Online payments innovator Klarna landed a strategic partnership along with a new round of funding this week. The Sweden-based company has partnered with fashion retailer H&M, which has invested $20 million in Klarna, bringing its total funding to almost $682 million.

Klarna, which is already partnering with retailers such as Ikea and ASOS, will work together with H&M to offer omni-channel payments, provide an in-app post-purchase service, and power payments for H&M’s digital loyalty program, H&M Club. As a result, millions of H&M customers across 14 countries will benefit from a simplified and more personalized payment experience. The retailer will go live with the U.K. and Sweden markets in 2019.

In the press release, Sebastian Siemiatkowski, CEO and co-founder of Klarna said, “Customers will no longer be forgiving of unnecessary complexity or when their retail experience does not leverage the insight available to make their engagement smart, personal and easy. This partnership is rooted in a shared obsession about just how good that shopping experience should be. Together we have worked hard on developing a unique solution for instore and online that will delight customers, drive economic value, and build loyalty.”

According to TechCrunch, today’s round values Klarna “north of $2.5 billion.” The publication also seeded a rumor that Klarna has been considering going public to gain liquidity.

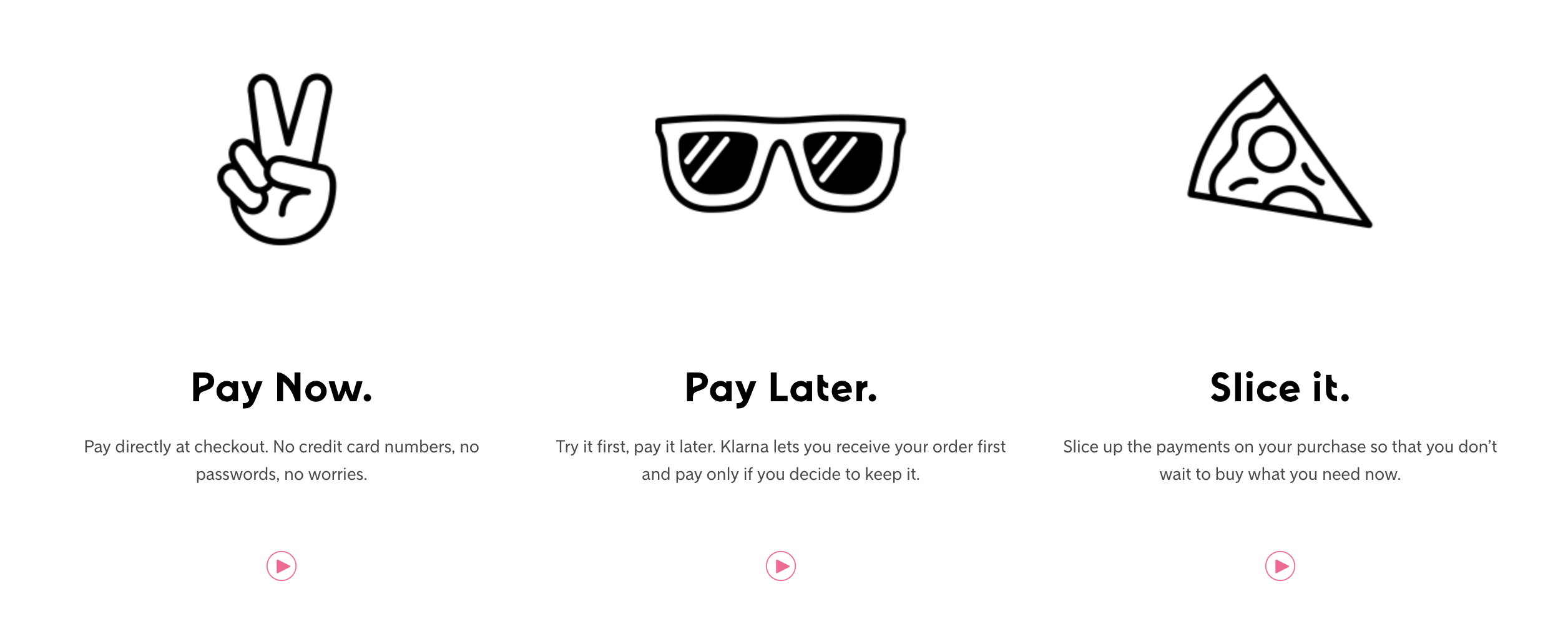

Founded in 2005, Klarna offers shoppers a range of options– pay at the point of sale, pay over time, or pay later. In addition to offering consumers more options, the payment variety helps businesses improve sales and Klarna’s online merchant portal helps them manage all of their payment and marketing tools from a single platform.

At FinovateSpring 2012, the company demonstrated its online payment-processing service. Klarna has formed a variety of merchant partnerships this year, and the company began 2018 with a partnership with ACI, in which the electronic payment solutions provider will enable online businesses to integrate Klarna’s payment products.