- Consolidation in the Buy now, pay later (BNPL) industry continues as Zip agrees to acquire competitor Sezzle.

- The deal values Sezzle at $355 million.

- After the acquisition is finalized, Sezzle will rebrand to Zip and the company’s CEO Charlie Youakim will lead Zip’s U.S. business.

Buy now, pay later (BNPL) player Zip (formerly known as Quadpay) is acquiring Sezzle in a deal that values Sezzle at $355 million.

Zip CEO and co-founder Larry Diamond expects the deal will help Zip scale up its operations. “Combining with Sezzle positions us as a leading global BNPL provider and prioritizes our ability to win in the important U.S. market.”

Following the deal, Zip’s customer base will increase from 9.9 million to 13.3 million and the number of merchant partners will grow from 82,000 to 129,000. Additionally, The Financial Review estimates that Zip’s total transaction volume will rise from $8 billion to $10.4 billion, and that almost $6.5 billion of this will be from U.S. users.

After the deal closes, Sezzle will rebrand as Zip and the company’s CEO Charlie Youakim will lead Zip’s U.S. business. “I believe the transaction will position us to win in the U.S. and globally,” Youakim said.

Today’s announcement is yet another indication of consolidation in the increasingly-crowded BNPL space. Industry giant Afterpay sold to Block (formerly Square) on February 2nd. And on February 17th, digital payments firm Latitude agreed to acquire Humm’s BNPL operations.

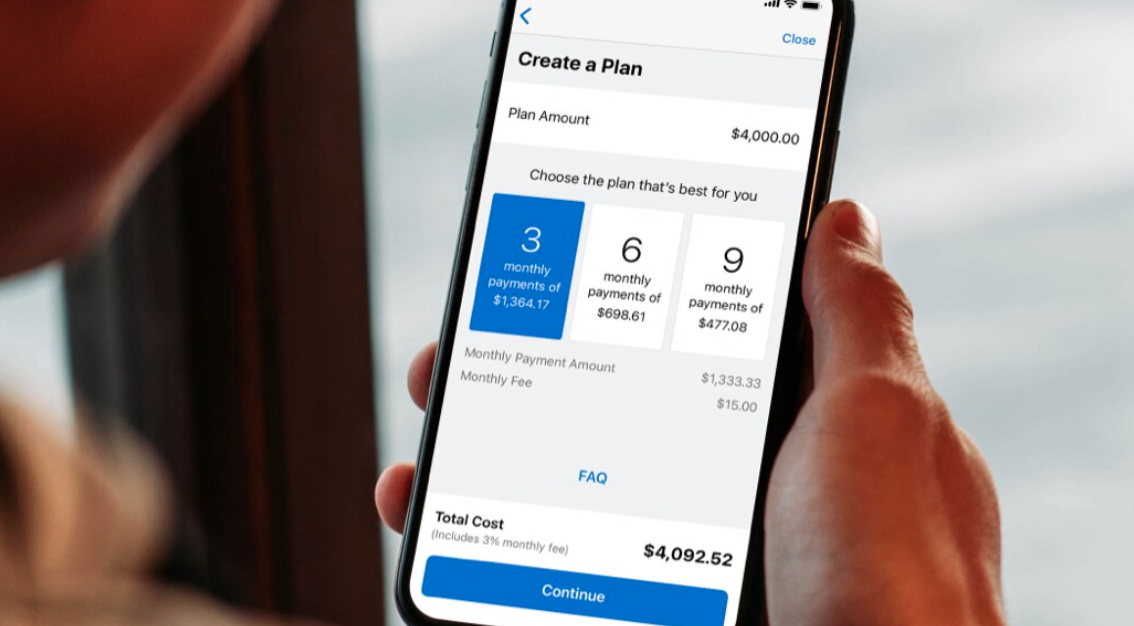

Australia-based Zip was founded in 2013, seven years before BNPL took off as an alternative payment method. Zip is publicly traded on the Australian Stock Exchange (ASK) under the ticker ZIP. The company allows users to split their purchase into four installments over the course of six weeks. With Zip’s app, shoppers use their Zip Virtual Card to pay for their purchase in installments anywhere that Visa is accepted, both online and in-store.

Similarly, Sezzle allows shoppers to use their Sezzle Virtual Card to pay for purchases in four installments over the course of six weeks. The company also offers a long-term financing tool in partnership with Ally and Sezzle Up, an alternative credit solution that helps shoppers build their credit.

Minnesota-based Sezzle was founded in 2016 and went public on the ASK in 2019 under the ticker SZL. At the time, Sezzle said it opted to list on the ASX instead of in U.S. markets because, prior to 2020, the BNPL model was more commonplace in Australia, given that Afterpay, a major player in the BNPL arena, is headquartered in Melbourne.

Photo by Jessica Lewis on Unsplash