In a round led by Yaletown Partners, Flying Fish Partners, and former CEO and Chairman of Absolute Software John Livingston, virtual banking assistant developer Finn.ai has raised $3 million in funding. The company will use the funding to add to its team – especially data scientists, engineers, and banking industry experts – as well as to support Finn.ai’s expansion in the U.S., and around the world.

“Finn.ai is built from the ground up specifically to help banks and credit unions transform the way they engage with customers,” Co-Founder and CEO Jake Tyler said. “(This) makes banking simpler, more accessible, more human, and ultimately (helps) to build trust and engagement between banks and their customers.

“Finn.ai is built from the ground up specifically to help banks and credit unions transform the way they engage with customers,” Co-Founder and CEO Jake Tyler said. “(This) makes banking simpler, more accessible, more human, and ultimately (helps) to build trust and engagement between banks and their customers.

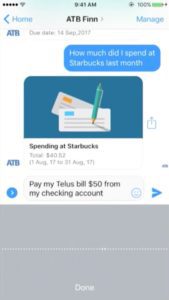

The funding for Finn.ai, which also featured the participation of an “experienced angel syndicate … of senior technology and banking executives,” coincides with news of the company’s partnership with ATB Financial. In this deal, announced earlier this week, Finn.ai’s technology will enable ATB Financial to provide the first, fully-featured, AI-powered virtual banking assistant on Facebook Messenger to its 700,000 customers.

In addition to the funding, Finn.ai announced that banking veteran Carrie Russell will join the company as Strategic Executive Adviser. Russell was formerly Chief Marketing Officer at D+H (now Finastra) and served as SVP for Retail Banking Products at TD Bank. Citing a need for banks to “move beyond transactional banking to build deeper, more personal relationships with customers,” Russell said, “I believe Finn.ai is the right partner to do this, acting as a proactive virtual assistant to help customers understand, plan, and take action to improve their financial lives.”

Finn.ai won Best of Show in its FinovateAsia debut last year in Hong Kong, and took home top honors again when the company demoed its virtual banking assistant last month at FinovateFall. Finn.ai has earned recognition from both Capegemini’s global InnovatorsRace and the VivaTech conference in Paris. The company was founded in 2014 and is headquartered in Vancouver, British Columbia, Canada.

The company’s Deserve Edu card is specifically focused on students, including international students. The card offers benefits such as an 18-month subscription to Amazon Prime Student, 1% cash-back on all purchases, and no fees on foreign transactions. And, for international students, there is no SSN required. To promote and encourage consumers to build their credit score, the company offers incentives for consumers to upgrade to the Deserve Pro Mastercard, which features 3% cashback on travel and entertainment, 2% cash back on restaurants, and 1% unlimited cash-back on all other purchases.

The company’s Deserve Edu card is specifically focused on students, including international students. The card offers benefits such as an 18-month subscription to Amazon Prime Student, 1% cash-back on all purchases, and no fees on foreign transactions. And, for international students, there is no SSN required. To promote and encourage consumers to build their credit score, the company offers incentives for consumers to upgrade to the Deserve Pro Mastercard, which features 3% cashback on travel and entertainment, 2% cash back on restaurants, and 1% unlimited cash-back on all other purchases.