In the U.S. market, the industry standard pricing model has been free online

banking access combined with fee-based bill payment. However, during the

past three years, the fees for bill payment have gradually gone away to the

point where the most major U.S. banks advertise free bill payment, though it

may not apply to all account types or balance levels.

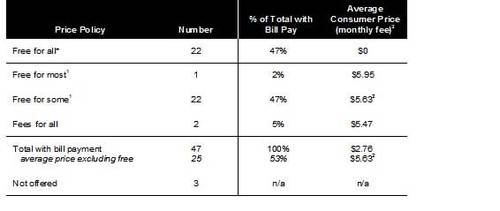

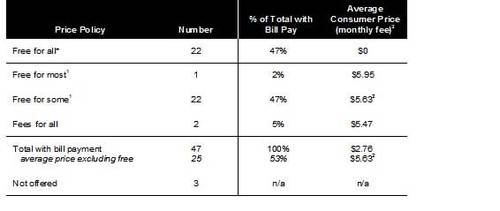

In July, we surveyed the top 50 U.S. banks and found only two that still

charged a monthly fee to all bill payment customers. Nearly half, 22 of 50,

offered bill payment free to everyone. Three banks did not offer bill

payment and the remaining 23 offered it free for certain accounts and/or

balance levels. In total, 45 of the 47 (96%) largest banks with bill payment

offered a free option . For those charging a fee, the average listed price

is $5.63/mo.

Last fall, TowerGroup found 33 of the 50 (66%) largest U.S. banks

providing bill payment free of charge to all or part of their customer base.

Furthermore, Tower found that bill pay penetration increased from 22% of

online banking customers prior to going free, to 38% after the change. This

70% lift was significantly more than what would have been expected without

the price change.

History of Free Bill Payment

Although BofA is largely credited with starting the free bill pay

movement, Citibank was actually the first to go free. In a major branding

campaign in the summer of 1997, the bank hit the streets of Manhattan

touting its no-fee electronic banking message (the fee-free policy also

applied to ATM transactions and other electronic banking transactions).

But until Bank of America’s high-profile move, most major banks held to

a $5 to $7 monthly charge, which not coincidentally covered their monthly

bill to CheckFree. Citibank handled payment processing in-house, which may

have contributed to their willingness to offer it fee-free.

Fees began to crumble in the fall of 2002 when BofA launched a

multi-million dollar television advertising campaign promoting free bill

payment. The campaign proved so popular with viewers that it continues to

this day. At the time, BofA said it was their most-remembered campaign of

all time. In the months and years since, most major U.S. banks have followed

suit. The most recent major to go free was U.S. bank earlier this year (see

Table 1, below).

One notable holdout is Wells Fargo, which last year said that 40%

of its base still paid a monthly fee.1 Assuming 2 million bill

pay accounts, with 750,000 paying monthly fees of $6.95, Wells Fargo is

bringing in more than $5 million per month in bill payment fees. While it

may lose a few customers to its pricing strategy, the $60 mil/yr can be

reinvested into better services, more marketing, or shareholder dividends.

1 American Banker, Wednesday, June 11, 2003

Table 1

Free Bill Pay Timeline

|

Bank |

Date |

Comments |

| Citibank |

1997 |

Part of high-profile strategy to make

all electronic services free-of-charge |

| AmSouth |

2001 |

Free-for-life promotion netted more

than 100,000 signups |

| Charter One |

2001 |

Became free for all |

| BofA |

May 2002 |

Became free for all |

| Nat City |

Sep 2002 |

Became free for all |

| Fifth Third |

Feb 2003 |

Became free for all |

| HSBC |

Sep 2003 |

Became free for all |

| Bank One |

Aug 2003 |

Free for all but basic accounts |

| US Bank |

Jan 2004 |

Web bill pay free for all consumers, MS

Money/Quicken still $4.95/mo |

| WAMU |

May 2004 |

Also offer free to small biz |

| Hibernia |

Sep 2003 |

Previously $4.95/mo |

Source: Online Banking Report, 7/04

Table 2

Summary of Consumer Bill Pay Fees at Top 50 U.S. Banks

Source: Online Banking Report, 7/04

(1) Free of monthly fees; in a minority of cases, fees apply for

excess usage and/or account inactivity

(2) Excludes Comerica, whose pricing is not disclosed, and MBNA

which charges by the transaction

(3) Average fixed monthly fee, excludes transaction fees for excess

usage

Table 3

Consumer Bill Pay Fees at US Top-10 Banks

Source: Online Banking Report, 7/04

1In June 2003, Wells Fargo

reported that 40% of its customers received it free-of-charge.

2Wachovia is the other top-10 holdout; it has said that 70% of

customers get it free-of-charge.

Table 4

Consumer and Small Business Bill Pay Fees at Top-50 US Banks

ranked by deposit size, 12/31/03

Source: Online Banking Report, 7/04

Bank of America landing page from Google ad

(8/25/04)

The Bank of America Story

Thanks to an unusual openness, motivated by the strategic importance1

of its free bill payment policy, Bank of America’s internal research

results have been widely circulated in print. To recap, in a 2.5 year study

of bill pay users compared to a control group of similar customers, the bank

found a 30% profit lift (see Table 5 right). Despite conventional wisdom,

little of it came from increased retention: the main driver was increased

balances.

Normally, we don’t pay much attention to studies correlating bill payment

with higher profits. It’s a function of the early adopter demographics and

will gradually diminish as bill payment becomes a mainstream service.

