The end of the year provides a unique challenge to banks. Customers are busy buying gifts, finishing year-end projects at work, and preparing for holiday travel, meal prep and/or extended family time. There isn’t an abundance of deep thought about long-term financial plans, other than how to pay down inflated December credit card bills.

The end of the year provides a unique challenge to banks. Customers are busy buying gifts, finishing year-end projects at work, and preparing for holiday travel, meal prep and/or extended family time. There isn’t an abundance of deep thought about long-term financial plans, other than how to pay down inflated December credit card bills.

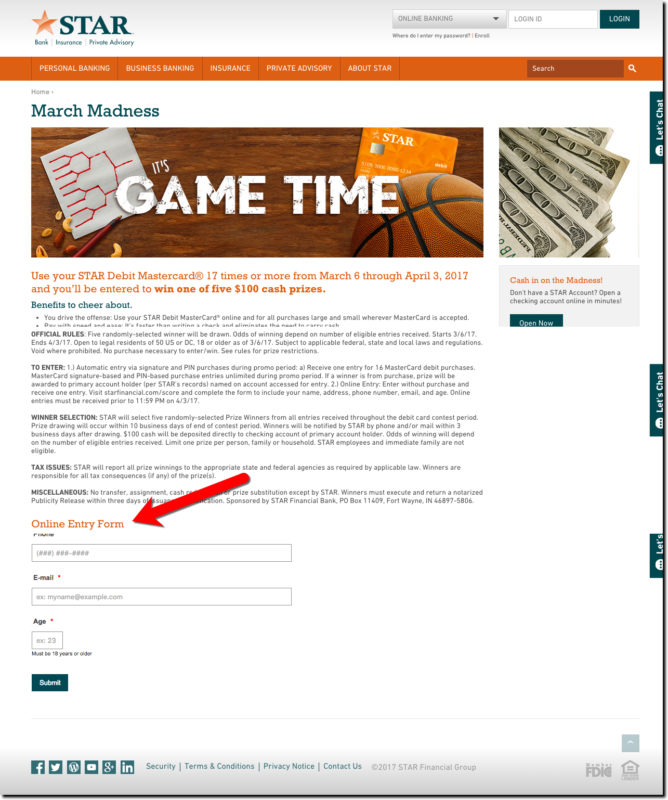

For banks, it’s a good time to run a few simple messages:

- Thank customers for a great year

- Wish them happy holidays and/or a wonderful new year

- Help customers deal with holiday overspending and planning for the new year

- Provide last-minute gift assistance via prepaid MasterCard/Visa cards

- Detail holiday branch hours and service options (extra credit for an online/mobile banking plug)

This is not a tall order, yet only 9 of the 20 largest banks managed to do even 1 of the above 5 during the week leading up to Christmas. While that may not seem like a great performance, it was more than double the measly four last year. And it’s back in line with historical norms of 9 banks 2013; 8 in 2012; and 10 in 2011. It looks like 2014 was an anomaly.

