- Verification platform Argyle announced a strategic investment round that featured participation from Mastercard, Bain Capital Ventures, Checkr, Rockefeller Asset Management, and SignalFire.

- The investment follows Argyle’s launch of verification of assets powered by Mastercard’s open finance technology earlier this year.

- New York-based Argyle made its Finovate debut at FinovateSpring 2022 in San Francisco. Shmulik Fishman is Co-Founder and CEO.

Consumer-powered verification platform Argyle announced a strategic investment round that featured participation from Mastercard as well as existing investors Bain Capital Ventures, Checkr, Rockefeller Asset Management, and SignalFire. The amount of the investment was not disclosed.

“This investment is more than capital—it’s validation,” Argyle CEO and Co-Founder Shmulik Fishman said. “We’re deepening our ability to serve customers with a comprehensive verification platform built on real-time payroll connections and open finance capabilities. By combining these strengths, we’re eliminating friction from verification workflows and giving lenders, fintechs, and tenant screeners a smarter path to faster, more accurate decisions.”

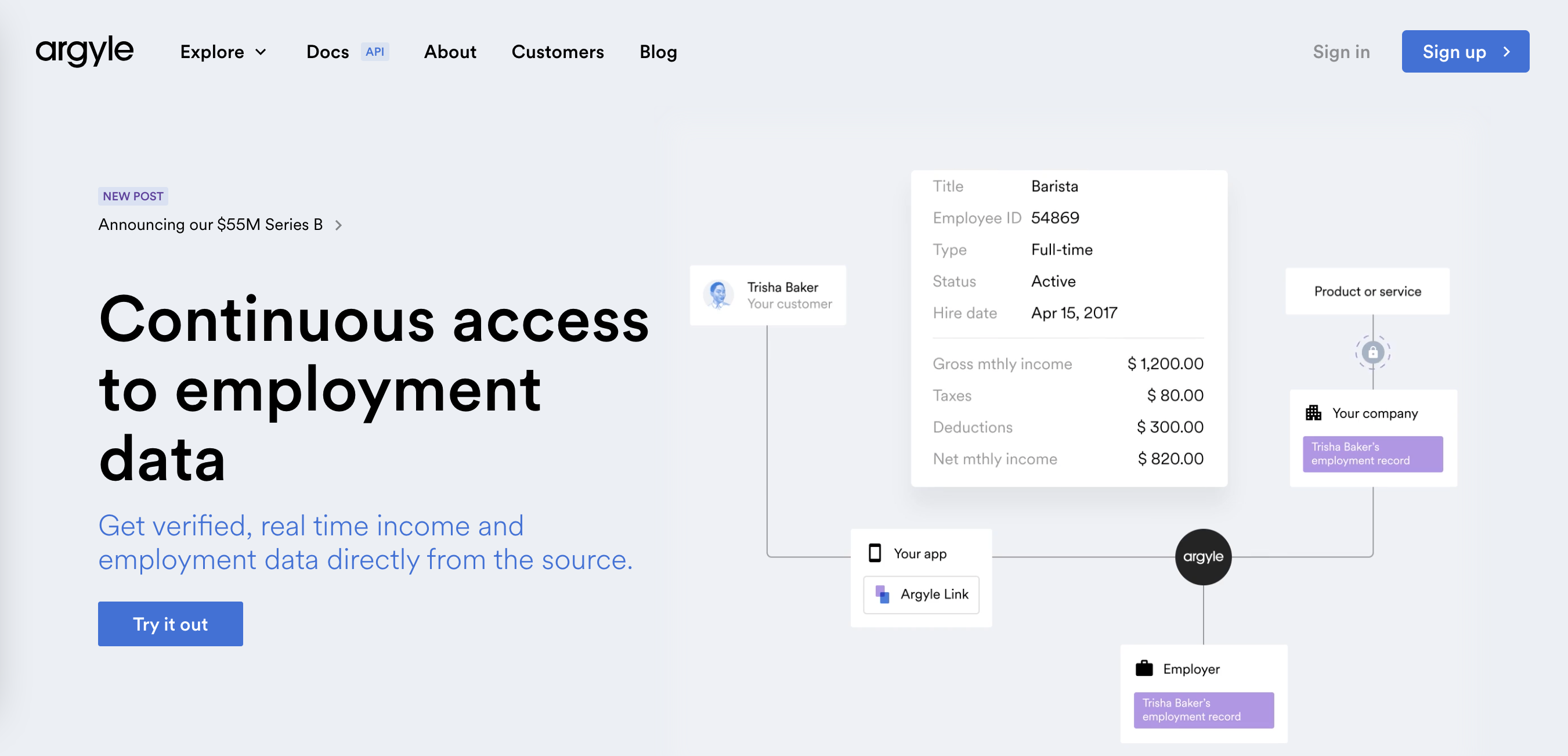

Argyle’s investment announcement comes a year and a half after the company reported securing $30 million in Series C funding. That round was led by Rockefeller Asset Management’s Fintech Innovation Fund. This week’s investment also follows Argyle’s launch of verification of assets powered by Mastercard open finance technology in June of this year. This new offering enables Argyle customers to access real-time consumer-permissioned payroll connections covering 90% of the US workforce. Customers are also now able to generate GSE-compliant reports—including verification of income (VOI), verification of employment (VOE), verification of assets (VOA), and combined verification of assets/income (VOAI)—from a single platform.

Argyle noted that the investment is a sign of growing demand for consumer-permissioned verifications. In a statement, the company highlighted a series of recent partnership accomplishments, including Checkr’s ability to reduce verification timelines from days to seconds at 90% lower cost compared to legacy solutions, Regional Finance’s success in automating verifications for more than 65% of borrowers, and Mutual of Omaha’s saving of more than $50,000 per month on verification costs.

“Argyle has built critical infrastructure for a category that’s long been overlooked by modern fintech,” Bain Capital Ventures partner Ajay Agarwal said. “We’ve supported the company from the early stages, and this latest round reflects our continued belief in their team, their momentum, and the long-term potential of consumer-permissioned data to transform verifications across financial services.”

Founded in 2018 and headquartered in New York, Argyle made its Finovate debut at FinovateSpring 2022. At the conference, the company demonstrated its Link 4.0 design update, which provides a more transparent and trustworthy experience for customers when linking their accounts.