However, Bank of America’s results deserve a second look because they used a

control group of similar non-bill payment customers to compare profit lift.

We have serious doubts that you will be able to recreate these results

within your own customer base. Here’s why:

- What really caused the profit lift? Was it the bill payment in

isolation, or was it the entire online banking experience at BofA’s

award-winning site.

· Did households in the control group already have one foot out the

door? Perhaps the control group didn’t adopt bill payment at Bank of America

because they were already in the process of moving their balances to another

financial institution. If so, the control group was predestined to have

lower profits no matter what factor was evaluated.

· Was the control group really that similar? Although, they may have

been in the same demographic segment, it seems to us that a household using

bill pay in 2001 was fundamentally different in their financial behavior

than one that didn’t use bill pay.

· Would the same profit lift be seen with any new product geared to

affluent customers, e.g., a new diamond credit card? In other words, it may

not be that bill pay causes balances to grow; it’s merely that those

with growing balances tend to sign up for new upscale services regardless of

what they are.

· Finally, even if you take the results at face value, does BofA’s

experience with early adopters during the past three years have any

correlation with what you might expect with mainstream users during 2005 to

2008?

1 Besides the free publicity, the bank has an ulterior motive

for promoting free bill payment across the entire industry. The bank

took a 16% interest (10 million shares) in CheckFree in Q2 2000; the

deal was valued at $400 million at the time.

Table 5

Bank of America Results

index of profitability with 100 = to

profits prior to the household using electronic bill payment

| Initial customer profitability |

100 |

|

| |

|

|

| + deepened relationships (+27) |

127 |

|

| |

|

|

| + increased retention (+3) |

130 |

|

| |

|

| + reduction in servicing cost (+1) |

131 |

| |

|

|

| – cost of bill pay service (-9) |

122 |

|

| |

|

|

|

|

|

Source: Bank of America, increase in customer profitability during a

31-month period ending in 2002, results of an analysis of 300,000

customers comparing profits from bill payment users vs. the profits of a

control group of similar households not using bill pay

Results from Online Resources

Online Resources, a major bill payment processor with more than 500

financial institution clients, found that bill pay penetration was 40% for free

vs. 28% for those with monthly fees of $5 or less

(see Table 6 below).

Table 6

Online Resources results

Aug 2003

|

|

Monthly Fee |

|

|

|

Free |

<$5 |

>$5 |

Lift |

| % of ORCC client’s charging this fee1 |

33% |

36% |

31% |

n/a |

| Online banking adoption2 |

18% |

14% |

13% |

30% |

| % Bill pay conversion2 |

40% |

28% |

20% |

60% |

| Bill pay adoption2 |

7.2% |

4.0% |

2.5% |

120% |

Source: Online Resources, 7/04

(1) January 2004 data

(2) June 2004 data

That’s a 30% lift in conversion of online banking users to bill pay; and an

even more impressive 120% lift in total bill payment adoption across the bank’s

checking account base. However, it’s been achieved at a hefty cost. Not only are

the banks giving up the $5 to $6 monthly free from their existing bill pay

customers, they’re paying several dollars per month for a whole new group of

customers.

It’s also difficult to ascertain how much of the increase in online banking

adoption was accounted for by the free bill pay offer. Since the first to offer

free bill pay tended to be more aggressive in their overall marketing of online

banking, some of the lift is from better overall marketing, regardless of the

price.

Results from Compete Inc.

Ecommerce researcher Compete Inc., which has a financial services

practice run by Stephen Franco, a high-profile analyst at US Bancorp Piper

Jaffray during the height of the bank technology boom. He found that banks

offering free bill payment had a higher share of their customer’s electronic

bill payments. At major banks that charge for bill pay, 18% of their customers

used biller-direct payments. In comparison, those offering it free-of-charge had

a third fewer customers (13%) using biller direct services (see Table 7 below).

Table 7

Bank Bill Pay vs. Biller Direct

Feb 2004

|

|

|

Penetration of: |

|

Segment |

Number |

Bill pay base |

Online banking base |

| Bank online |

28.7 mil |

n/a |

100% |

| Any pay online |

11.3 mil |

100% |

39% |

| Bank only |

5.7 mil |

|

20% |

| Billers only |

4.6 mil |

|

16% |

| Both |

1.0 mil |

|

3% |

Source: Compete, Inc. 5/04

LowerMyBills landing page from Google ad (8/25/04)

![]() Launched this month, Whatbills <whatbills.com> is a simple $1.95/mo Web-based service for tracking your bills and sending yourself email reminders to pay. Although the functionality is limited, i

Launched this month, Whatbills <whatbills.com> is a simple $1.95/mo Web-based service for tracking your bills and sending yourself email reminders to pay. Although the functionality is limited, i t's the kind of service banks should be offering. We found out about the service through its Google advertisement on the phrase "quicken online" (see screenshot right).

t's the kind of service banks should be offering. We found out about the service through its Google advertisement on the phrase "quicken online" (see screenshot right).  But neither of those business models will yield much more than low-six figures per year. A more likely scenario for the San Diego-based company is a sale to Microsoft, Google, or a major financial institution for a few hundred thousand, a price that would be less expensive for a large company than developing the application internally.

But neither of those business models will yield much more than low-six figures per year. A more likely scenario for the San Diego-based company is a sale to Microsoft, Google, or a major financial institution for a few hundred thousand, a price that would be less expensive for a large company than developing the application internally.