- New York-based Signal Intent has rebranded as Chimney.

- The company won Best of Show in its Finovate debut at FinovateSpring last year.

- The rebrand announcement accompanied news that Chimney had raised seed funding that “exceeded its investment goals.”

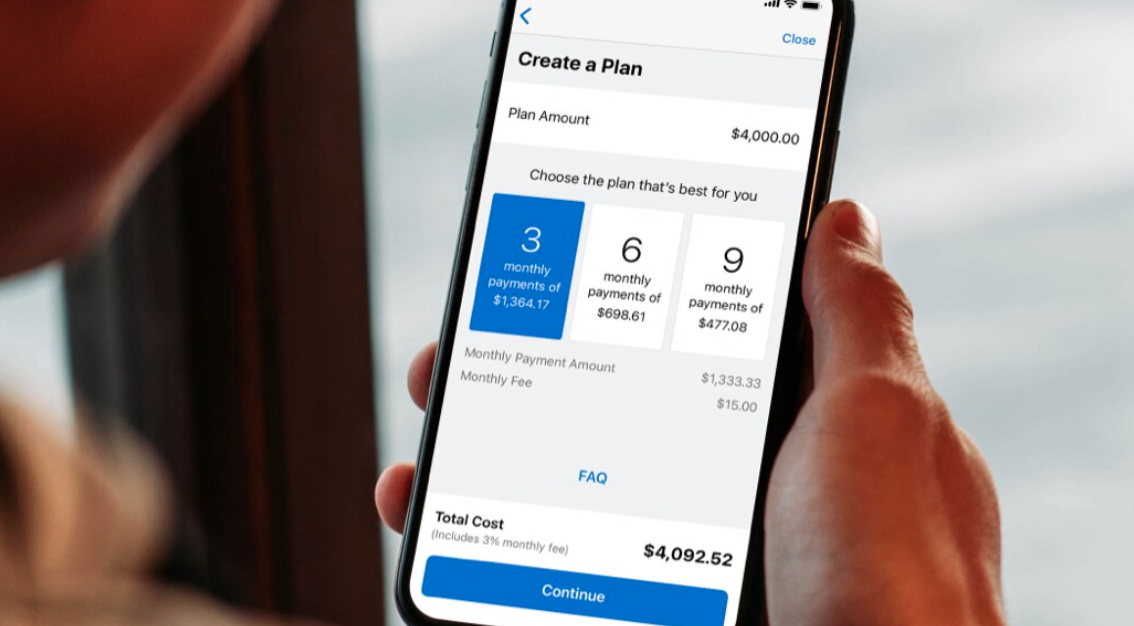

Signal Intent, which won Best of Show in its Finovate debut at FinovateSpring 2021, has rebranded as Chimney. The company develops financial calculators for banks, credit unions, insurers, and mortgage companies that are “built for the digital age.” The New York-based fintech’s rebrand, announced last month, was accompanied by a seed investing round with participation from individual investor Anil Aggarwal, as well as investment firms Fin VC, and Converge.

“Banking is fundamentally changing as consumer behaviors shift,” Chimney CEO Matthew Covi said. “To compete, banks must change their digital strategy. It is no longer about providing outstanding products and services. It’s about the value they provide through digital experiences. As consumers increasingly make financial decisions online, they expect experiences that are embedded in their everyday life. Chimney is committed to delivering not just the products consumers want, but the experiences they expect.”

More than 60 financial institutions in 30 states use Chimney’s financial tools and technology to better engage their customers and fund more loans. The company said that its financial institution clients have experienced a 15% boost in conversions since deploying Chimney’s technology that helps connect customers to the right solution at the right time. Chimney also helps FIs reduce acquisition costs while growing their loan portfolios.

Selected for the 2022 ICBA ThinkTECH Accelerator program, Chimney plans to add to its team, including multiple “key positions” over the next several months. The company’s co-founders include Chief Technology Officer Ryan F. Salerno, former Technical Co-founder of equity management platform Finta (previously Equity Token); and Chief Revenue Officer Chase Neinken, former VP of Global Sales at B2B media company Industry Dive.

“We created Chimney to build the future of financial guidance,” Neinken said. “We believe in a world where people are empowered to make better financial decisions through technology – it’s about confidence and understanding. The demand so far has exceeded expectations and we’re thankful to our clients, partners and investors. Big things are coming ahead.”

Photo by Mikhail Nilov from Pexels