This post is part of our live coverage of FinovateFall 2015.

BehavioSec debuted BehavioSec on Demand:

BehavioSec debuted BehavioSec on Demand:

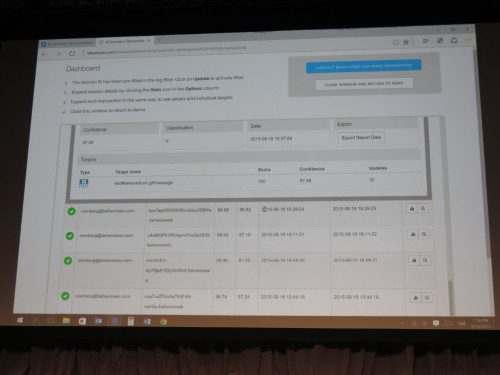

We are revealing our new BehaviorSec on Demand service. We have extended the proven and tested technology from BehavioSec’s large banking installation of behavioral biometrics that work as an additional layer of security, and we implement it as a transaction-based service in the cloud. This helps organizations that need better control of who is accessing their service and that suffer from fraudsters compromising the integrity of companies and individuals.

Presenter: COO Olov Renberg (COO)

Product distribution strategy: Direct to Business (B2B), through financial institutions, through other fintech companies and platforms

HQ: Stockholm, Sweden

Founded: 2009

Website: behaviosec.com

Twitter: @BehavioSec