Israeli behavioral biometrics startup SecuredTouch gained backing from Arvato Financial Solutions this week. The $8 million investment was strategic, and brings the company’s total funding to $11.5 million.

Robert Holm, Senior Vice President of Fraud Management at Arvato said, “Investing in SecuredTouch allows us to partner with a global leader in behavioral biometrics for mobile devices, and to reinforce our online security and fraud prevention services in the best possible manner.” The firm’s President of Risk Management Frank Schlein said that protection against cybercrime is “essential,” and added, “I am really pleased that our involvement with SecuredTouch will enable us to enhance and expand this platform further.”

On the strategic side, SecuredTouch will benefit from Aravato’s established relationships with international players across various industries. Yair Finzi, CEO and founder of SecuredTouch, said, “We see a clear synergy between the offerings and strategies of Arvato Financial Solutions and SecuredTouch. We have created a partnership that will enable SecuredTouch to expand its international presence and enhance its positioning in the areas of fraud and authentication. Arvato Financial Solutions with its international expertise in risk and fraud management is an ideal investor and partner for this purpose.”

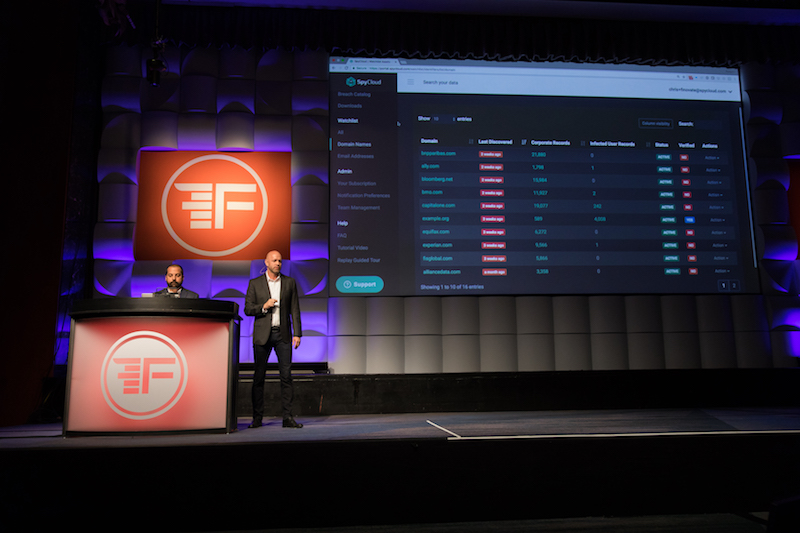

SecuredTouch was founded in 2015 and specializes in behavioral biometrics for mobile transactions. As Finzi explained, the company ensures that “legitimate transactions are recognized quickly as such and can be conducted smoothly. The aim is to ensure a secure, fast, and convenient customer experience in mobile transactions, on a sustained basis.” The company maintains a foothold in the security space by leveraging more than 100 parameters to continuously authenticate users in a session without friction. SecuredTouch’s technology is able to differentiate between human and non-human behavior to catch and block would-be fraudsters.

SecuredTouch demoed U-nique, a behavioral biometrics technology that leverages machine learning, at FinovateEurope last month in London. The company also offers U-manobot, malware detection technology; and Continew-ID, a device takeover prevention technology. SecuredTouch’s other investors include Rafael Development Corporation, Eshbol Ventures, and Wellborn Ventures.