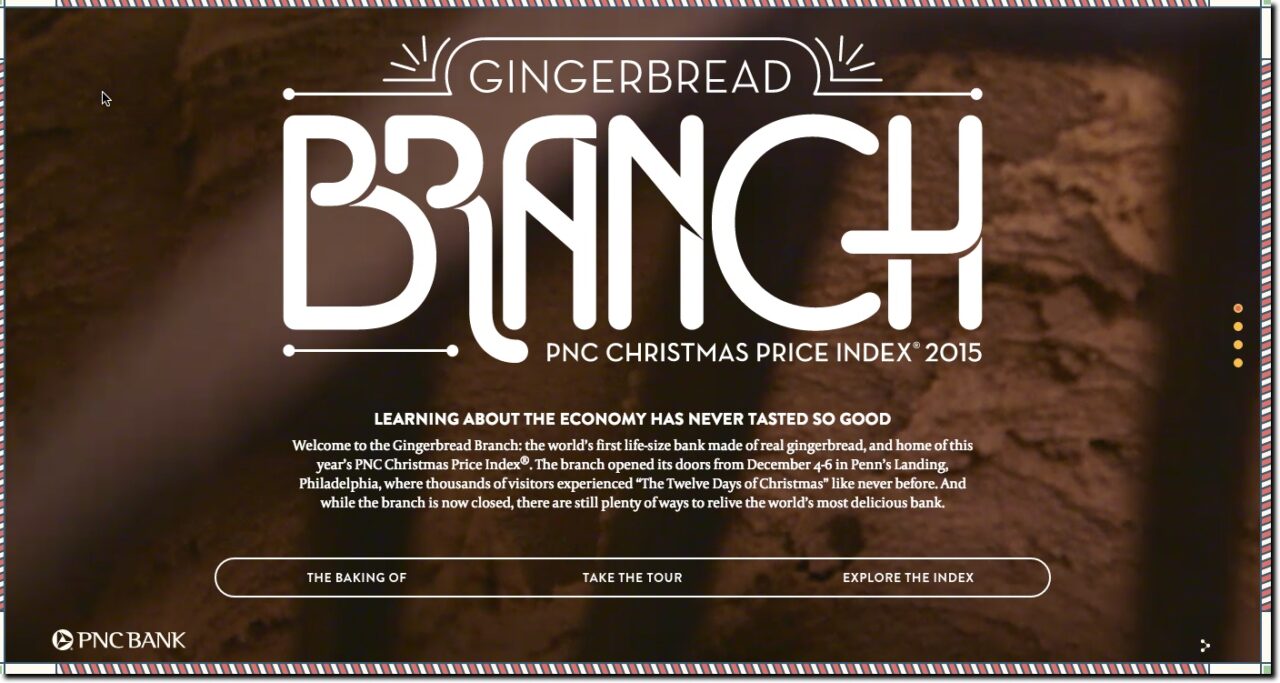

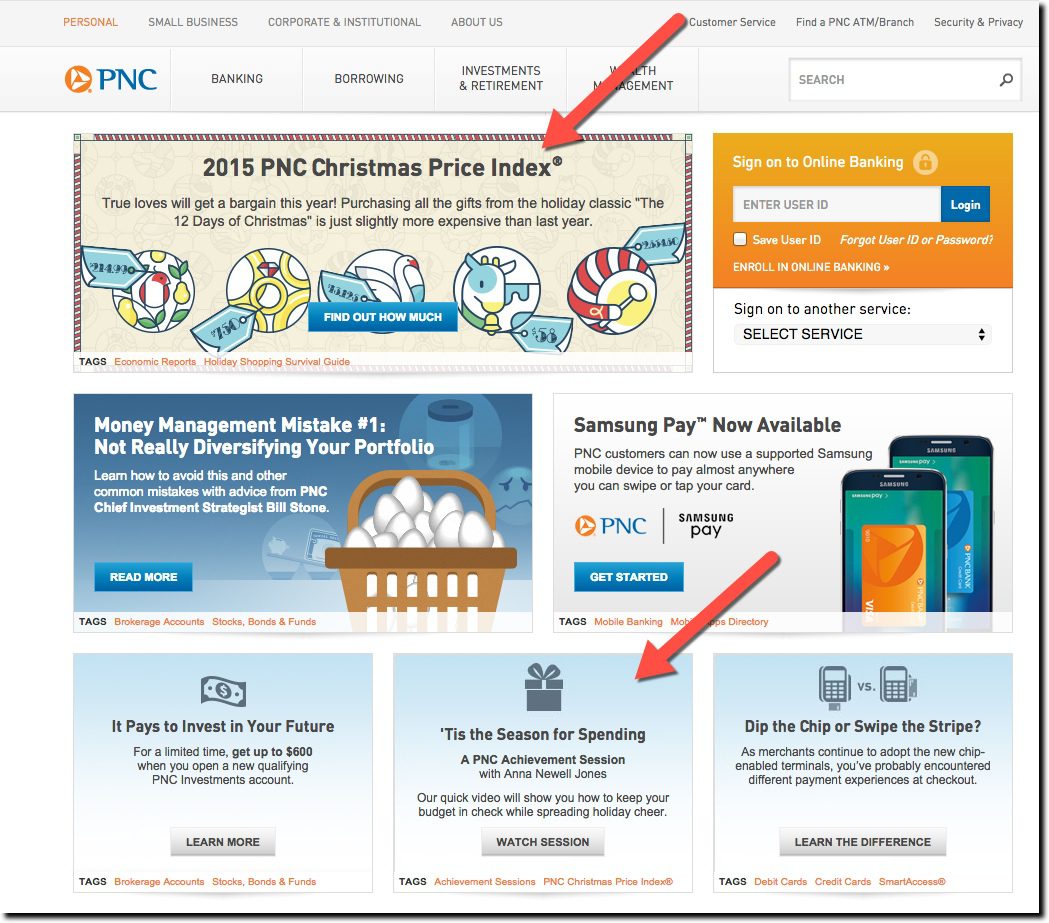

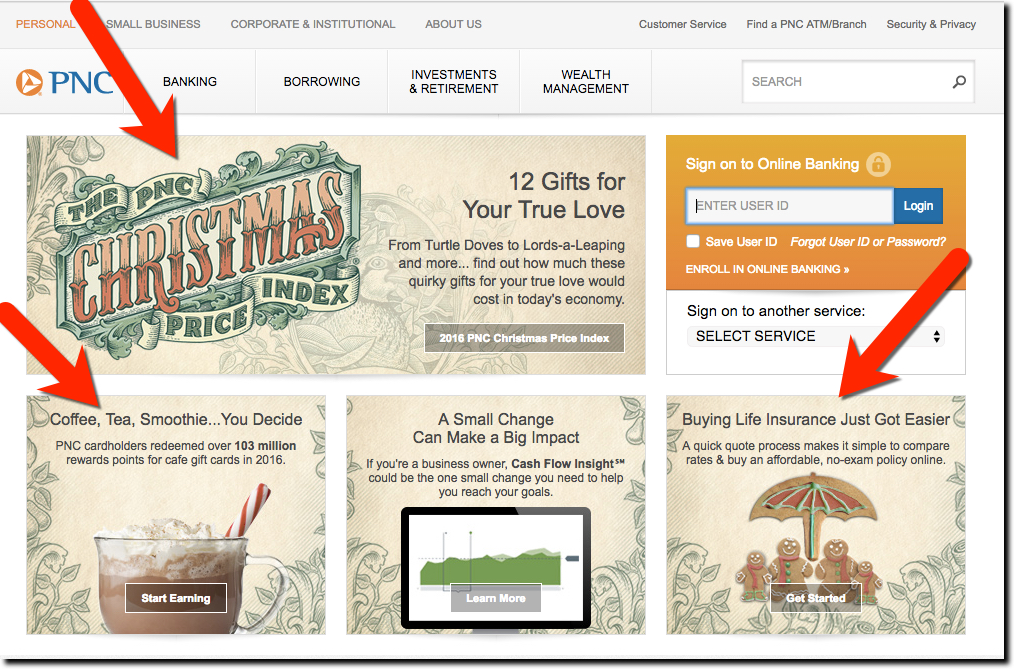

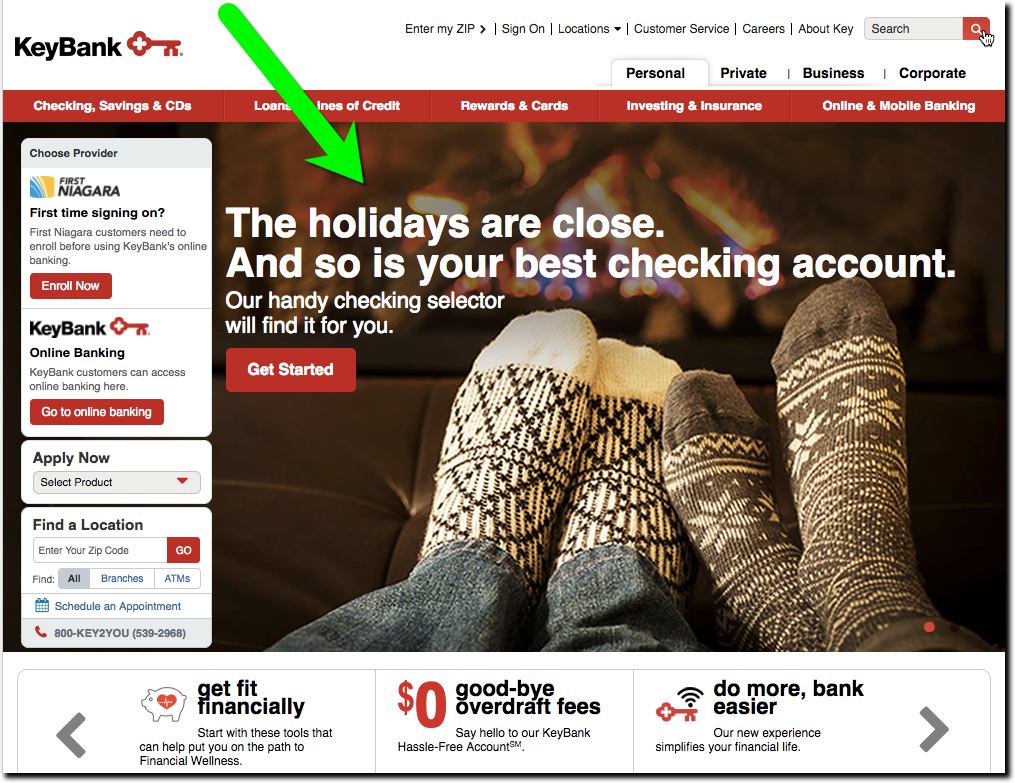

Congrats to PNC Bank, which once again, proved it was the holiday champ thanks to its long-running 12 Days of Christmas Index, earning a full 5 bulbs on our 1-to-5 light bulb scale. Runner-up Key Bank moved up to an impressive 4-bulb performance with four holiday promos. And we had three 3-bulbers (Fifth Third, BMO Harris, Union Bank) who posted impressive holiday graphics.

The scrooge list: Top-20 banks with no holiday promotions or graphics on 23 Dec 2015:

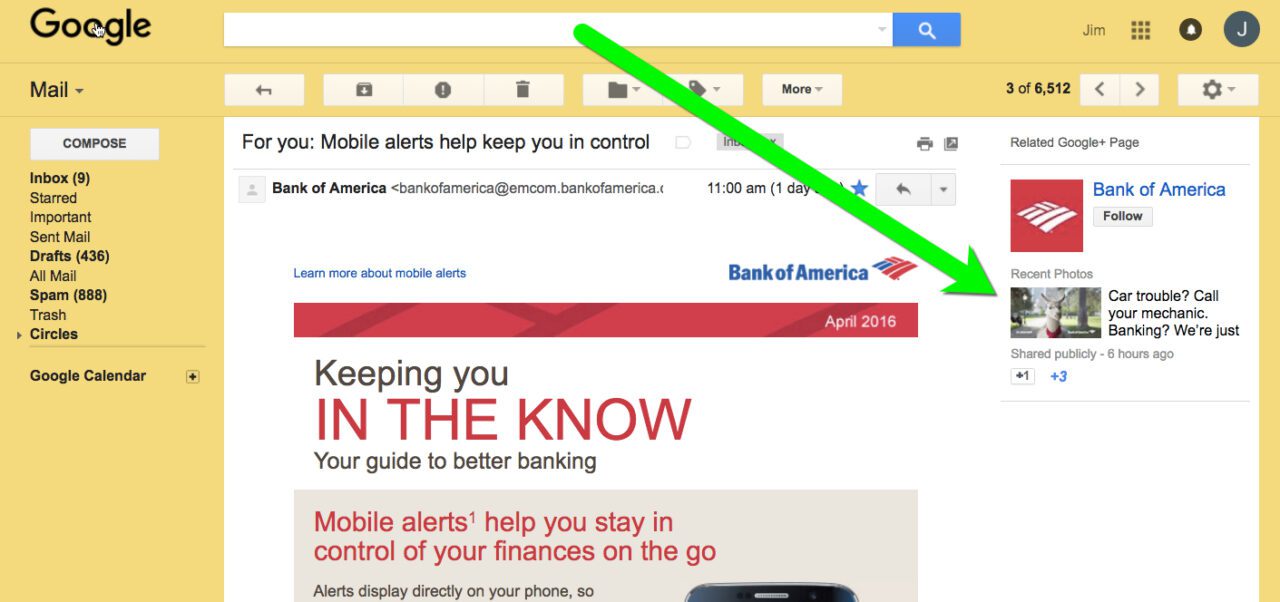

Bank of America; Bank of the West (BNP Paribas); BB&T; Capital One & Capital One 360 (formerly ING Direct); Chase (note 2); Citizens (RBS); HSBC; SunTrust; US Bank; Wells Fargo; Zions Bank.

Following is a quick overview of the promotions, including a 1- to 5-bulb rating.

Previous year-end holiday posts: 2014, 2013, 2012, 2011 (big banks), 2011(CUs/community banks), 2009 part 1, 2009 part 2, 2007, 2006, 2006, 2004.

_____________________________________________________________________

Large U.S. banks show holiday spirit

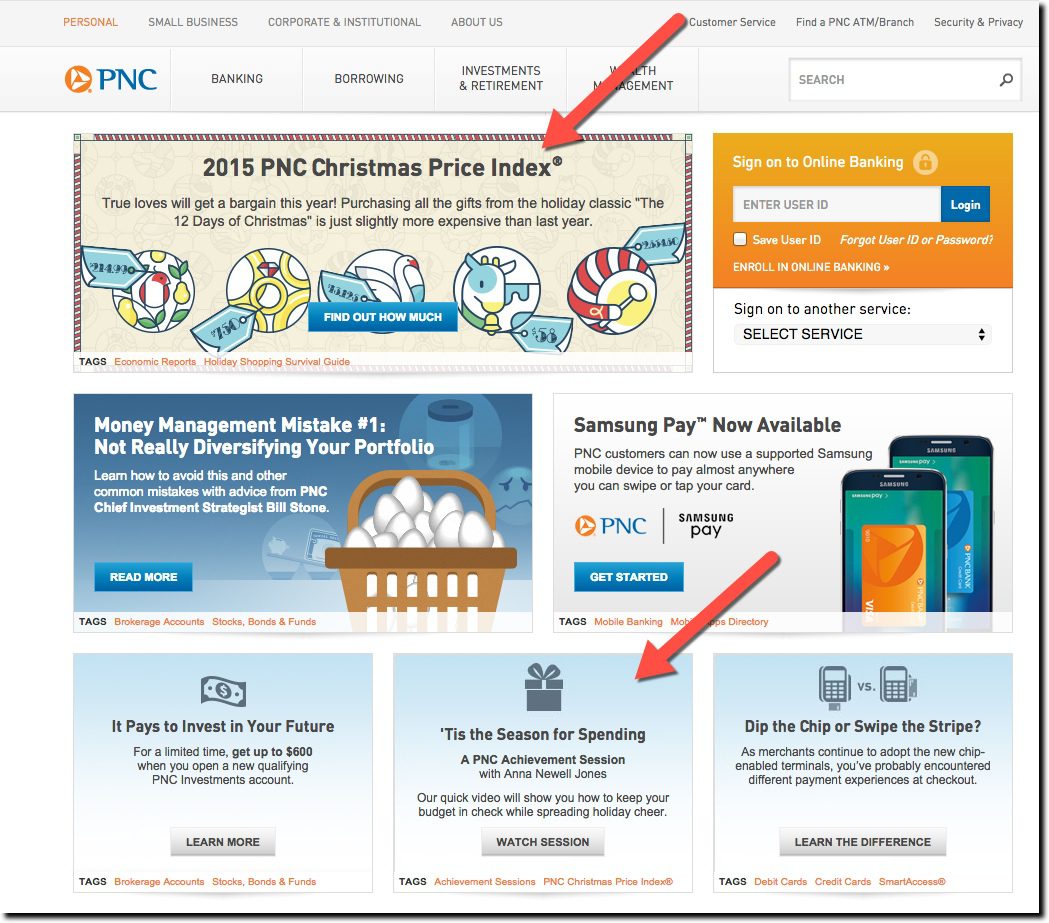

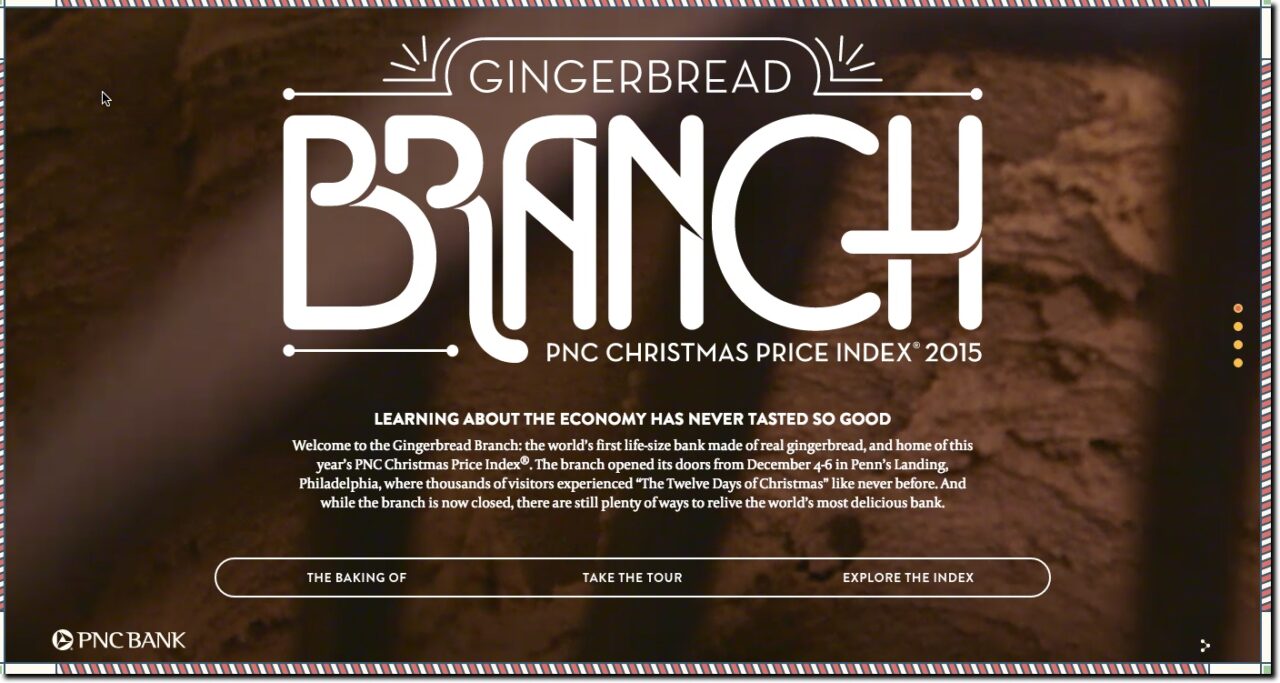

PNC Bank

Score:

