Fintech has always had a digital backbone. Cashless payments. Security tokens. Robo advisors. Invoice financing. Mobile banking. And hundreds of other connectors, all building the path for a digital future, a future where companies are growing and innovating faster than ever.

From a buyer side, companies need technology to digitally do business. From a seller side, companies have to deliver these services and solutions. And all sides need confidence that Finovate’s fall events are going to run successfully to help them achieve their business needs. With all of that in mind, we’re embracing digital.

Now that the events have been moved online, you know FinovateFall Digital and FinovateWest Digital will take place. You can plan with 100% confidence, see more solutions, expand your reach, and access highly curated and produced content. These are all things Finovate is already known for.Â

Because of Finovate’s quality standards, these won’t be like any other digital events you’ve seen before. Live and on-demand content will put your finger on the pulse of the industry. Live Q&A and polls will ensure you can engage directly with speakers. And 24/7 networking and an app packed with fintech enthusiasts will make it easy to start a conversation with the right person.

So if you’re a buyer, register now. And if you’re a seller, apply to demo at FinovateFall, FinovateWest— or both– to reach different audiences.

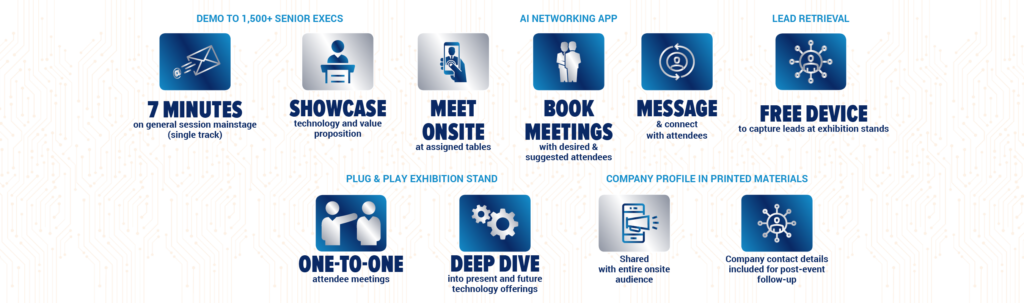

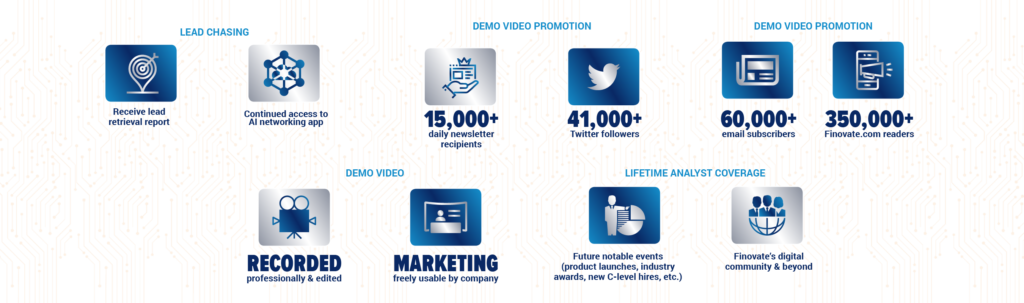

Demos will be live streamed throughout the events, plus available on-demand to 1,000+ senior fintech leaders. All demo companies will have virtual booths for Q&A, deeper product dives, and 1-to-1 meetings. Plus, we’ll deliver leads to everyone participating. Visit the event websites above for more information.

The future of fintech is digital, and we hope to see you digitally this fall.

Photo by Johnson Wang on Unsplash