News this week that Russia’s Yandex had agreed to acquire the country’s biggest online bank Tinkoff was a reminder of how vibrant fintech is not just in Europe, or even just in Central and Eastern Europe, but in Russia, as well.

As our Senior Research Analyst Julie Muhn noted in her coverage of the news, “This is a pretty big deal, not necessarily because of the size of the transaction, but because of the players involved. Yandex is essentially the Google of Russia– it is a tech giant in the region. And Tinkoff Bank is the world’s largest digital bank in terms of customers, boasting more than 10 million clients.”

With this in mind, we want to send out a shout-out to the many fintech companies based in Russia that have demonstrated their technologies live on the Finovate stage over the years. Here’s a look at our Russia-based alums going back to our first European conference in 2012.

PayReverse – FinovateAsia 2018. Founded in 2017. Headquartered in Moscow. Offers a white label cashback service.

Ak Bars Digital Technologies – FinovateFall 2018. Founded in 2016. Headquartered in Kazan. Offers a payments via face recognition technology, Face2Pay.

Tinkoff – FinovateFall 2018. Founded in 2006. Headquartered in Moscow. Offers a digital ecosystem of financial and lifestyle products and services.

JuicyScore – FinovateMiddleEast 2018. Founded in 2016. Headquartered in Moscow. Offers a digital risk-management-as-a-service solution for the financial industry.

SMART Valley – FinovateEurope 2018. Founded in 2017. Headquartered in Moscow. Offers a distributed innovation platform that enables key players to collaborate effectively.

Speechpro – FinovateSpring 2017. Founded in 1990. Headquartered in St. Petersburg. Offers a voice biometric technology, VoiceKey.FRAUD for use in contact centers. Finovate Best of Show winner. U.S.-based subsidiary of Russia’s STC Group.

Sberbank – FinovateSpring 2016. Founded in 1841. Headquartered in Moscow. Offers banking and financial services as the core bank of an international financial group. One of the largest banks in Russia and Europe.

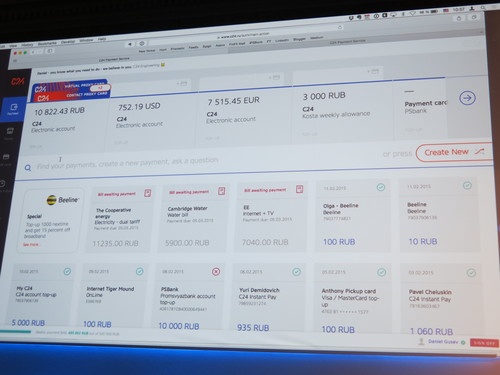

C24 – FinovateEurope 2015. Founded in 2013. Headquartered in Moscow. Offers a multi-channel platform that enables users to connect and aggregate their accounts with different banks. Became Paysend.

LifePay – FinovateEurope 2015. Founded in 2012. Headquartered in Moscow. Offers payment services as one of the largest mPOS EMV chip and pin companies in Russia.

My Wishboard – FinovateEurope 2014. Founded in 2013. Headquartered in Moscow. Offers a social crowdfunding platform to help users fund their goals along with the help of friends, family, and subscribers.

SoftWear Finance – FinovateEurope 2014. Founded in 2012. Headquartered in St. Petersburg. Offers a platform that enables banks to provide their customers with the best possible user experience regardless of platform or device.

Yandex.Money – FinovateSpring 2013. Founded in 2002. Headquartered in Moscow and St. Petersburg. Offers a fast, reliable way for online businesses to collect payments for Russians and customers in Russian-speaking countries. The solution, since sold to Sberbank, originally was launched by Yandex, the leading IT company and search engine in Europe.

LifePAD – FinovateAsia 2013. Founded in 2012. Headquartered in Moscow. Offers a “personal online bank manager” in a table, providing customer service 24/7.