Amazon made headlines around the banking/fintech world this week following a WSJ story Monday about a rumored collaboration with Chase Bank and/or Capital One. The click-bait title, Next Up for Amazon: Checking Accounts (apparently revised from the title embedded in the hyperlink, “Are You Ready for an Amazon-branded Checking”) made it go viral in the United States, at least with news organizations.

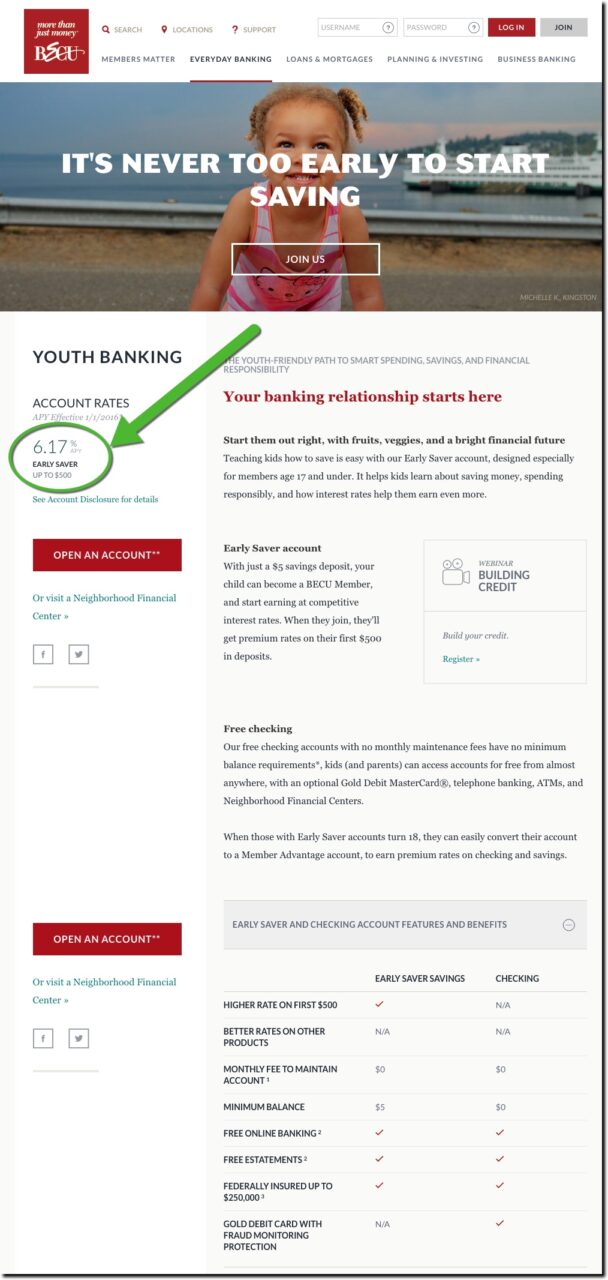

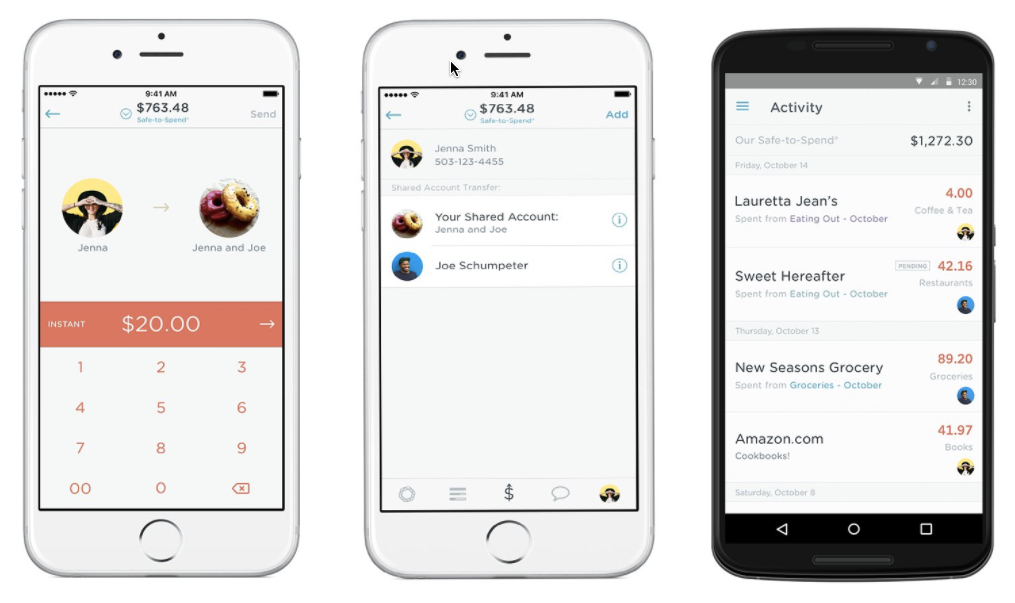

The facts were less exciting than the headline. Apparently the ecommerce giant issued an RFP last year seeking suppliers of a “hybrid” checking account aimed at younger and unbanked customers (it’s unclear whether that is a single segment “young and underbanked” or two segments, “young” and/or “underbanked”). And there was no indication that any new product was coming now, or ever.

