When digital banking makes bank branches less necessary, should banks keep their branches simple and cater to those that are less technologically savvy or should they transform their branches into high tech havens with kiosks and robots? As it turns out, a handful of banks are trying something in between.

Six banks across the globe are piloting coffee shop branches. These locations not only serve as a way for folks to buy a coffee and a snack, they are also co-working spaces, meeting rooms for non-profits, a place to gain education about personal financial management and, of course, a location where customers and prospective customers can conduct banking activity and apply for a loan.

Check out each bank’s different approach:

Capital One

Capital One was the pioneer in the bank-coffee shop branch model, launching its flagship location in 2017. The bank now has 31 Capital One Cafes and has replaced its bank tellers with “ambassadors” to make banking more friendly and approachable. These locations also offer free, one-on-one money coaching sessions (that don’t apply any sales pressure) for members and non-members alike.

Capital One has partnered with Peets Coffee and offers Capital One cardholders 50% off coffee beverages.

Each cafe offers free wifi and power outlets, comfortable seating, and private community rooms that are free for nonprofit, alumni, and student group meetings and events.

Chase

Photo credit: Bankrate.comChase opened its first coffee shop branch in December of 2019. The bank teamed up with Joe Coffee for the pilot of a full service coffee shop in downtown Manhattan.

In some respects, calling Chase’s new branch a coffee shop is a bit of a longshot. It looks like the majority of bank branches I’ve walked into. Chase doesn’t even offer any differentiation on the home page of the branch.

That said, the new location has a more modern look, offers a kid’s play area, and is dog friendly. Another differentiating factor is that the branch has only one teller window and it is located in the very back of the branch.

Tangerine

Scotiabank subsidiary Tangerine has built its image around the cafe concept. As the bank’s website states, “People who know Tangerine know we’re not a typical bank. Typical banks have typical bank branches. We don’t. We have Cafés located in some of the busiest Canadian communities.”

Tangerine’s cafes have a laid back, modern atmosphere. Each location has free wifi as well as coffee and treats for sale (all proceeds go to charity).

Unlike other bank cafes, Tangerine does not offer any teller services since it is a fully digital bank. The bank offers ATMs for cash deposits and withdrawals and employs representatives (called cafe associates) for client acquisition, to upsell products, and to answer client questions.

CaxiaBank

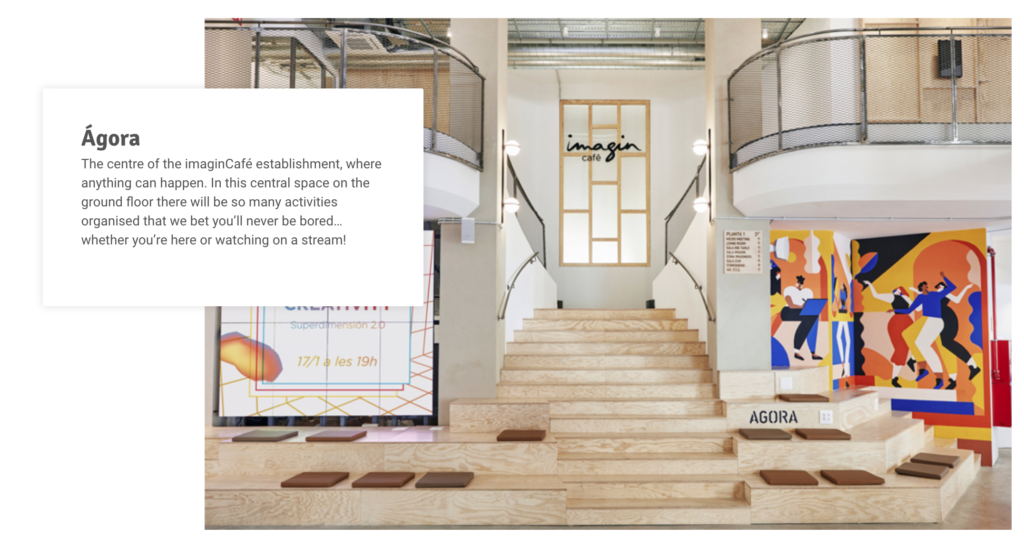

In 2016, CaxiaBank launched imaginBank, a mobile-only bank aimed to serve millennial customers. A year later the bank opened a single physical location, ImaginCafe, to appeal to its user base.

ImaginCafe isn’t quite a bank branch, however. It’s not a place where members can deposit cash or speak with bank representatives. Instead, as CaxiaBank CMO Xavier Mas explained, the cafe is “a place where the ‘imaginBank’ brand is rendered tangible thanks to a blend of innovation, immediacy, the combination of the online and offline environments, interaction with users, and the interests of young people.”

As with many bank-cafes, this location serves as a coworking space and has private meeting rooms and spaces available to rent for meetings and events. It also has an art exhibition space, a fashion showcase room, a modern theatre, a multimedia laboratory, and a gaming area. ImaginCafe hosts multiple events each month including art expos, music discussions, shows, gaming events, and concerts.

Umpqua

Umpqua bank calls its branch locations “stores” and incorporates retail and hotel-like amenities into the locations to make them more welcoming.

EVP of Umpqua Bank Brian Read explained that factors contributing to the uniqueness of the stores include free Umpqua-branded coffee, a dog-friendly environment, and community spaces that host yoga classes and non-profit meetings.

Santander

Santander has eight Work Cafes across the globe. These locations look like traditional coffee houses and aim to make visiting a bank something that consumers want to do, not an obligation.

As with many other banks’ concept branches, Santander’s locations offer spaces where events, conferences, and classes are hosted. These cafes are also geared toward offering entrepreneurs a co-working space and offers advertising opportunities for small businesses.

These concept branches have been successful for the Spain-based bank, which reports that anywhere from 2x to 4x more accounts are opened at Work Cafes than at its traditional branches. Additionally, at the bank’s Spain location the number of customers is increasing by 11% per year and new loan production has been boosted by 73%.