Bill reduction specialist BILLSHARK is partnering with digital payments company Payrailz to give banks and credit unions a new money-saving offering for their customers and members. Via the agreement, Payrailz will integrate BILLSHARK’s bill negotiation, subscription cancellation, and curated shopping functionality into its platform, giving small businesses and individuals new tools to lower their monthly bill costs.

“BILLSHARK is excited to partner with Payrailz to bring our convenient, no-hassle approach to lowering monthly bills to their growing network of bank and credit union clients,” BILLSHARK co-founder and CEO Steve McKean said. “We look forward to helping Payrailz deliver on their vision of reinventing the way the banking and financial services industry approaches the payment experience.”

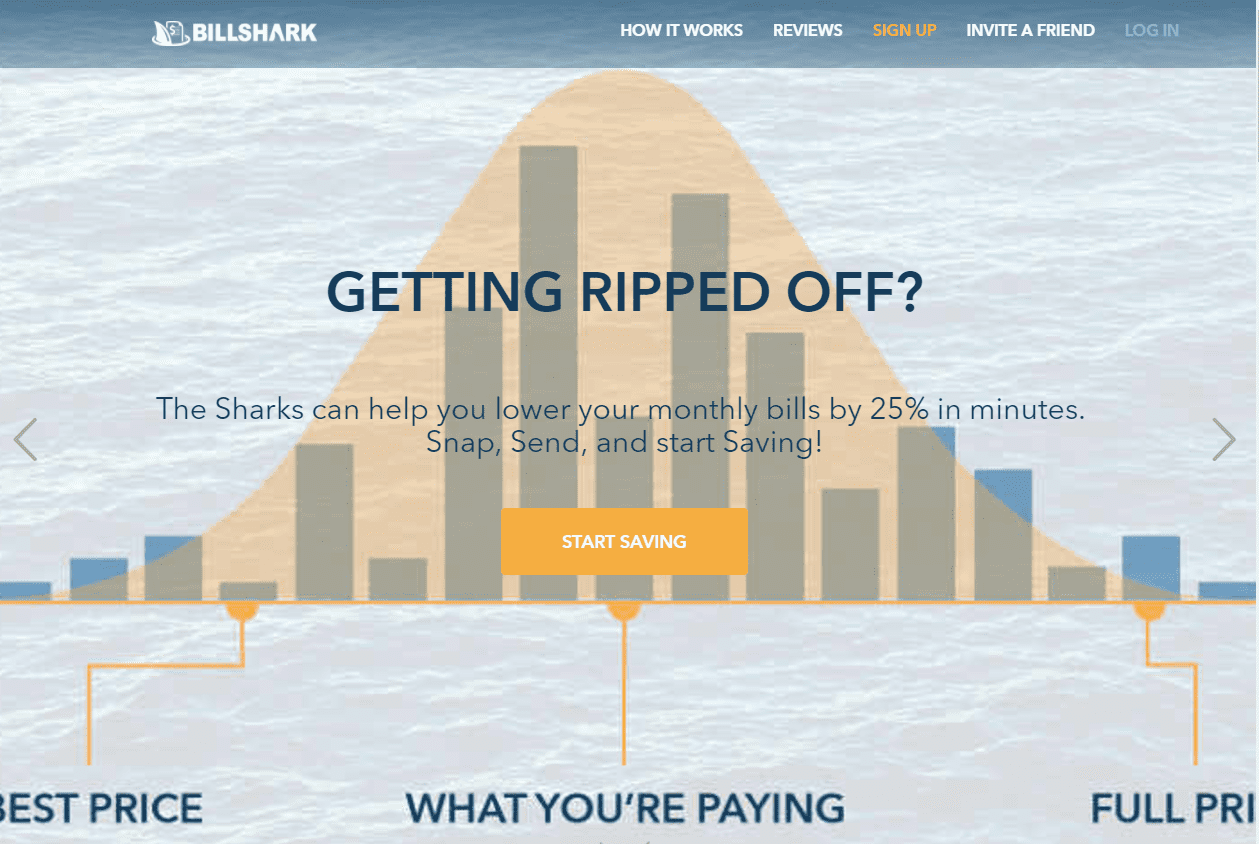

BILLSHARK works by negotiating with service providers to find the best possible terms for your monthly bills. Bill payers send copies of their bills to BILLSHARK through its website, app, or email. The company then investigates to see if there are options to lower the amounts that customers pay and updates the customer on how the bill reduction process is going. And for using the service, BILLSHARK provides customers with a $25 dining or shopping reward as a thank you.

BILLSHARK has an 85% success rate in negotiating and winning reductions in bills for cable and satellite TV subscriptions, internet access, satellite radio, and home security. Through a combination of bargaining and cancellations of unwanted subscriptions on behalf of customers, BILLSHARK has saved consumers more than $3.5 million. The company’s service is risk-free; if BILLSHARK does not save the customer money on bills, no fee is paid. For successful bill reductions, BILLSHARK charges 40% of the realized savings. For example, if BILLSHARK saves a customer $500, the fee is $200.

Founded in 2015 and headquartered in Boston, Massachusetts, BILLSHARKÂ demonstrated its Shark Connect bill reduction API at FinovateFall 2017. The API makes it easy for FIs and fintechs to integrate BILLSHARK’s bill reduction features into their applications. This week’s integration with Payrailz is the second such partnership in 2018 for the company; digital banking platform Narmi integrated BILLSHARK’s API at the beginning of the year.

BILLSHARK also made headlines earlier this year when it reported that investor and owner of the Dallas Mavericks NBA team Mark Cuban would be joining as an advisor and financial backer of the company. Also this spring, BILLSHARKÂ unveiled its One Bill, One Child program, in which the company will pay for middle-school aged kids to receive an hour of financial education from Ramsey Solutions for every bill submitted to BILLSHARK for negotiation.