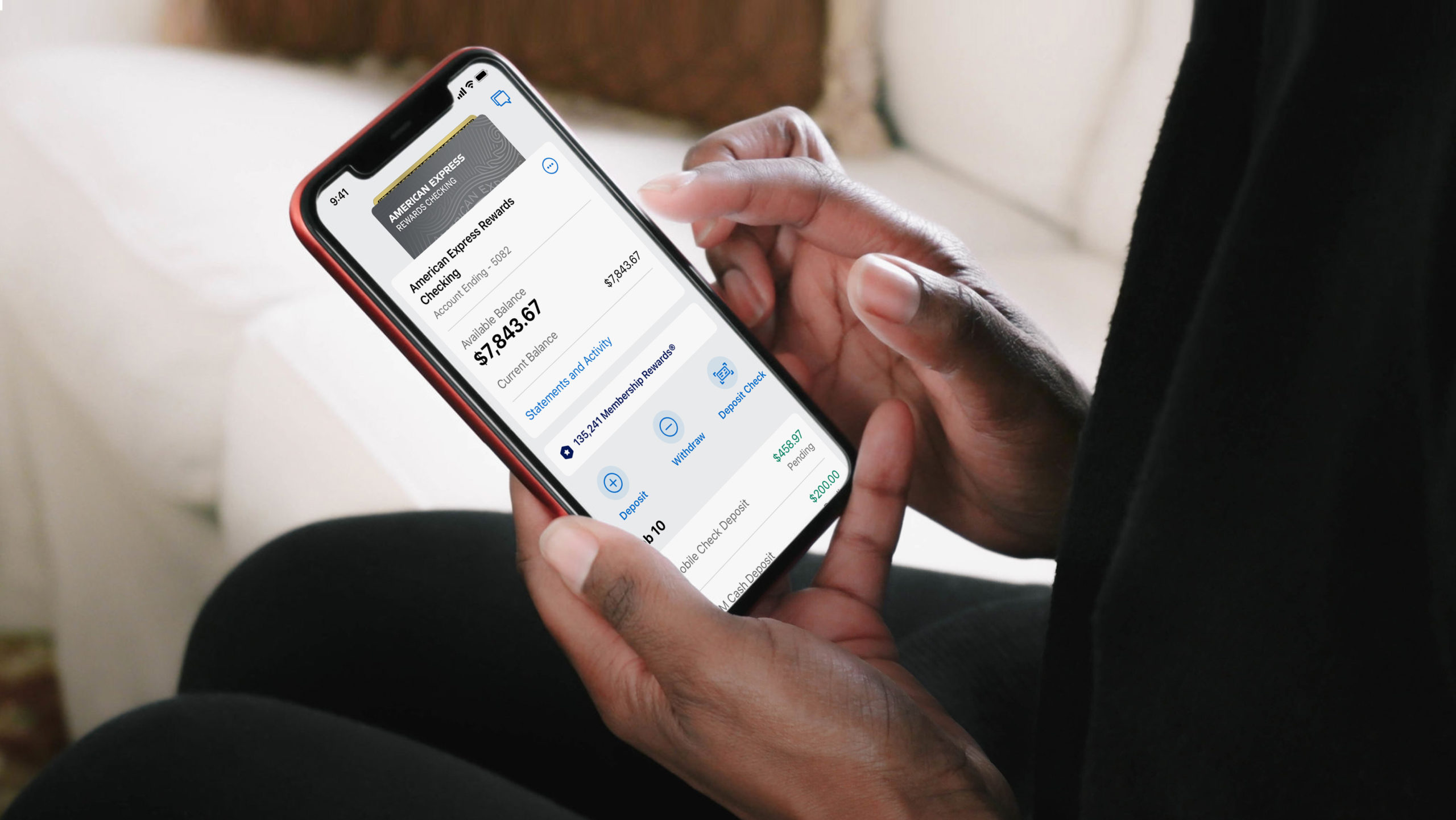

- American Express is launching a new, digital checking account called Amex Rewards Checking

- The Amex Rewards Checking account will offer a 0.50% high-yield APY on account balances, along with other membership rewards

- The new checking account is only open to primary American Express credit cardholders and is limited to individual users.

Financial services giant American Express is expanding its horizons into the crowded world of digital checking. The company is launching Amex Rewards Checking, an all-digital consumer checking account, for eligible U.S. card members.

As an incumbent player, American Express has multiple advantages over the many smaller digital challenger upstarts that have launched in the past two years. That’s because not only does the New York-based firm have credibility and a pre-existing large customer base, it also comes with a reputation for its rewards and perks.

“Our Members want more banking products and services from us,” said American Express Executive Vice President and General Manager of Consumer Banking Eva Reda. “And they want more from their checking account, without giving up the benefits that are important to them. That’s why we built Amex Rewards Checking to deliver more value for Members with the powerful and trusted backing of American Express. It’s digital checking without compromises.”

The checking account product will be a draw to Millennial and Gen Z users, who look for banking products with incentives and rewards. In fact, according to a study from Amex, 35% of consumers rank rewards and offers at the top when considering opening a new account. Given this, Amex packed competitive features into its new checking account. Accountholders can:

- Earn 0.50% high-yield APY on their account balance, which is 10x higher than the national rate

- Gain one Membership Rewards point for every $2 spent on eligible debit card purchases. Users can redeem these points for deposits into their Amex checking account

- Pay no monthly maintenance fees or minimum balance fees

- Receive purchase protection for accidental damage or theft on eligible purchases

- Access Amex’s customer care providers 24/7 via phone or chat

- Receive fraud protection and monitoring

- Make fee-free ATM withdrawals at 37,000 MoneyPass ATM locations

The new Rewards Checking account is only open to primary American Express credit cardholders who have had their account for more than three months. Currently, the new checking account is limited to individuals and cannot accommodate joint accounts.

The new Amex Rewards Checking is American Express’ first checking account for retail customers. The financial services giant has offered small business checking for a little over a year now. The company acquired Kabbage in 2020 for $850 million and leveraged the purchase to launch a small business checking offering in 2021. That said, it’s worth noting that Amex’s new debit card is not available to its small business checking customers.

American Express, which presented at our developers conference in 2015, is listed on the New York Stock Exchange under the ticker AXP. The company saw $36 billion in revenue in 2020 and has a market capitalization of $149 billion. Stephen Squeri is CEO.