The facts were less exciting than the headline. Apparently the ecommerce giant issued an RFP last year seeking suppliers of a “hybrid” checking account aimed at younger and unbanked customers (it’s unclear whether that is a single segment “young and underbanked” or two segments, “young” and/or “underbanked”). And there was no indication that any new product was coming now, or ever.

There is one thing missing in the 100+ stories that appeared in the wake of the WSJ piece:

Amazon already is a bank in everything but the name

Here’s a list of its current financial and payment offerings:

- Amazon Pay: Used by 33 million to pay for goods at non-Amazon sites

- Amazon Gift Cards: Available at brick & mortar retailers all over the country (I’ve bought more of those than all other gift cards combined)

- Amazon Store Card, with financing option on qualified purchases: Issued by Synchrony Bank

- Amazon Cash, a virtual debit card which allows cash deposits to the Amazon Pay wallet

- Amazon Rewards Visa Signature Card, an affinity card issued by Chase Bank (also Amazon Prime Rewards card; see also March 13 update below)

- Amazon Prime Reload, which pays a 2% bonus for cash deposits into Amazon Pay

- Amazon.com Corporate Credit Line: A way for businesses to pay for Amazon purchases via monthly consolidated billing, underwritten by Synchrony Bank

- Amazon Lending: Which has originated $3B to smaller merchants since 2011 (cited by Bloomberg, sourced to CB Insights)

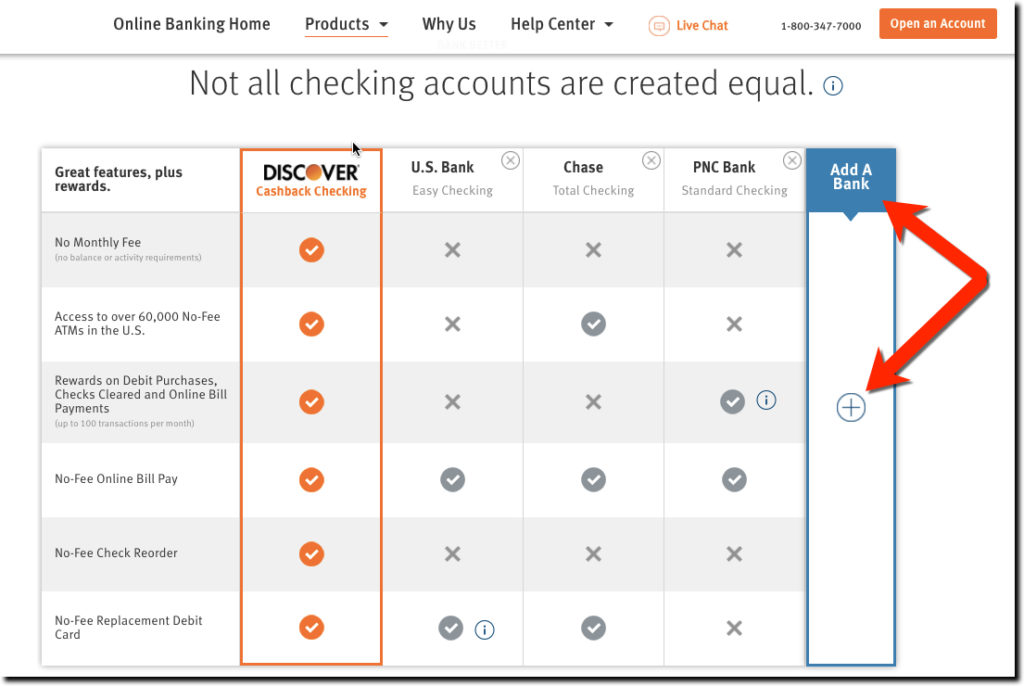

- Credit Card Marketplace: Hadn’t seen that before, includes Amazon co-branded cards along with Discover and American Express

- Gift Card marketplace: Hundreds of prepaid gift cards from other retailers along with restaurants, travel, and entertainment providers

- Amazon Currency Converter: For purchasing on Amazon.com in local currency

- Amazon Allowance: Tool for parents to enable their kids to pay directly (link was broken so not sure the status)