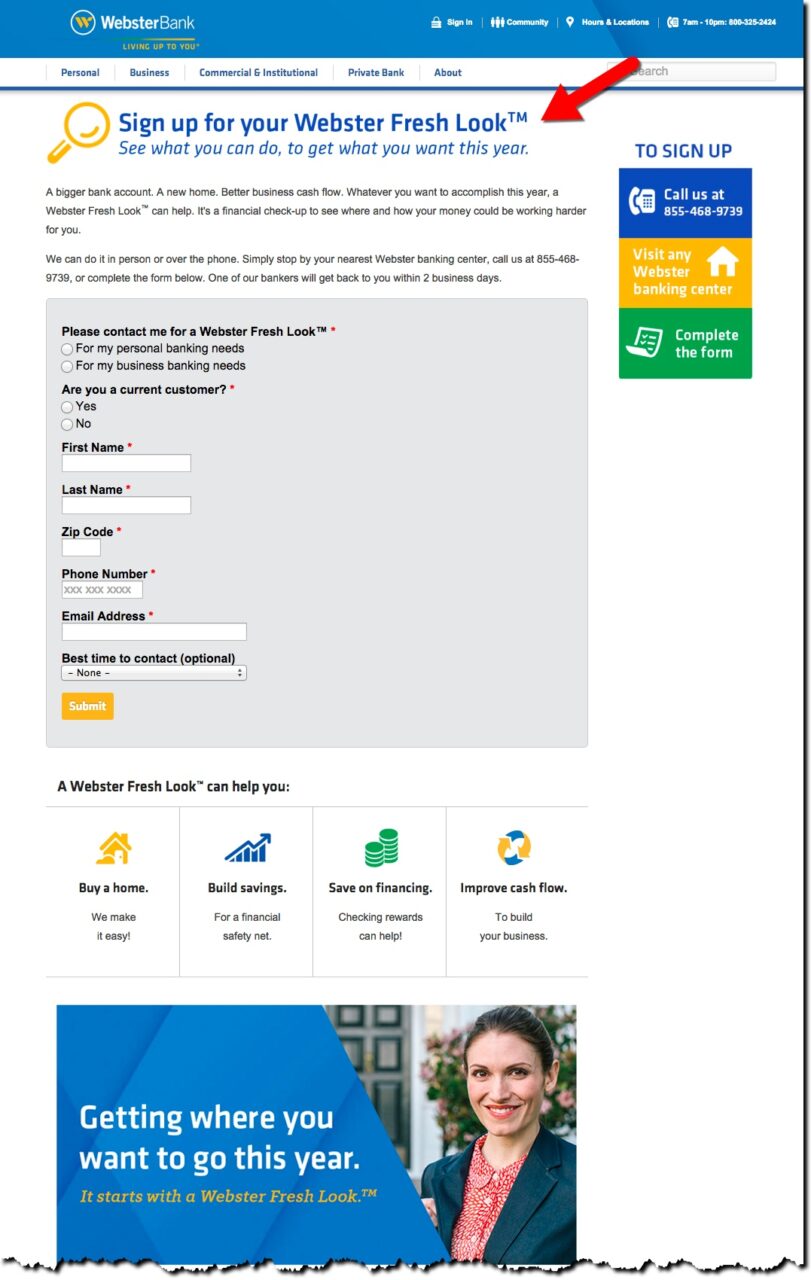

Homepage (23 Dec 2015):

PNC Christmas Price Index page:

