In a world of shrinking valuations and declining VC funding, payments company Marqeta is bucking the norm. The California-based company announced today it raised $150 million. Marqeta has also boosted its valuation to $4.3 billion, more than double the $1.9 billion valuation it earned a little over a year ago.

Today’s funding comes from a single investor, which Marqeta has not disclosed. However, sources have identified the party as L.A., California-based Capital Group. Marqeta’s previous investors include Coatue, Vitruvian Partners, Visa, Goldman Sachs, 83North, Granite Ventures, ICONIQ Capital, and others.

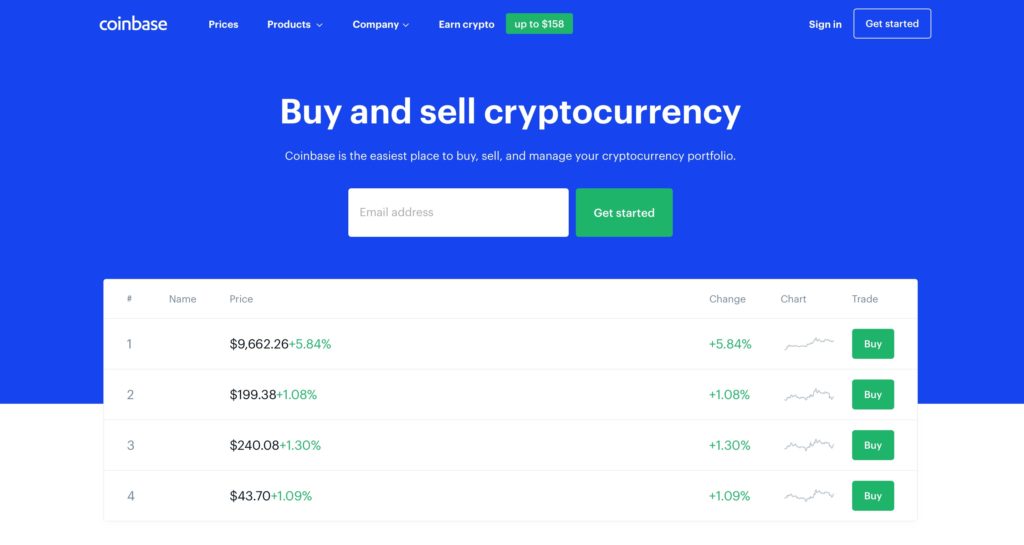

Marqeta, which was founded in 2010, positions itself as a modern card-issuing platform. The company offers scalable and configurable payments solutions available via an open API. Its services include ecommerce, incentive and disbusrsement payments, expense management, lending, and digital banking. Among its clients are Square, Uber, Affirm, Instacart, and DoorDash.

“Marqeta continues to move forward from strength to strength in 2020 as our global modern card issuing platform provides essential infrastructure and support to our customers across industries and oceans,” said Marqeta CEO and Founder Jason Gardner. “We’re building a single global platform to define and power the future of money for the world’s leading innovators. This new capital helps us accelerate our mission to empower builders to bring the most innovative products to market, wherever they are in the world.”

The company’s payment services are available in the United States, Canada, Europe, and Australia and is able to process payments in 10 countries in the Asia Pacific region. Last year, Marqeta marked the issuance of 140+million cards and doubled its revenue from the year prior to exceed $300 million. Jason Gardner is founder and CEO.