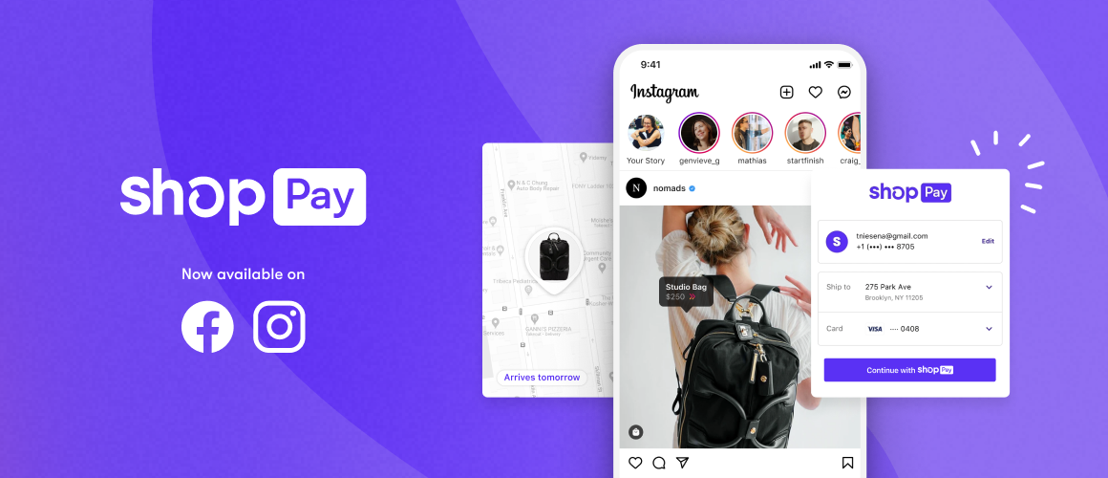

As social commerce rises, e-commerce platform Shopify is getting in on where the action is happening. The company announced today it is bringing its Shop Pay checkout and payment processing system to Instagram users and Facebook Shops.

This builds on the existing payment methods available to these Facebook-owned social platforms. Previously, shoppers had the option to either pay with PayPal or manually enter their payment card credentials.

Shop Pay, on the other hand, stores users’ payment card and shipping information to make the embedded payment experience as seamless as possible for the end customer. Prior to today, Shop Pay was only available to Shopify’s e-commerce store clients, including brands such as Allbirds, Kith, Beyond Yoga, and Jonathan Adler.

Shop Pay has 60 million users and last year helped buyers complete more than 137 million orders. This is small compared to PayPal’s 377 million active users. Shopify, however, is aiming to gain an edge by targeting the millennial customer base by offering carbon offset options that allow merchants and customers to offset the carbon emissions of their deliveries.

“People are embracing social platforms not only for connection, but for commerce,” said Carl Rivera, General Manager of Shop. “Making Shop Pay available outside of Shopify for the first time means even more shoppers can use the fastest and best checkout on the Internet.”

As for what’s next in the Shopify-Facebook tie-up, Rivera said to expect more collaboration in the future. He added, “…we’ll continue to work with Facebook to bring a number of Shopify services and products to these platforms to make social selling so much better”

The ecommerce tools are available for Instagram users today and will be available for U.S. Facebook Shops in the coming weeks.

Photo by Lisa Fotios from Pexels