———–

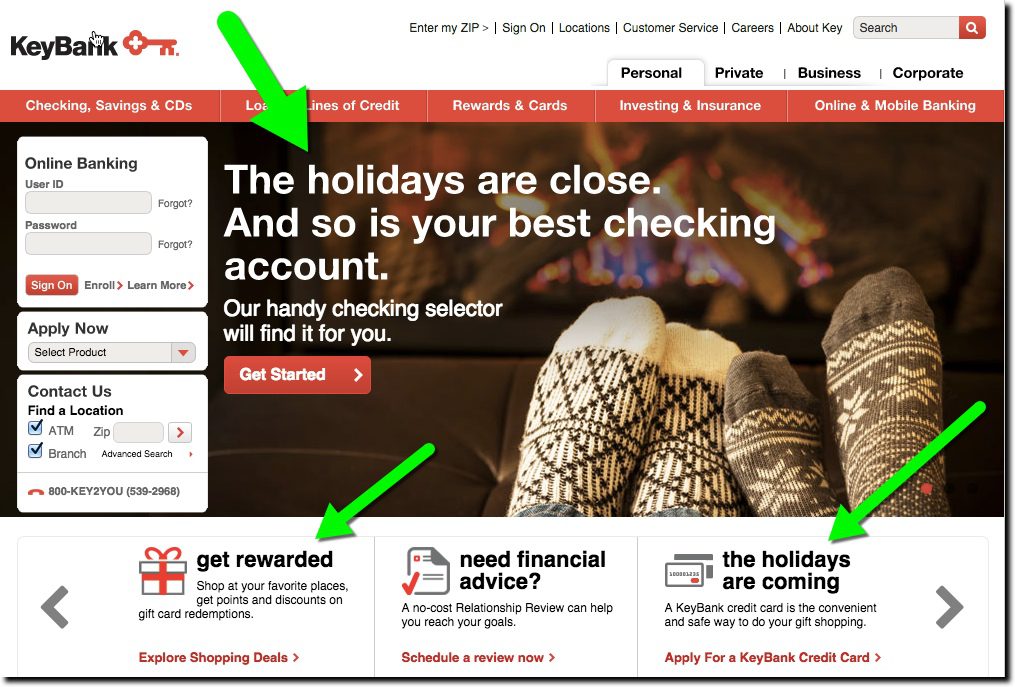

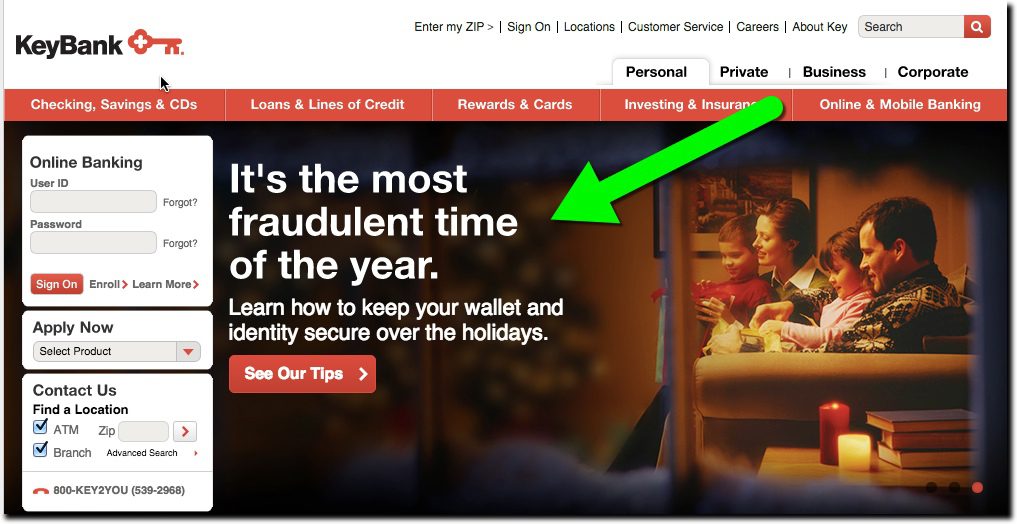

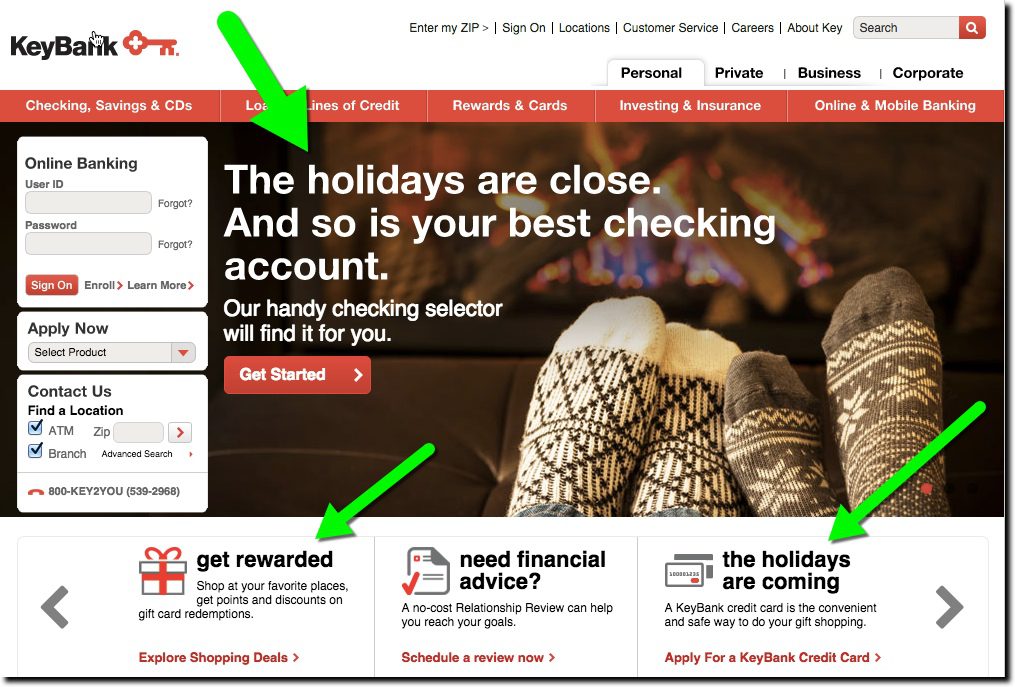

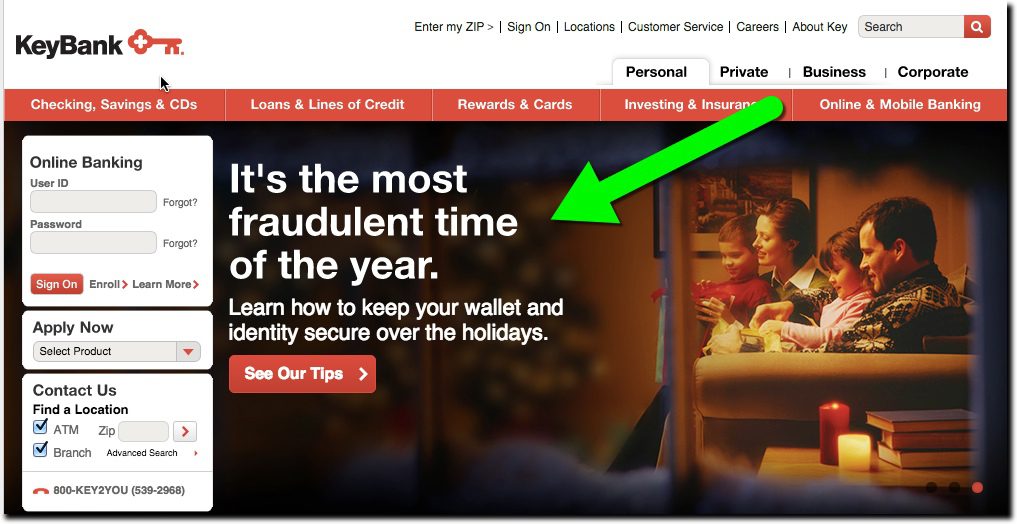

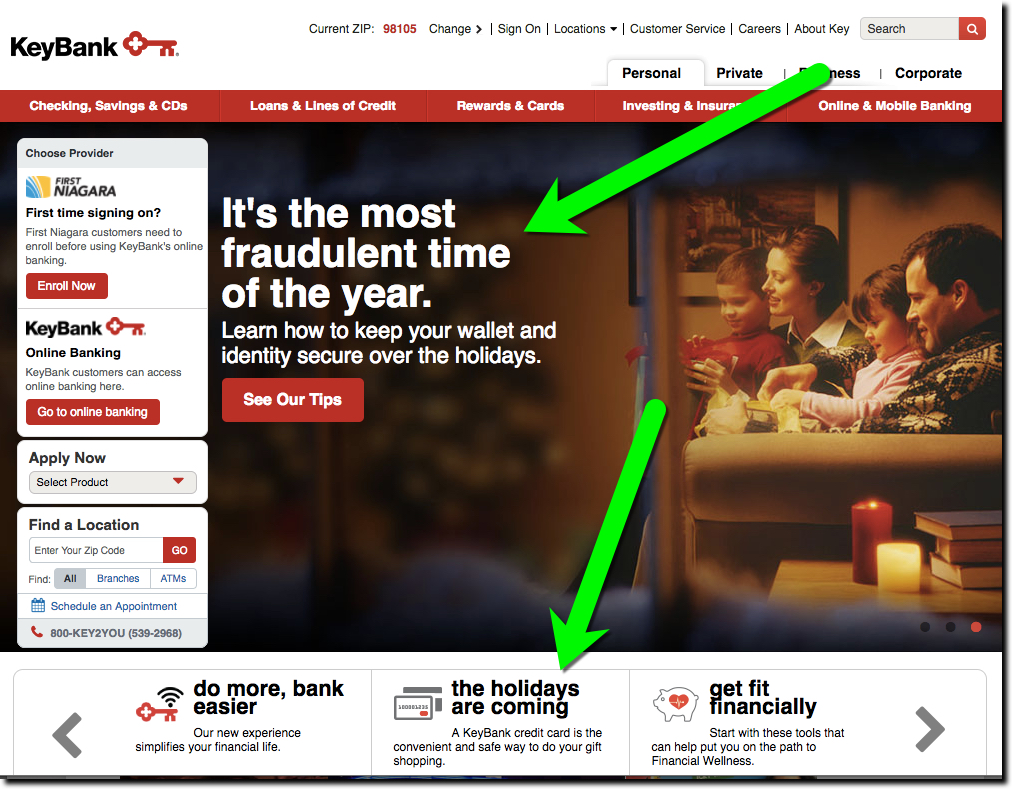

Key Bank

- Checking account promo with holiday imagery (1 of 3 rotating promos)

- Security tips related to holiday spending (2 of 3 rotating promos)

- Rewards promo with holiday image (lower left on homepage)

- Credit card promo with holiday copy (lower right on homepage)

Score:

Homepage promo #1 (23 Dec 2015):

Homepage promo #2:

———-

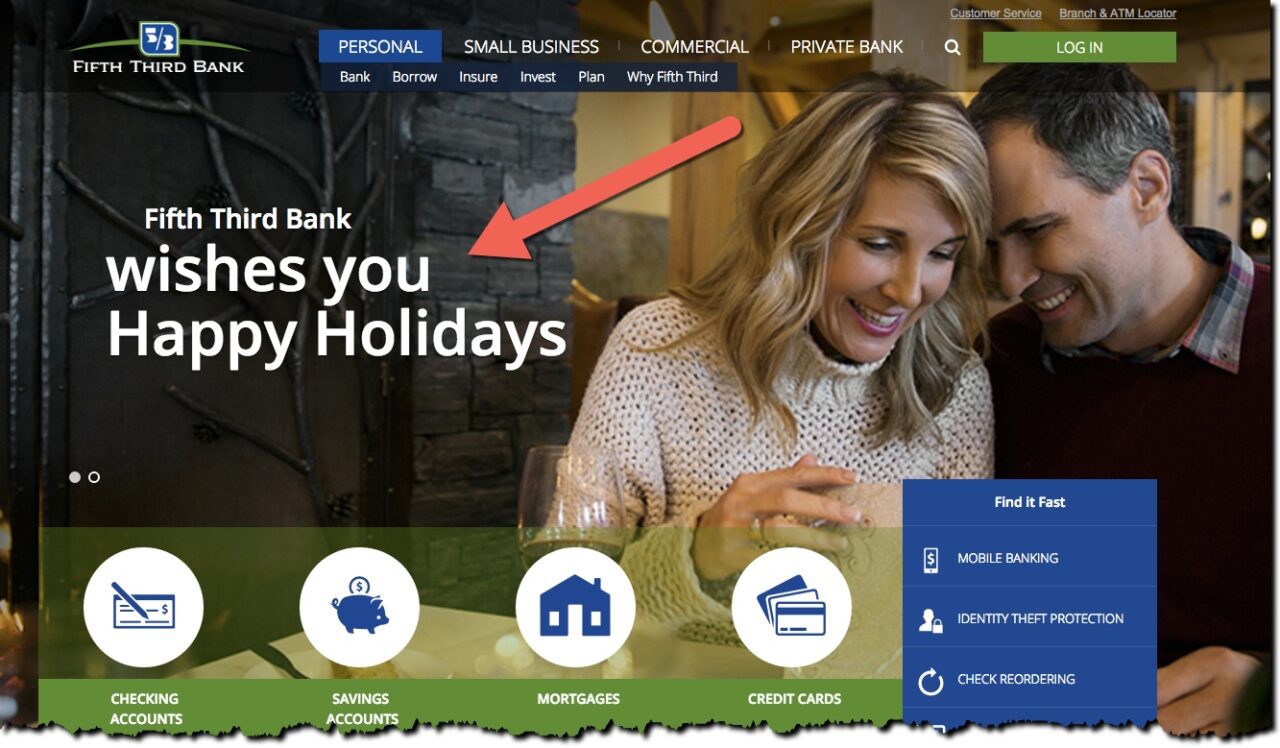

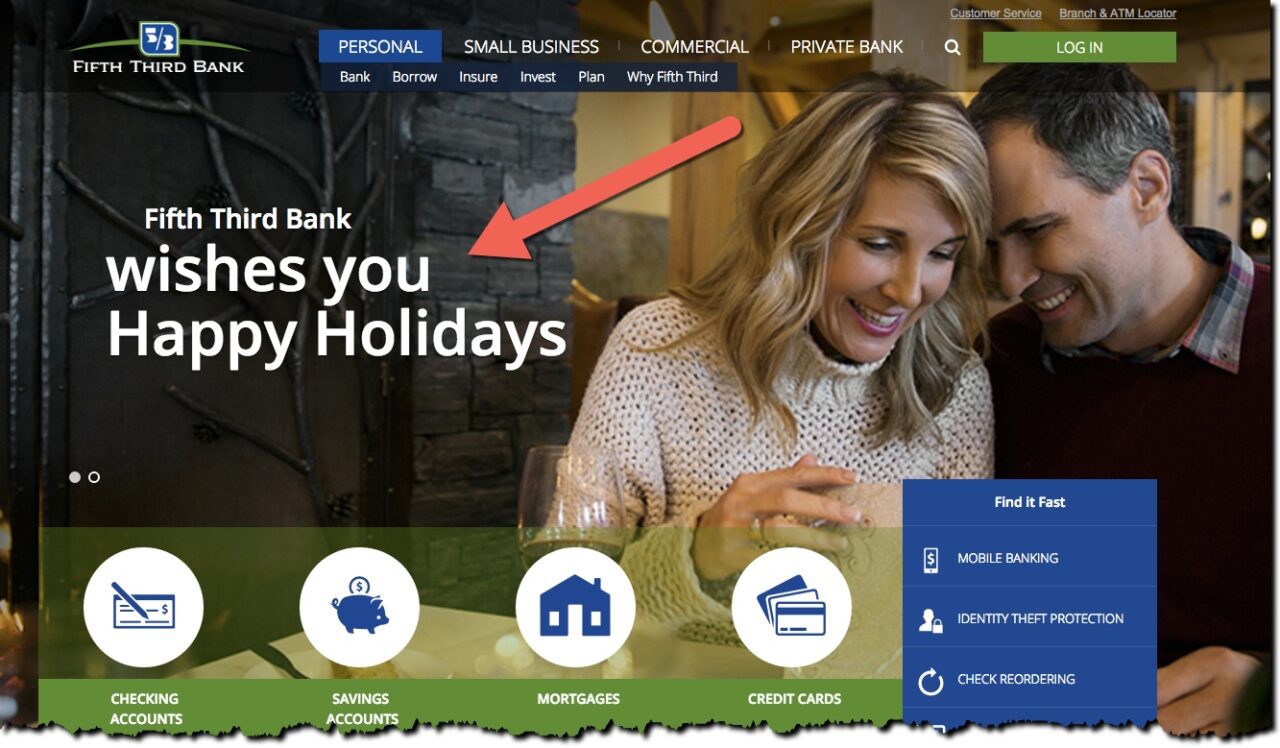

Fifth Third Bank

Score:

Homepage (23 Dec 2015):

