According to eCheck.org, the "modern" check dates back to the early 1500s; that is, if you don't count chiseled IOUs from the Roman era 2,000 years earlier (see history here).

According to eCheck.org, the "modern" check dates back to the early 1500s; that is, if you don't count chiseled IOUs from the Roman era 2,000 years earlier (see history here).

Five-hundred years ago, I'm sure a "user customizable" piece of paper you could trade for a goat was an exciting new way to pay for something. But there hasn't been a whole lot of innovation since then. As a matter of fact, the paper check-writing practice has all but disappeared in most countries.

That's why it's newsworthy when someone puts a new spin on a five-centuries-old product as ING Direct is attempting with its new Electric Orange (EO) checking, currently in invitation-only trial, but soon to be released to the entire country. And they are having some early success, landing more than 60,000 accounts as we mentioned here, and creating some online buzz as Ron Shevlin points to here at Marketing ROI.

What are the features of Electric Checking?

- Cool name

- Great user interface for payments (see screenshots below)

- Same-screen initiation of electric (ACH) or paper payments

- 24-hour payment delivery for $15 fee

- High-payment limits: $100,000 for paper, $25,000 per day on debit card, $5,000 for ACH, and $1,000 per day on ATM withdrawals

- Good branding with the ING Direct no-nonsense design, colors, and copy

- 100% fee-free (other than a few rare items)

- 4% to 5.3% interest depending on balance (see note 1)

- 30-second account setup for existing ING Direct customers

- Easy-to-use website and online access

- No paper checks

Analysis

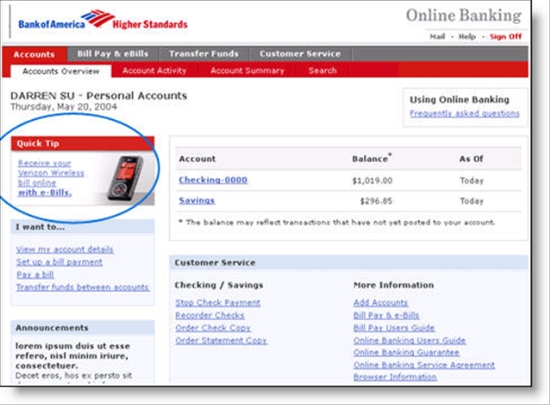

Electric Orange is an outstanding product, with one major exception which I'll discuss later. The online integration of electronic and paper payments on the same screen makes it intuitive to use and perhaps the best bill-pay suite on the market (see screenshot below). With 32,000 free ATMs, high interest rates, and a MasterCard debit card, this account competes fairly well with old school checking accounts that also come bundled with unlimited free access to 5,000-square-foot human-powered branches.

But I take issue with the account's most unique feature, "no paper checks" (see note 2). While I understand the marketing advantage of this anti-paper non-benefit, it's actually somewhat limiting for account holders. Instead of not supporting paper at all, why not simply charge a hefty transaction fee for paper checks while keeping electronic items fee-free? Sell me bright orange checks for $5 per 100 and charge a quarter per cleared check. That'll keep the volume down, while allowing customers the convenience of the old-fashioned paper check. And ING Direct gets the "viral marketing" benefit of those bright orange negotiable instruments being literally flown across the country.

I'd be willing to give up preprinted paper checks if a good subsitute were available. Reading earlier descriptions of the account before its introduction, I thought the bank had invented a new in-home process for printing checks, like printing through Quicken but a whole lot easier. Unfortunately, the paper option is good old online bill pay, complete with five-day mailing delays. That won't cut it when you need to pay the lawn guys standing in your front yard with a truck full of toxic liquid (see note 3).

The last missing piece in EO is electrification of the deposit process. Since the bank opened its doors in late 2000, it's been exceptionally easy to ACH money into the account. That's been one of its key growth drivers. But now that it offers full checking services, the bank should adopt remote deposit capture technology so EO customers could zip paper checks to them over the Net (see USAA's remote deposit service here).

ING Direct Electric Orange main payments screen

Select electric or paper checks

Electric Orange "send paper check" interface

Looks just like a "paper" check, and no need to have the payee set up prior to creating the payment (see next step)

ING Direct "add payee" interface

If the payee in the previous step is new, users simply "address" this virtual envelope to set up the payee; users also have the option of not saving the payee info.

Notes:

1. In online forums and blogs, some confusion has been expressed about what happens within this account when more than six transactions are made in a single statement period. In the account disclosure, ING Direct says that each Electric Orange account is divided into a savings account and checking account, and that the bank will direct deposits into the appropriate account as it deems appropriate, but that after six transactions, all funds will be put into the checking subaccount. However, all monies EARN THE SAME RATE OF INTEREST, so there is no impact on the customer, nor does the customer even see these transfers. It's a technical manipulation that saves ING Direct from having to maintain transaction account reserves on most balances, thereby cutting costs.

2. Actually ING Direct does offer "remote paper check" initiation via the online bill pay function where users choose from electric or paper checks (see screenshot above). The bank just doesn't allow users to have the paper in their own hands.

3. The bank does offer a quicker ACH payment function, but you need to have access to the bank account number of the recipient, which is not readily available from most people/businesses to whom occasional checks are written. And ACH usually takes 48 to 72 hours to post in the recipient's account, unless they are ING Direct customers.

It's isn't often you see one of the companies that we write about make it to the top of Inc. Magazine's list of fastest growing private companies (note 1). But this year, Timonium, MD-based Bill Me Later landed at number six.

It's isn't often you see one of the companies that we write about make it to the top of Inc. Magazine's list of fastest growing private companies (note 1). But this year, Timonium, MD-based Bill Me Later landed at number six.  The company's been on a fabulous run and it will be interesting to see how long they stay private. Depending on the credit quality of the company's receivables, it could be an attractive acquisition target for a traditional financial institution or for a certain Web-based payment giant.

The company's been on a fabulous run and it will be interesting to see how long they stay private. Depending on the credit quality of the company's receivables, it could be an attractive acquisition target for a traditional financial institution or for a certain Web-based payment giant.  #205: CreditCards.com (Austin, TX) with an amazing $43 million revenues, up 10-fold from its $3.7 million in 2003. With 16 employees, the company does almost $3 million per.

#205: CreditCards.com (Austin, TX) with an amazing $43 million revenues, up 10-fold from its $3.7 million in 2003. With 16 employees, the company does almost $3 million per.  #382: CashEdge (New York, NY) up 7.5 fold from $2.4 million in 2003, to $20.4 million last year, 315 employees.

#382: CashEdge (New York, NY) up 7.5 fold from $2.4 million in 2003, to $20.4 million last year, 315 employees.

According to eCheck.org, the "modern" check dates back to the early 1500s; that is, if you don't count chiseled IOUs from the Roman era 2,000 years earlier (see history

According to eCheck.org, the "modern" check dates back to the early 1500s; that is, if you don't count chiseled IOUs from the Roman era 2,000 years earlier (see history

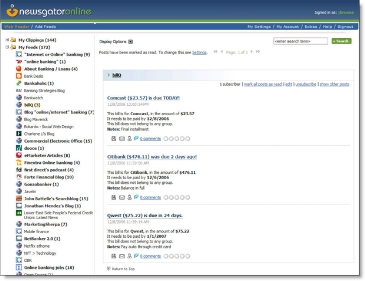

For the past few months, I've been more or less obsessed with RSS feeds (see our latest full report on the subject

For the past few months, I've been more or less obsessed with RSS feeds (see our latest full report on the subject