- Shop with Points: A number of major banking rewards programs can shop directly at Amazon with their bank-provided points including Citibank, American Express, Chase and Discover

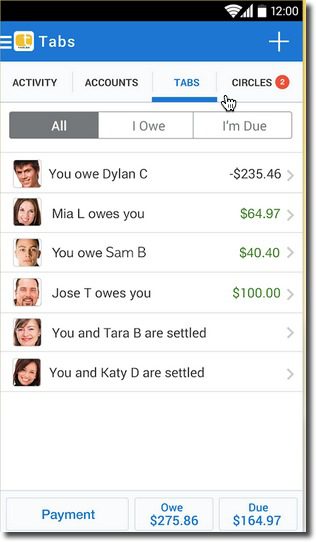

- Alexa: Supports banking and payments info (aka skills) from a number of financial institutions including Capital One, US Bank, and American Express

- Teen accounts: Amazon allows teens to set up separate logins and make purchases from an allowance amount and/or request approval directly from parents (Source: Business Intelligence).

(Update 29 March 2018) Recent news reports imply that Amazon may be looking at creating additional teen payment options, potentially in partnership with banks

The only major retail banking service missing, a stand-alone debit card (although you can already link a debit card to your Amazon account). Which I’m guessing is the core of the RFP mentioned by the Wall Street Journal.

Update (13 Mar 2018): Bloomberg reports that Amazon is planning on launching a small business co-branded card with Chase, the issuer of Amazon’s consumer card.

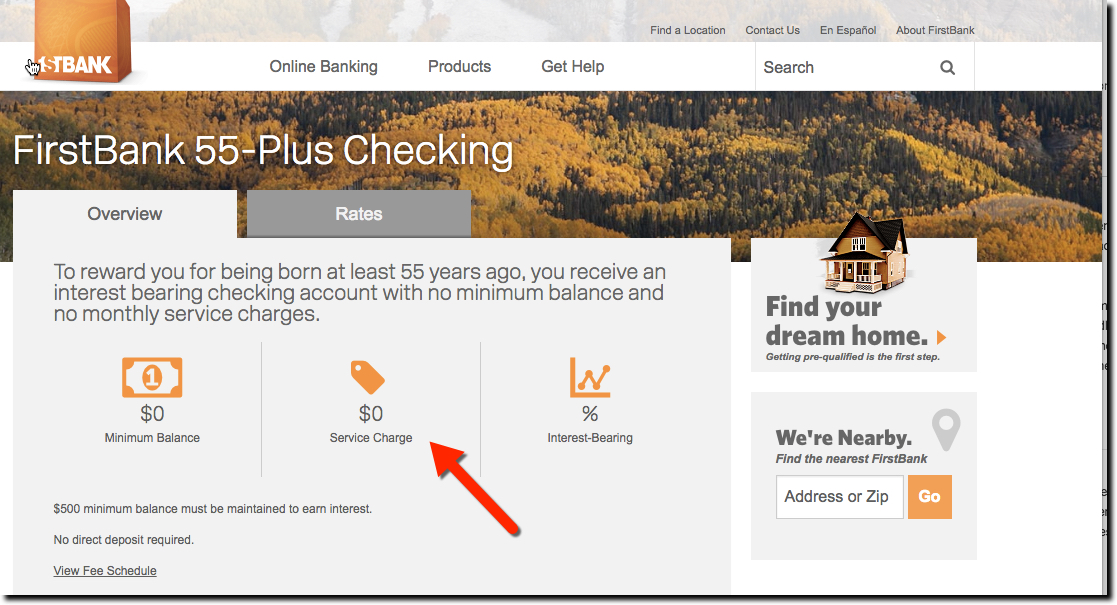

Bottom line: Amazon is already deeply involved in banking and payments, as are most major retailers. Gift cards, co-branded credit cards, and SMB credit products are already being used by millions of consumers. Adding a debit card and/or “hybrid checking account” isn’t going to make them any more menacing as a competitor. The prime concern for banks is whether Amazon can move payment volume from bank-issued credit cards, where the industry enjoys healthy profit margins, to debit/ACH with narrow-to-non-existent margins.

Author: Jim Bruene (@netbanker) is Founder & Advisor at Finovate as well as Principal of BUX Certified, a financial services user-experience accreditation program.

