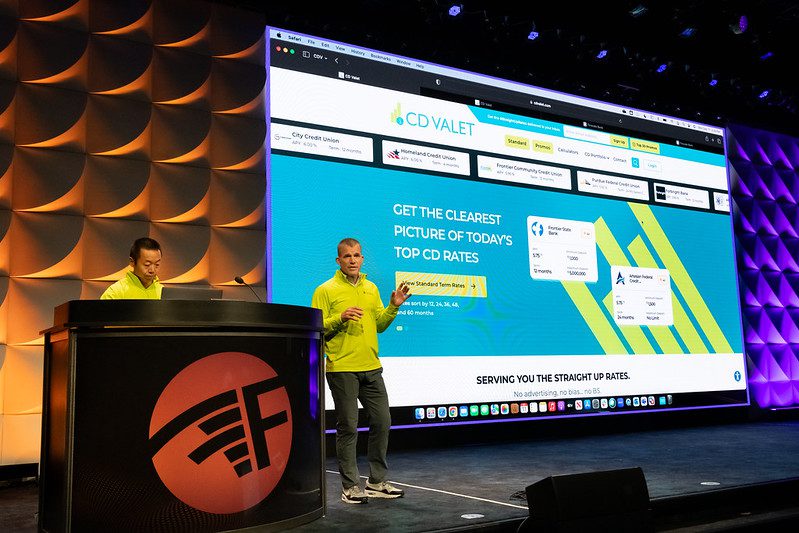

A look at the companies demoing at FinovateFall in New York on September 9 and 10. Register today using this link and save 20%.

Bud Financial

Bud Financial is a transaction intelligence platform transforming raw financial data into rich actionable insights with added customer context and readable outputs for LLMs.

Features

- Link: Connect consumer debt accounts with a phone number

- Guide: Provide the best next action to improve financial outcomes

- Act: Money-saving actions taken in-app by customers

Who’s it for?

Banks and financial institutions

Eisen

Eisen offers account offboarding solutions for financial institutions, streamlining compliance with regulatory outreach, disbursement, and escheatment requirements.

Features

- Save time on a complex process

- Stop losing customers

- Get proactive to reactivate inactives

Who’s it for?

Banks and credit unions.

Fin3 Technologies

Fin3 Technologies is the modern payment solution to physical checks. Fin3 is a trailblazer in the digital payments space and launched a new payment method, Digital Drafts, based on changes to payment law, specifically UCC 12.

Features

Fin3 Digital Drafts:

- Replaces physical checks

- Offers all the legal benefits of physical checks but is 100% digital

- Integrates with core banking software

Who’s it for?

Banks, credit unions, insurance companies, SMBs, and others using physical checks.

ID-Pal

ID-Pal uses 100% AI-powered technology for real-time identity verification and OFAC screening, ensuring seamless customer onboarding, compliance, and zero access to customer data.

Features

- Provides built-in AI document fraud detection

- Delivers global coverage and streamlined OFAC compliance

- Offers seamless integration options and fully customizable

Who’s it for?

Banks, neobanks, community banks, credit unions, payments providers, insurance companies, asset management companies, and financial institutions.

ModernFi

ModernFi helps banks and credit unions grow, retain, and manage their deposits through the ModernFi Deposit Network by enabling extended federal deposit insurance.

Features

- Delivers first fully integrated and API-driven deposit network available to banks and credit unions

- Offers first and only credit union focused deposit network

- Provides powerful digital experience for depositors

Who’s it for?

Banks and credit unions.

MoneyKit

MoneyKit is a superaggregator, a universal API that intelligently aggregates data from multiple sources, maximizing institution coverage, connection success rates, and connection stability over time.

Features

- Supports data from Akoya, Finicity, MX, Plaid, and Yodlee

- Offers intelligent routing, data standardization, and enrichment across providers

- Provides SDKs for the simplest integration of all time

Who’s it for?

Banks, credit unions, community banks, scaled fintechs, wealth management groups, payment providers, and IDV.

QuickFi

QuickFi is the first and only embedded finance platform in the market for secured commercial equipment lending.

Features

- Offers 100% digital, end-to-end borrower self-service, with 24/7 access

- Automates credit, contract structuring, business verification, and compliance

- Completes transactions in minutes vs. days or weeks

Who’s it for?

Banks, equipment manufacturers, and equipment distributors.