If there is one region where “A Tale of Two Fintechs” applies, that region is Asia.

From blockchain-based innovations in trade finance to leveraging mobile to better serve the historically underbanked, fintech’s role in Asia is not just a tale of economic and technological development. Increasingly, it is a story of leadership in solving real world problems, as well.

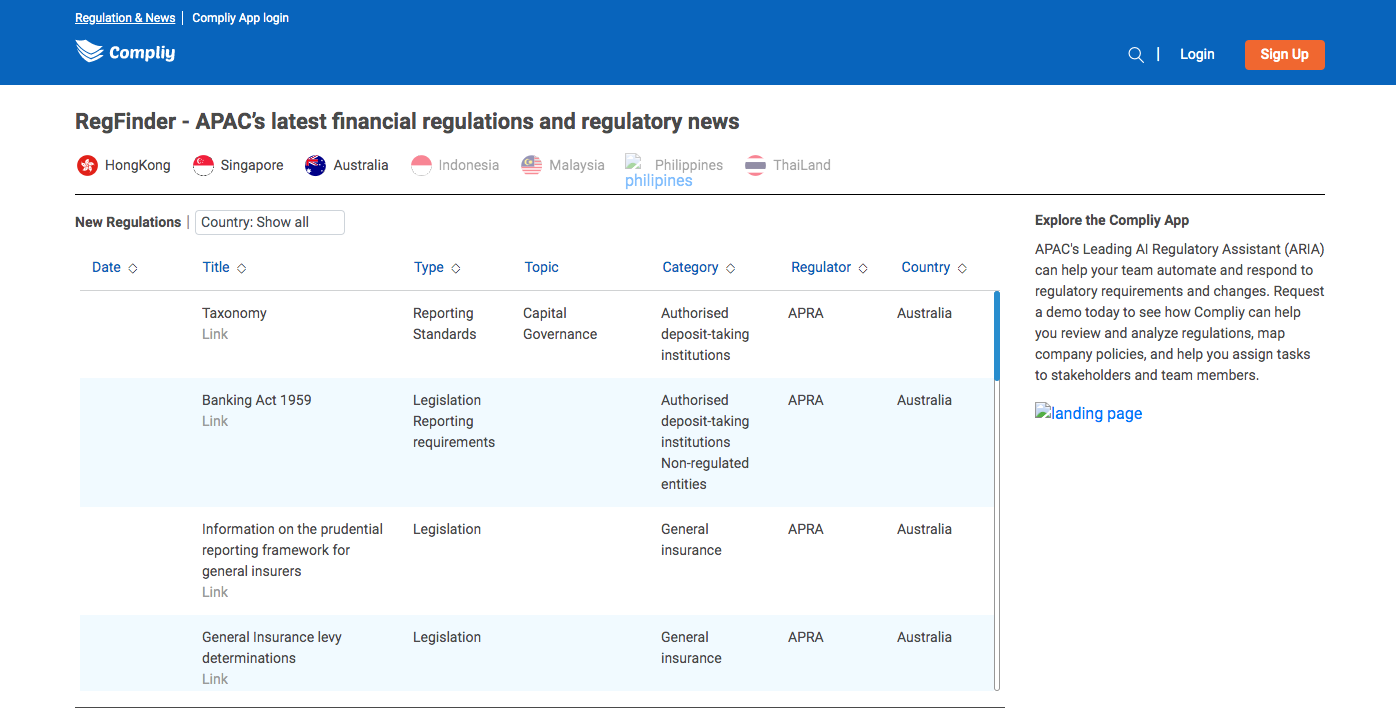

As Finovate returns to Singapore for FinovateAsia next week, we thought it would be an ideal opportunity to look at some of the notable numbers and key trends in fintech in the region.

Singapore

- Singapore is home to 500+ fintech startups and 40+ innovation labs

- Fintechs in Singapore picked up more than $370 million in funding in 2018

- The fintech adoption rate by consumers in Singapore topped the global average this year.

When it comes to fintech, Singapore is clearly punching above its weight. With a smaller population, fewer local customers, and a modest pool of tech talent to draw from compared to the U.S., the U.K., and China, the fact that Singapore was ranked fourth in a listing of global fintech hubs – after the U.K., and the east and west coasts of the U.S. (judged separately in a report from Ernst & Young) – is a testament to the vibrancy of Singapore fintech.