![What’s the Fuss? Amazon Already Offers Full Suite of Banking Services [Updated]](https://finovate.com/wp-content/uploads/2018/03/amazon-banking-product-line.jpg)

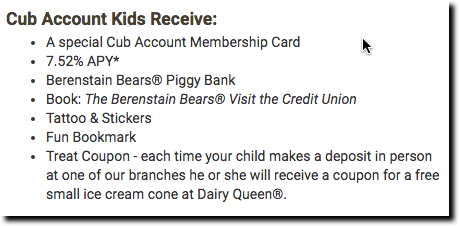

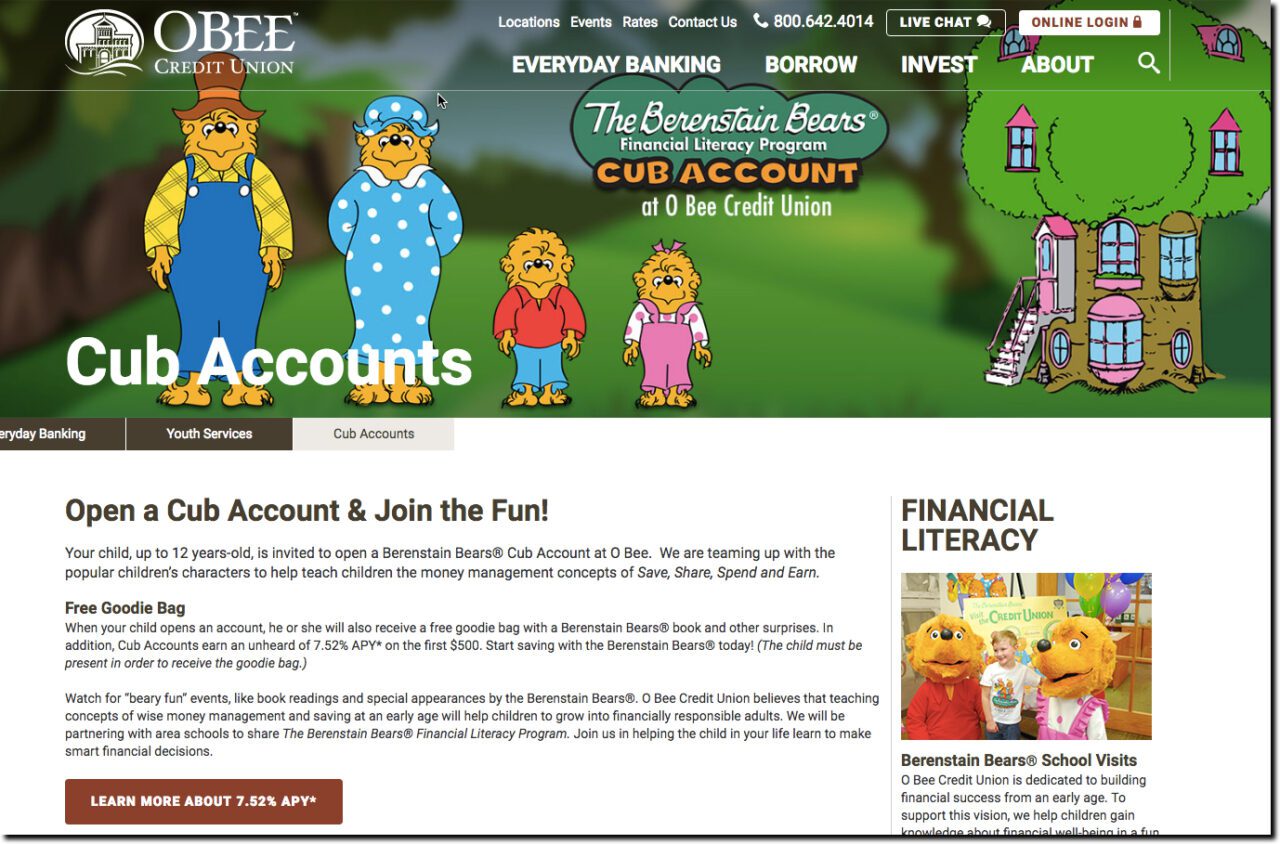

The book is in use at a number of credit unions, but none more prominently than

The book is in use at a number of credit unions, but none more prominently than

Savedroid enables users to set behavior-based rules called “smooves” that help steer a small amount of money toward savings for various goals. For example, set aside $1 for every cup of coffee you buy at your favorite cafe, or $5 every time you spend more than an hour on social media. The savings strategy works as well for short-term goals like a vacation a few months from now or longer-term goals like saving for college. Hankir added: “We make saving exciting, convenient and rewarding, and thus particularly suitable for the target group of millennials.”

Savedroid enables users to set behavior-based rules called “smooves” that help steer a small amount of money toward savings for various goals. For example, set aside $1 for every cup of coffee you buy at your favorite cafe, or $5 every time you spend more than an hour on social media. The savings strategy works as well for short-term goals like a vacation a few months from now or longer-term goals like saving for college. Hankir added: “We make saving exciting, convenient and rewarding, and thus particularly suitable for the target group of millennials.”