———-

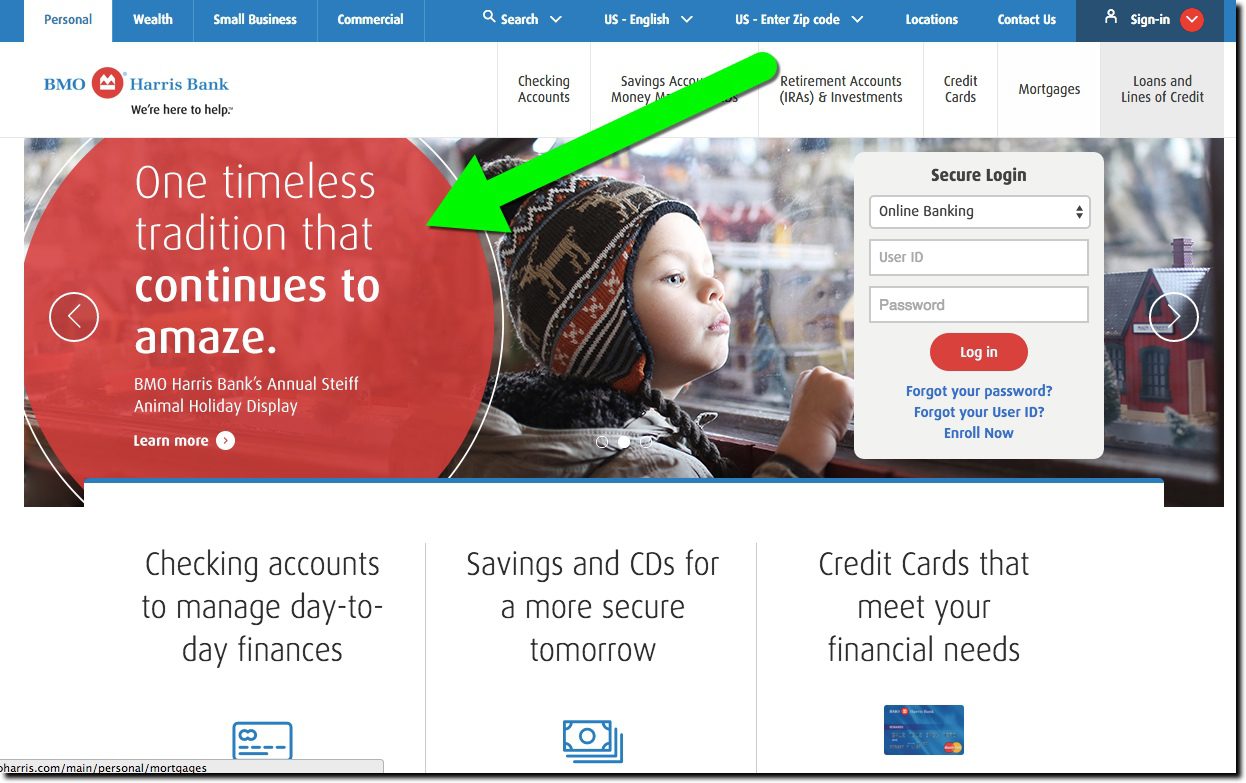

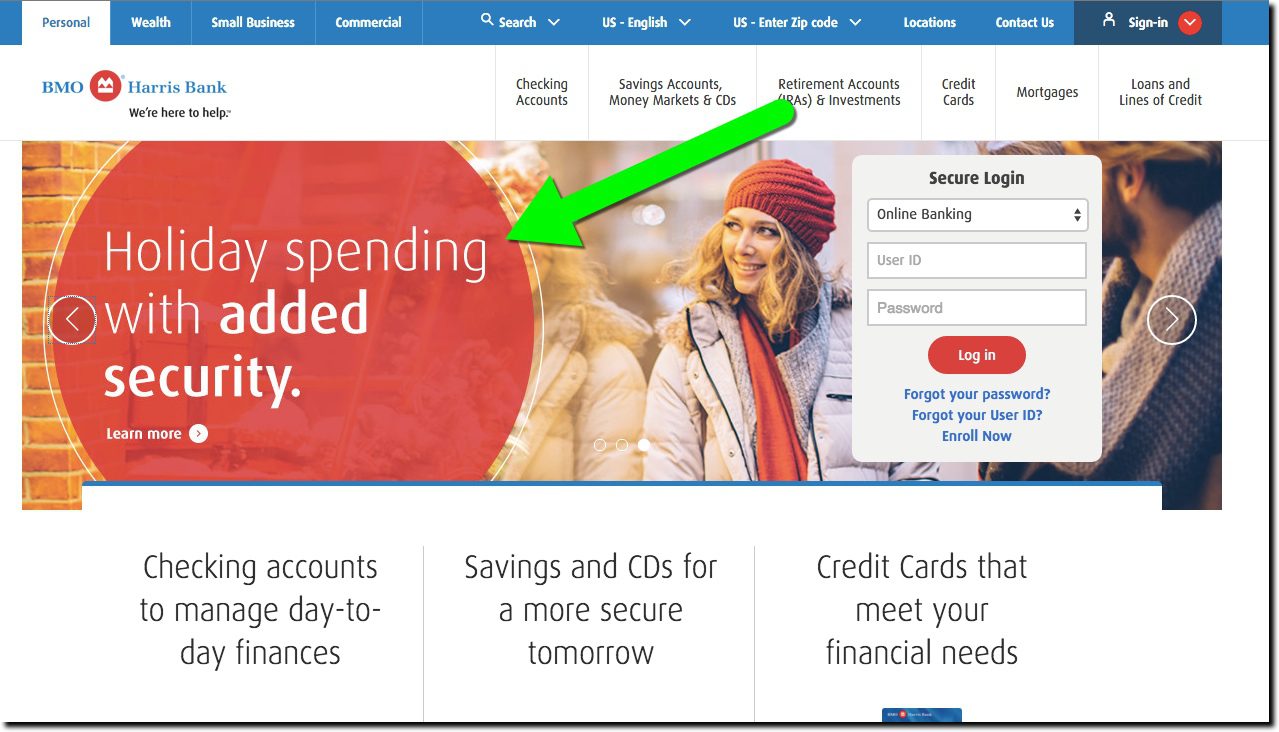

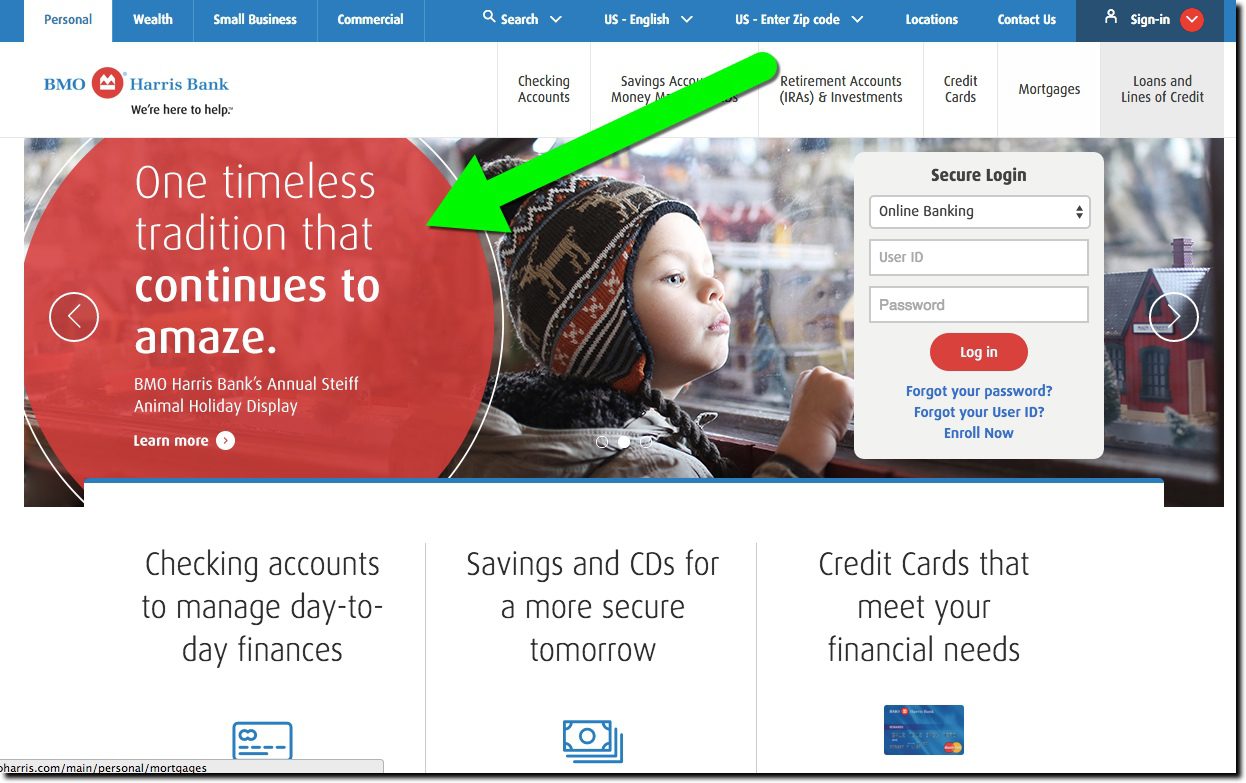

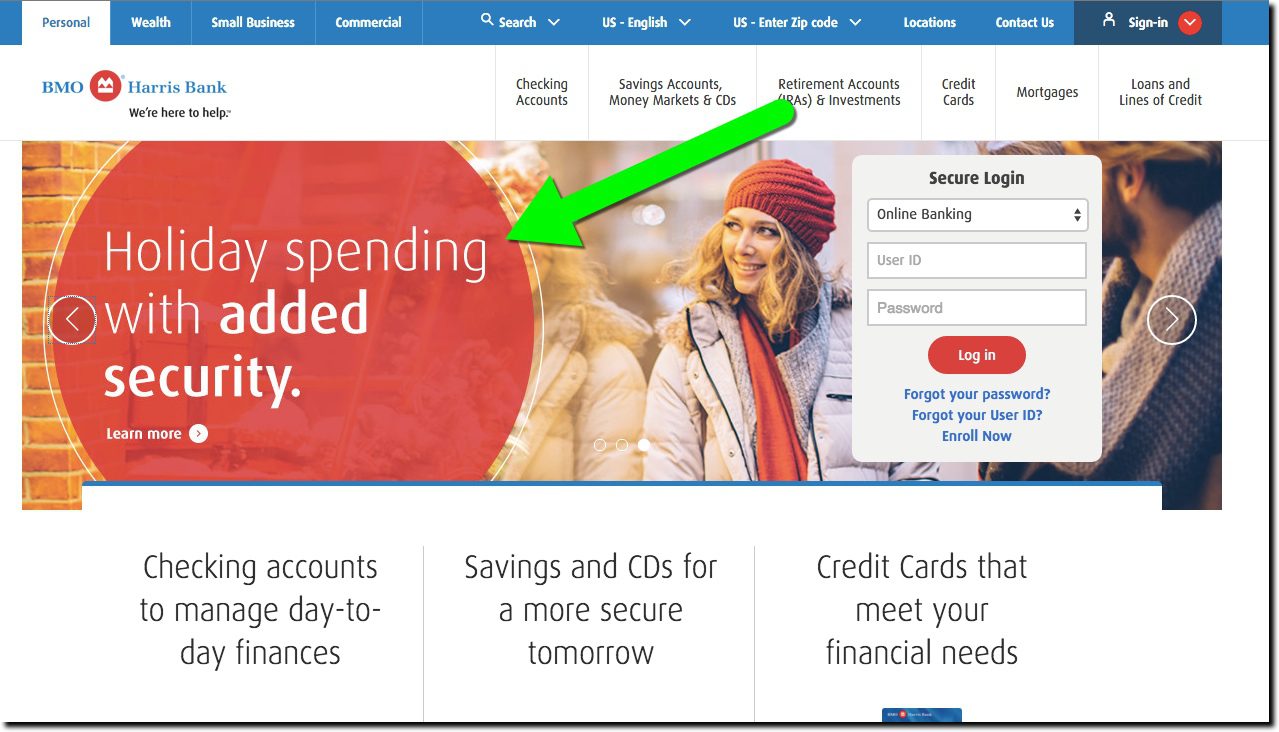

BMO Harris

- Community service announcing a Milwaukee holiday display (#2 of 3 rotating promos)

- Security message related to holidays and its new chip card (#3 of 3 rotating promos)

Score:

Homepage promo #1 (23 Dec 2015):

Homepage promo #2:

