- Payroll connectivity innovator Atomic launched its subscription management solution, PayLink Manage.

- The new offering for financial institutions enables users to monitor recurring payments and make real-time changes from within their banking app.

- Atomic most recently demoed its technology earlier this month at FinovateSpring in San Francisco.

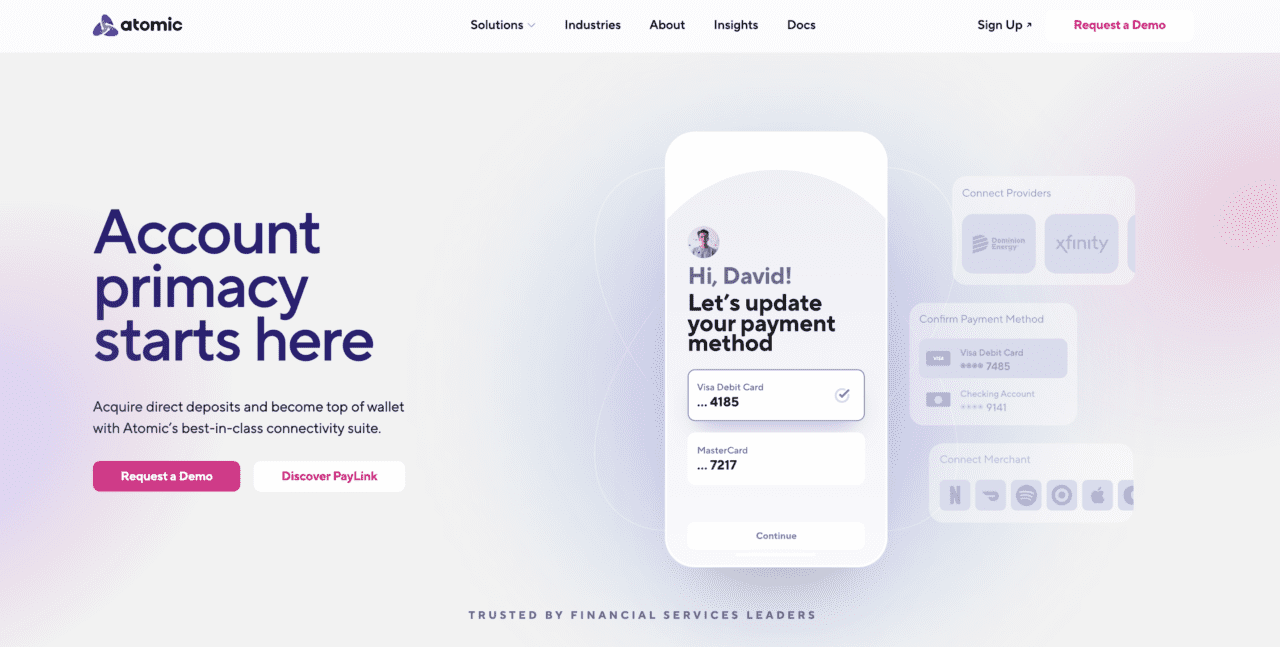

Payroll connectivity innovator Atomic unveiled its latest offering: PayLink Manage. The new solution is an actionable subscription management tool for financial institutions that enables users to monitor recurring payments and make real-time changes from within their banking app.

“By integrating PayLink Manage, banks can not only improve their service offerings and increase engagement, but also can solidify themselves as the primary banking relationship,” Atomic CEO and Co-Founder Jordan Wright said. “When banks help their account holders with innovative insights that are actionable, everybody wins.”

PayLink centralizes and automates oversight and control of recurring payments. Users can connect, view, and track a variety of payment types from subscriptions and bills to streaming services and mortgage payments. PayLink Manage also enables users to make real-time changes to their subscriptions directly within the banking app. Additionally, courtesy of Atomic’s direct connectivity, financial institutions can gain insights into usage data, itemized receipts, and other key subscription information. This facilitates deeper analysis, driving more personalized guidance that helps users save money.

“PayLink leverages Atomic’s proven technology, which has already facilitated millions of secure connections across financial platforms,” Atomic Chief Product Officer Andrea Martone said. “With this launch, we are extending our trusted, robust connectivity framework to subscription management, providing financial institutions with a tool to enhance customer engagement and improve retention by helping people take action to improve their financial outcomes.”

Headquartered in Salt Lake City, Utah, Atomic made its most recent Finovate appearance earlier this month at FinovateSpring in San Francisco. At the conference, the company demoed its subscription management technology, which leverages its access to payroll, HRIS systems, and merchants to support a range of financial services, including direct deposit switching, income and employment verification, and more. Founded in 2019, Atomic has raised more than $68 million in funding from investors, including ATX Venture Partners and Portage Ventures.