.

Dynamics‘ Wallet Card, an all-digital telecommunications connected loT payment device, uses edge-to-edge paper-thin flexible electronics to address lack of customer loyalty, card fraud and costs associated with physical card issuance for any issuer’s cardholder.

eurobits technologies created a single digital access point that securely connects with every online financial and fiscal data source in Spain for digital services providers that require high-quality real-time data.

FCase is a fraud orchestrator mission control fixing the fragmentation of fraud management and delivering rapid benefits, such as fraud reduction and enabling compliance.

FI.SPAN‘s cloud-based services management platform uses APIs to connect customers and fintechs for financial institutions in the U.S. and Canada.

Five Degrees, a complete end to end retail bank in the cloud, solves time to market, digitisation and operational cost challenges for banks.

Icefire‘s Modularbank aims to solve the resource-heavy challenge of setting up new financial institutions and rapidly launching new products using a module-based integration platform.

IMburse Treasury 4.0, a “transaction as a service” platform, enables financial services companies to efficiently manage and provide payments using cloud-based deployment strategies.

iGTB‘s CBX ‘Contextual Banking Experience’ resolves customer dissatisfaction with the corporate banking experience for transaction banks worldwide using ‘best next offer’ point-of-need bank product offerings.

InnoValor‘s Read ID identity document verification technology solves the lack of mobile onboarding using NFC.

iProov‘s mobile palm authentication supplies a highly usable, strong customer authentication for banks and financial institutions using unique liveness and anti-spoofing technology.

ITMAGINATION redefines the modern investment experience with our advanced financial analytics platform for individuals and institutional investors by leveraging cloud-based tools to build simple and accessible financial analysis.

ITSCREDIT is a credit platform that improves credit processes using an end-to-end product covering all steps.

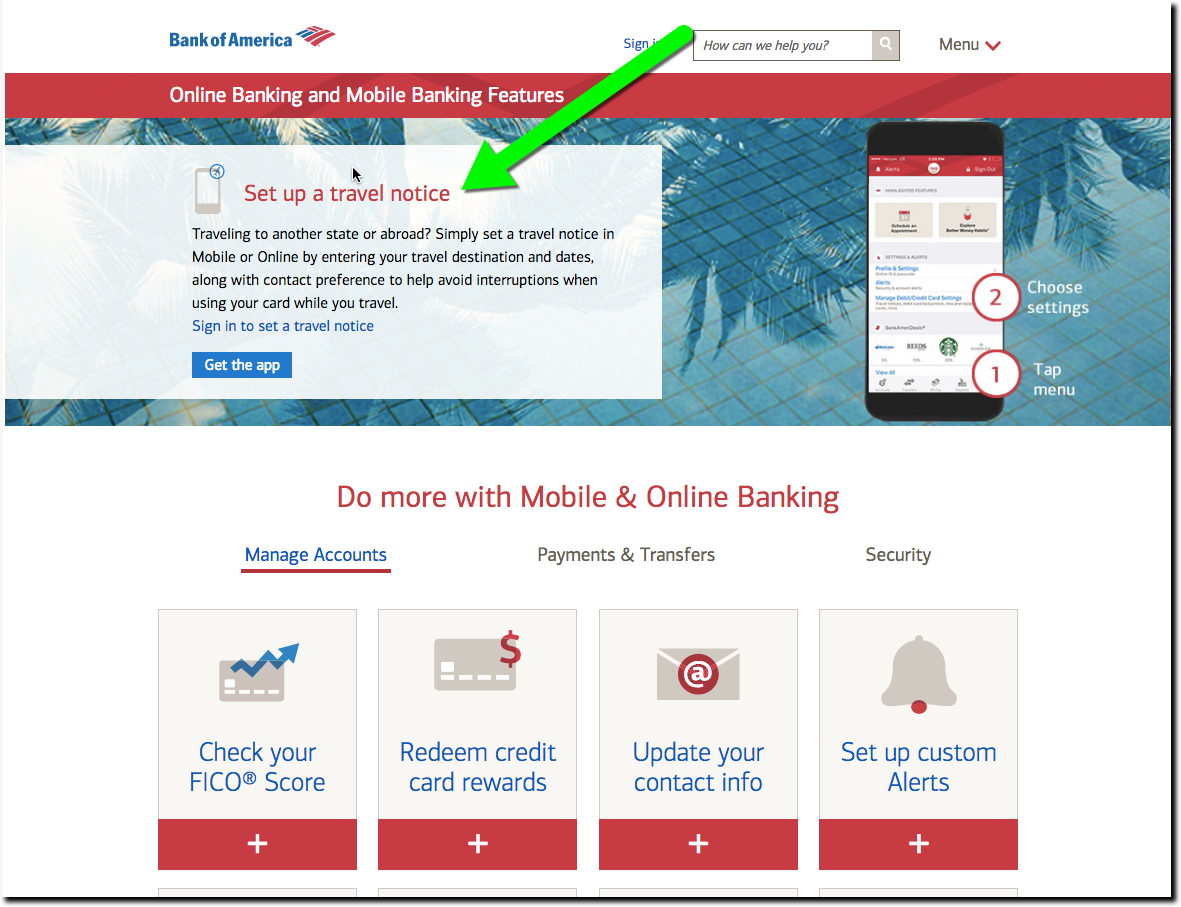

Launchfire‘s Lemonade combats lagging user adoption rates of digital banking products using game-based learning, production simulations, and role-play scenarios.

LOQR uses an integrated and centralized one-stop-shop approach to manage customers’ digital identity lifecycle in the financial world.

Microblink‘s next-generation identity document scanning and data extraction software targets poor user experience in a growing number of customer onboarding processes.

Minna Technologies is a subscription management platform using open banking APIs and machine learning and integrates into banks digital channels resulting in better customer experience, retention and new revenue streams.

Modular Banking‘s API increases access to, security for, and compliance with cryptocurrency for retail banks using a decentralized network development expertise and proprietary code.

Monobank‘s Mono Pay is an app with state of the art functionality and technology that solves the lack of control of poor outdated payment solutions for modern adults with high demands.

Neo‘s cash management platform supplies access to automated multi-currency accounts for medium to large corporations using restful API code.

Nine Dynamic‘s advanced financial analytics platform redefines the modern investment analysis experience for individuals and institutional advisors by leveraging the latest cloud-based tools and architecture to build simple and accessible financial analysis tools.

Nordigen Report utilizes a transaction-based categorization platform to streamline the global credit-scoring based loan decision making process using existing user data categorization and scoring models.

Qwil Messenger is a global client chat platform that enables safe and compliant business conversations for all professional service organizations from one single app.

REACH offers a SaaS solution to solve poor customer experiences, extended onboarding, delayed transaction cycles, and KYC challenges in the digital age for financial services organizations using a completely web based platform.

Salt Edge‘s Open Banking API Hub solves the interoperability problem between different APIs identifying Payees for payment for licensed third parties (banks, lenders, fintechs) using a single API gateway.

Secfense is a cyber security solution targeting phishing problems for the banking and fintech industry using a 2FA method available on any application.

Taxnology Innovations provides an online tool supplying tax return preparation in various countries for cross-border operating companies.

UX Design Agency‘s user-interface design based on user-experience engineering addresses the complexity and lack of human-centricity in financial products.

W.UP‘s Sales.UP — a digital banking sales and engagement tool — targets financial institutions’ need of customer insights and personalized automated marketing campaigns based on transactional and non-traditional data using Insight Store, Marketing Automation and Data Universe.