———

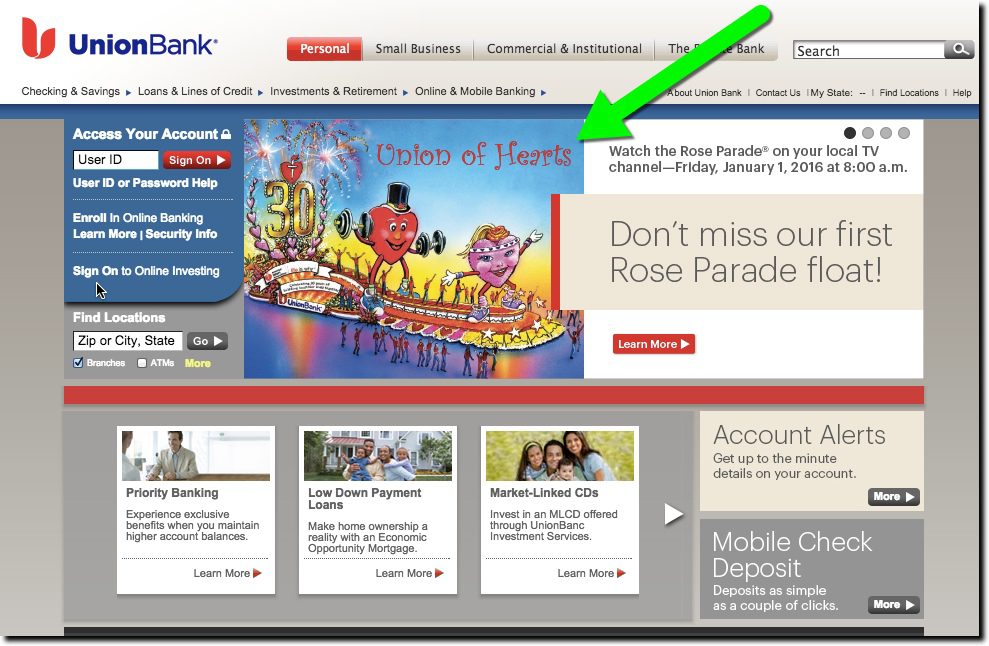

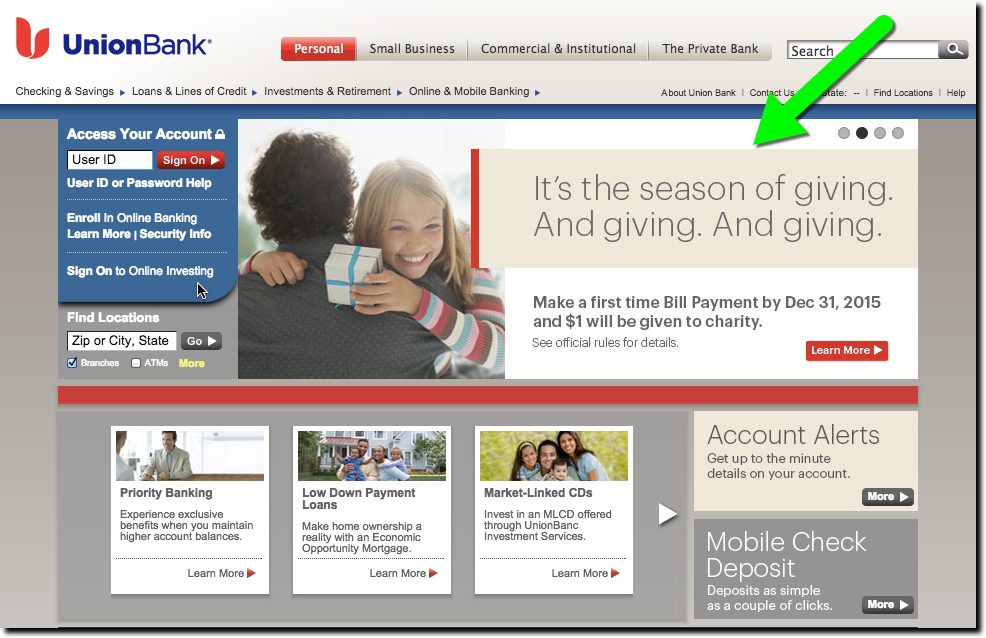

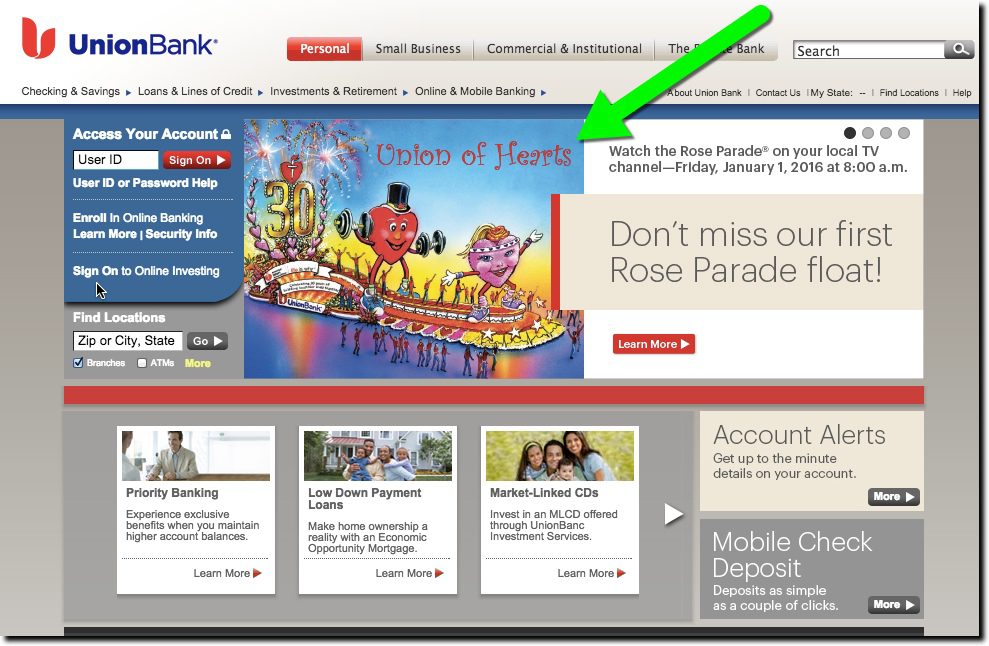

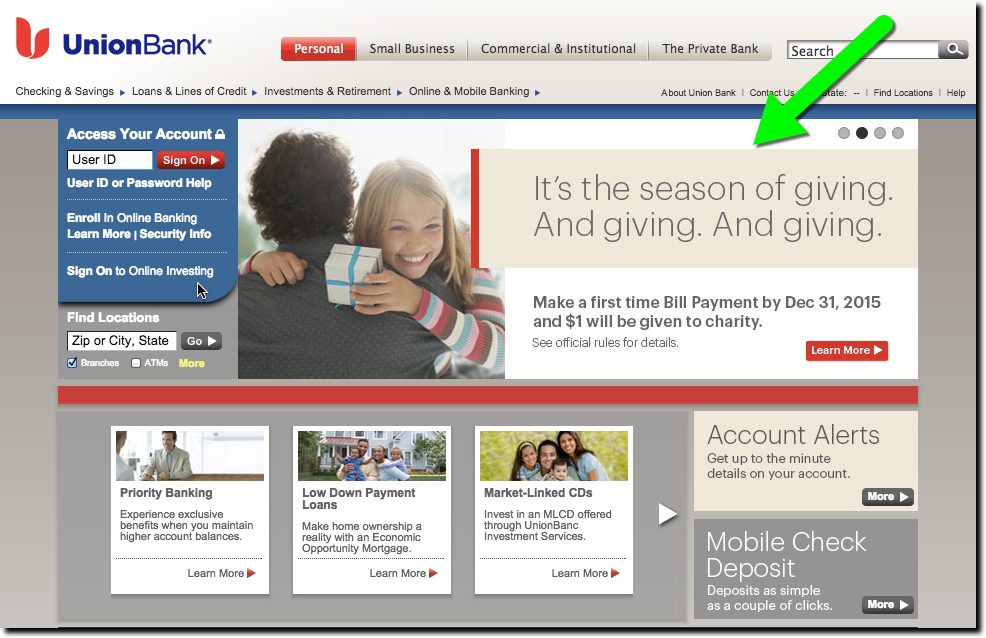

Union Bank

- Rose Bowl parade float (#1 of 4 promos)

- Billpay offer with charity tie-in (#2 of 4 promos)

Score:

Homepage promo #1 (23 Dec 2015):

Homepage promo #2:

———–

Comerica

- Gift card promo integrated into main image (promo 2 of 3 rotating)

Score:

(2.5)

(2.5)

Homepage (23 Dec 2015):