How does Singapore do it? Close alliances and mentorships, including private-public partnerships and a willingness to work with other countries and fintech hubs around the world are one factor. The city-state’s central bank and financial regulatory body, the Monetary Authority of Singapore, has pledged to commit $168 million over the next five years to support collaborations between financial institutions and fintechs. Singapore has also begun issuing more digital banking licenses in recent months. Could a booming challenger bank industry be far behind?

At FinovateAsia, be sure to check out:

Mentoring Power Panel: What Every Start-up Needs to Know About Fund Raising, Winning Investors, Marketing, Building Scale & Overcoming the Hurdles to Form Fruitful Partnerships in Asia.

China

- $25.5 billion in fintech deals in 2018 according to Accenture; 44% of all fintech investments worldwide

- Top Deals in 2018: Ant Financial’s Alipay raised $14 billion, Baidu spinoff Du Xiaoman Financial raised $4.3 billion, Lufax raised $1.3 billion

- Four of the top 10 fintechs in the world are Chinese according to H2Ventures and KPMG

Payments dominate Chinese fintech: 34 out of top 100 fintechs are payments companies. And with ecommerce driving much of fintech innovation in China, many are wondering what the next big thing in the industry will be? Some have suggested that wealth management, catering to a new generation of Chinese investors, may be the next frontier for innovation in Chinese fintech.

At FinovateAsia, be sure to check out:

Keynote Address: The Exponential Rise of B2B and B2C Fintech in China – What’s Next for the World’s Most Progressive Fintech Market?

Hong Kong

- Hong Kong-based fintechs received $545.7 million in funding in 2017

- Host to more than 550 fintech companies, Hong Kong has a 67% fintech adoption rate

- 80% of publicly-funded tertiary educational institutions have fintech-related programs for undergraduates or graduates

Public-private partnerships are a key driver of fintech innovation in Hong Kong. The Hong Kong Monetary Authority’s launch of its Faster Payment System in 2018 paved the way for instant fund transfers between the Chinese renminbi and the Hong Kong dollar, as well as the issuance of eight virtual banking licenses this year. The Monetary Authority is also responsible for introducing a trade finance platform based on blockchain technology.

At FinovateAsia, be sure to check out:

Fireside Chat: How Financial Institutions Can Successfully Collaborate with Fintechs.

India

- The overall transaction value for the Indian fintech industry is estimated at more than $66 billion in 2019 by PwC

- Indian fintechs received $1.8 billion in venture capital funding across 97 investments in 2018

- With a fintech adoption rate second only to China’s, India surpassed China in the number of fintech deals in Q2 of 2019

India is often overlooked in the conversation on Asian fintech. But the most notable aspect of the country’s experiment with mobile payments, its unified payment interface (UPI), has been a dramatic display of the power of interoperability. In the three years since UPI was launched, the service facilitated 800 million monthly transactions. More than 140 Indian banks are participating in UPI and both Alphabet’s Google and Facebook’s WhatsApp offer instant payments via the technology.

At FinovateAsia, be sure to check out:

Fireside Chat: India is the Second Highest Fintech Adopter Globally – Where Do the Opportunities Lie?

ASEAN at Large

- The ASEAN region is the third largest region in Asia and consists of Singapore, Indonesia, Thailand, Malaysia, Philippines, Brunei, Vietnam, Laos, Myanmar, and Cambodia

- In Southeast Asia, less than 30% of adults have access to formal banking services. Approximately 33% of SMEs lack access to business financing

- Market growth of the fintech market in Southeast Asia is expected to reach as much as $70 billion by 2020

The fintech industry of Southeast Asia is increasingly gaining the attention of analysts and investors alike. Earlier this year, Indonesian e-commerce payments and lending innovator Akulaku picked up a $40 million investment from Ant Financial. The #1 payment app in Vietnam, Momo, closed a Series C investment at the beginning of the year valued at $100 million.

And while financial inclusion is a huge theme for the underbanked in this region, innovations in a variety of fintech subcategories should be recognized, as well. For example, fintechs like Jitta in Thailand are bringing digital investing solutions to the region while Malaysia’s mortgagetech innovator MHub offers networking and collaboration solutions for property developers and financial services professionals.

At FinovateAsia be sure to check out:

Strategy Roundtable: Capturing the Opportunities in Emerging Asian Markets – Indonesia, Malaysia, Thailand, Vietnam, the Philippines, Korea.

Still don’t have your ticket to FinovateAsia? There’s still time to register for the event, taking place October 14 through 15 in Singapore.