———-

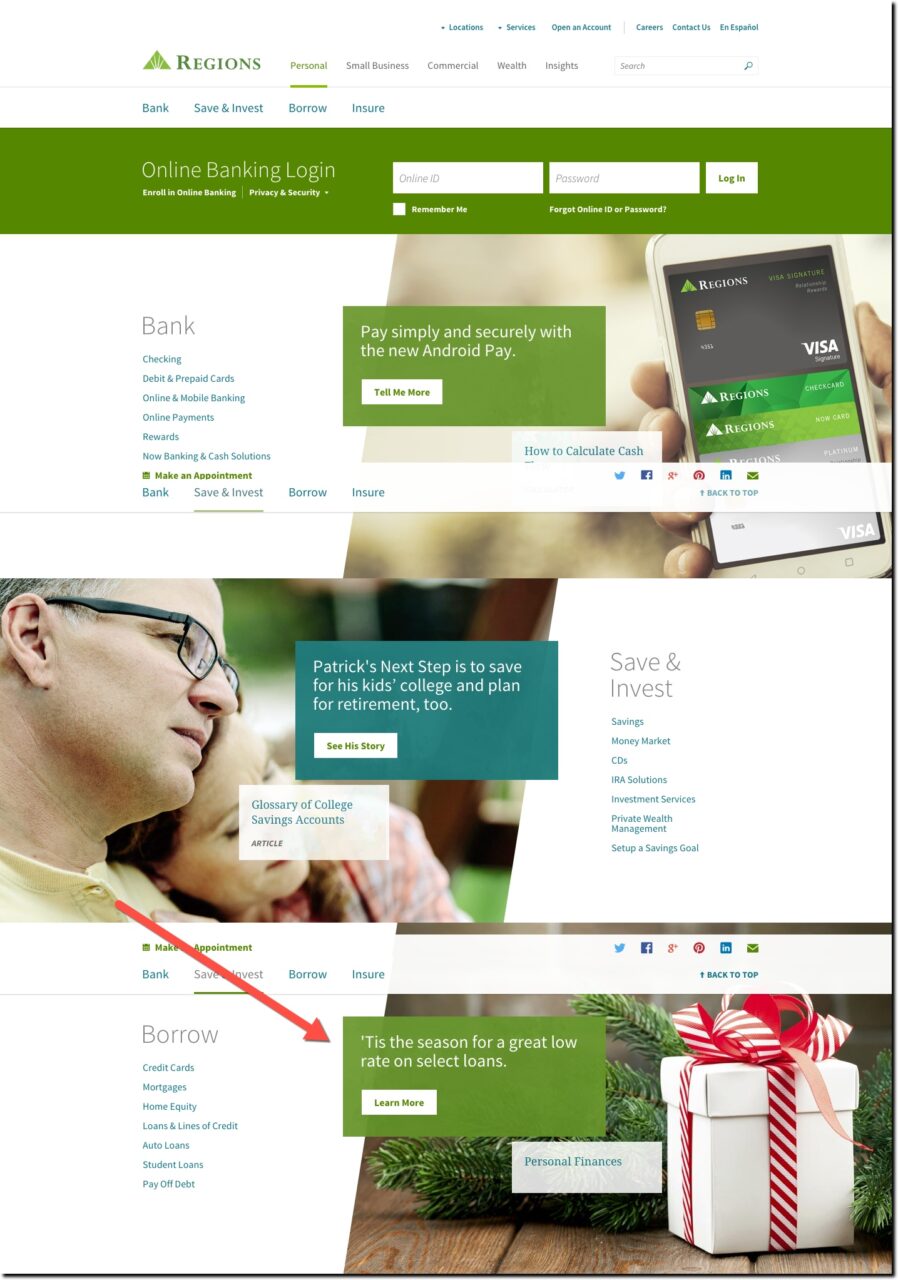

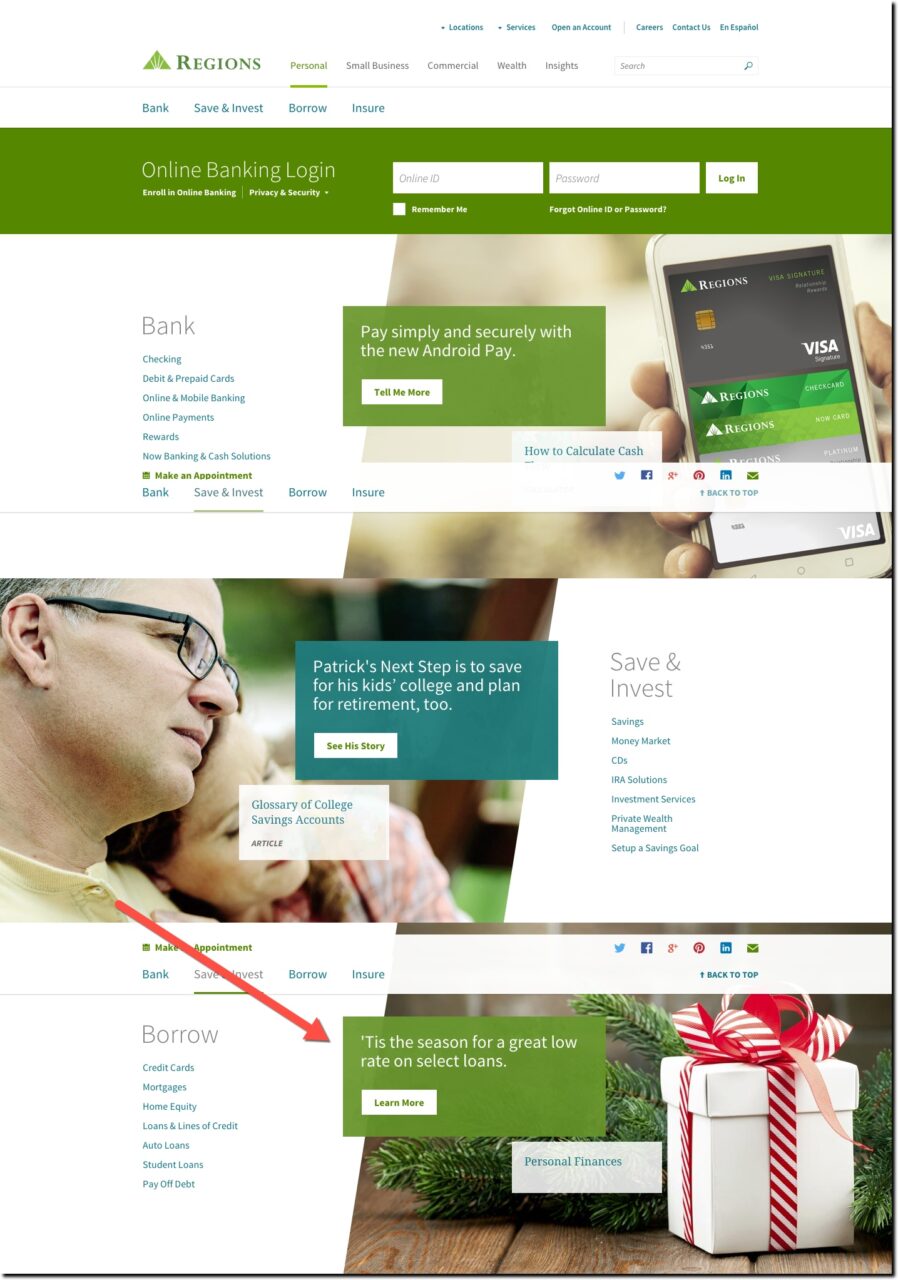

Regions Bank

- Loan discount with holiday copy (well below the fold)

Score:

Homepage with loan offer (23 Dec 2015):

Landing page for loan offer:

——–

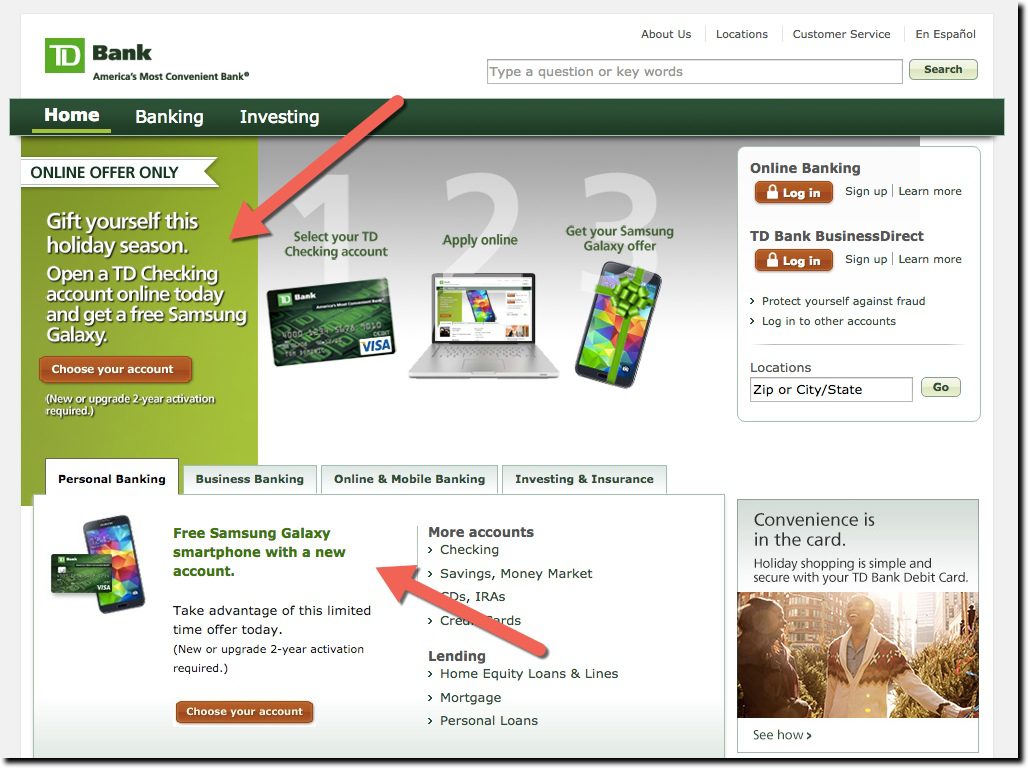

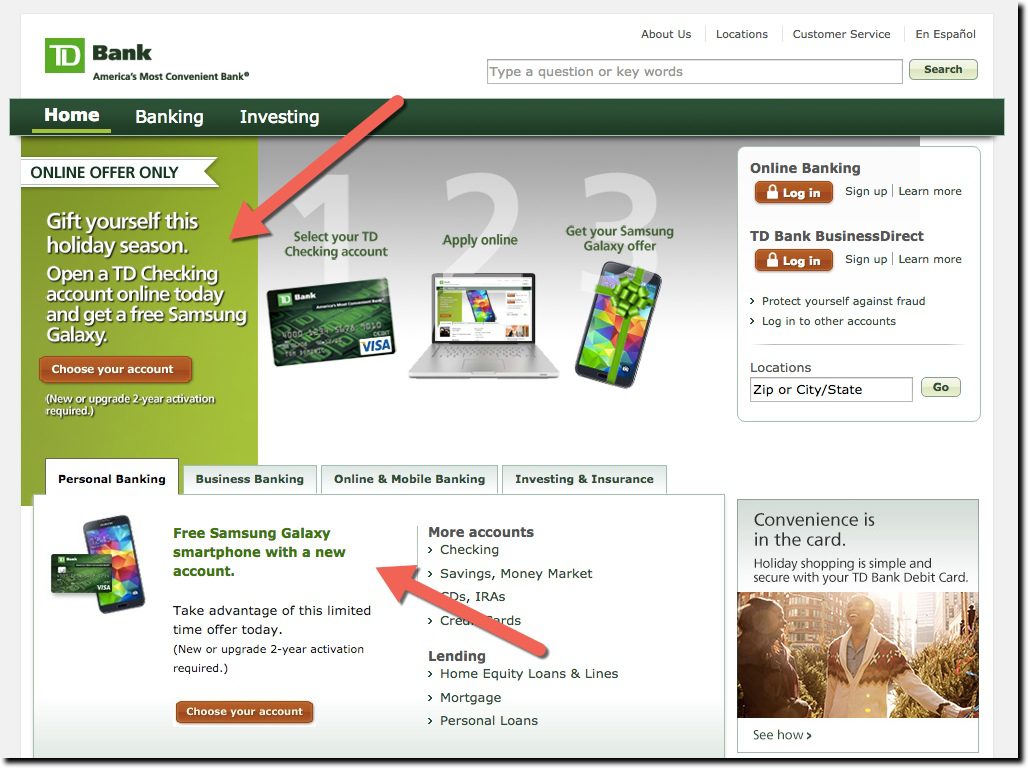

TD Bank

- Checking account promo with holiday imagery and Samsung giveaway (main promo)

Score:

Homepage with checking promo (23 Dec 2015):

———-

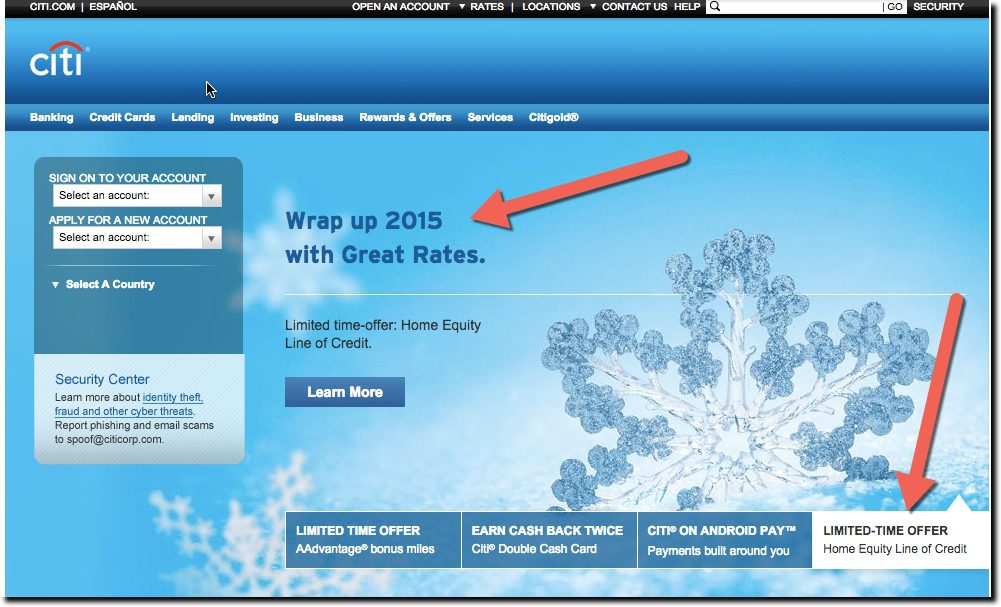

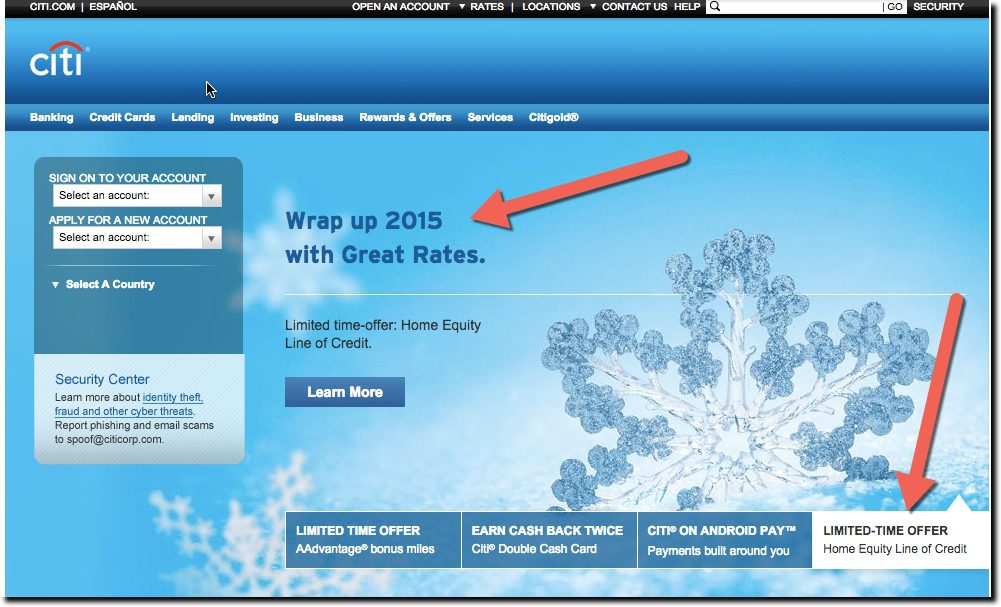

Citibank

- Year-end home-equity promo with winter imagery

Score:

————————-

Notes:

1. Observations taken between 7:00 a.m. and 8:00 a.m. Eastern Time on Wed, 23 Dec 2015, from a Florida IP address, running Mac Chrome browser with cookies cleared.

2. Chase is running a series of newish articles/posts below the fold, one of which covered holiday budgeting. But it wasn’t prominent enough to move them off the scrooge list.

3. Animation from

http://www.millan.net/anims/christmas.html#

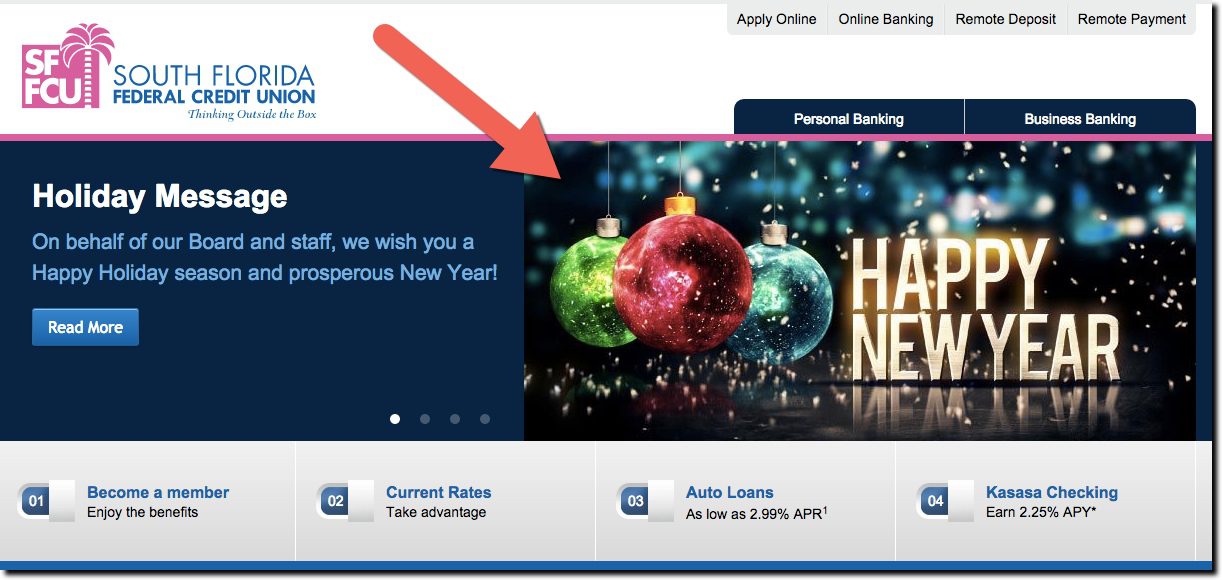

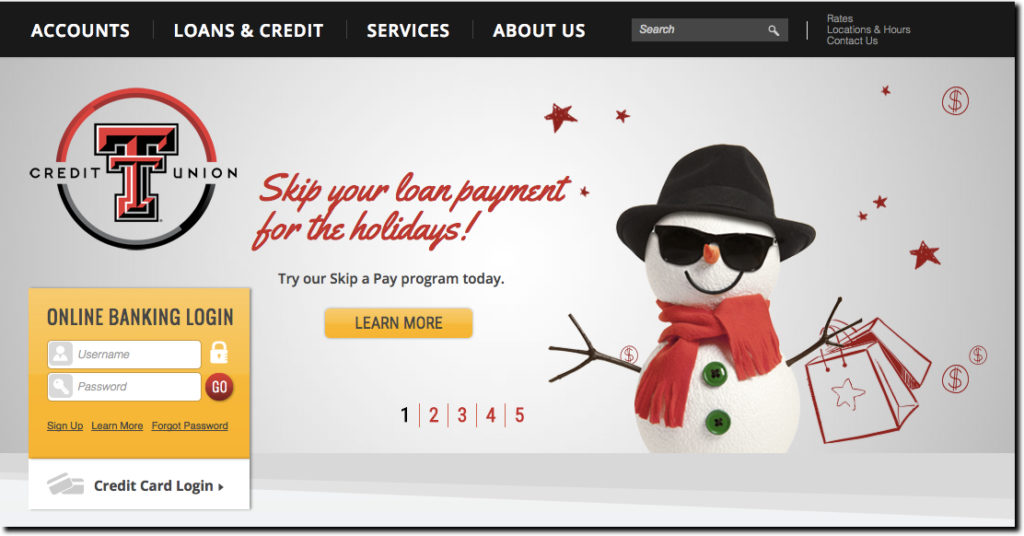

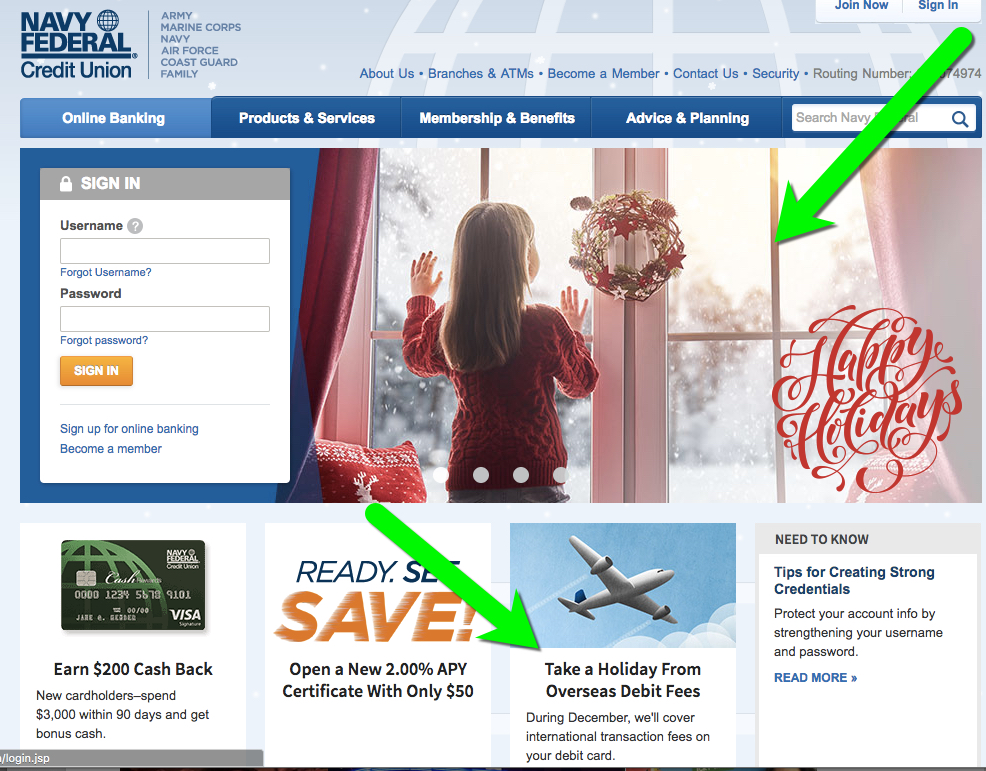

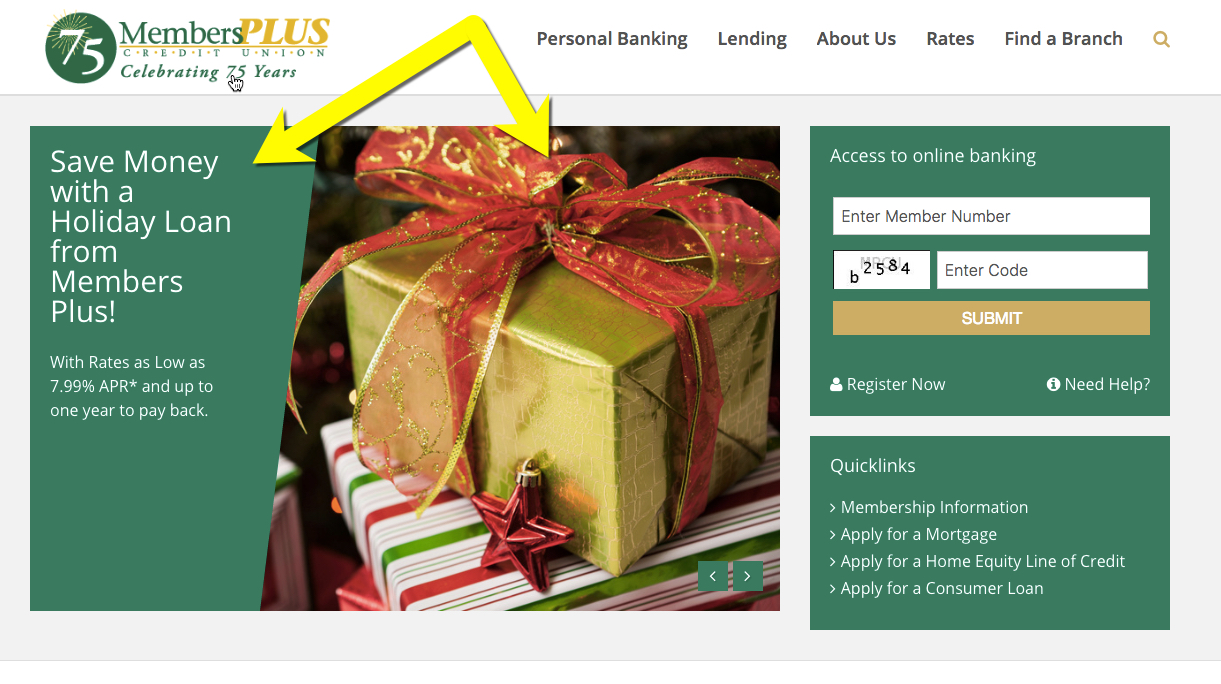

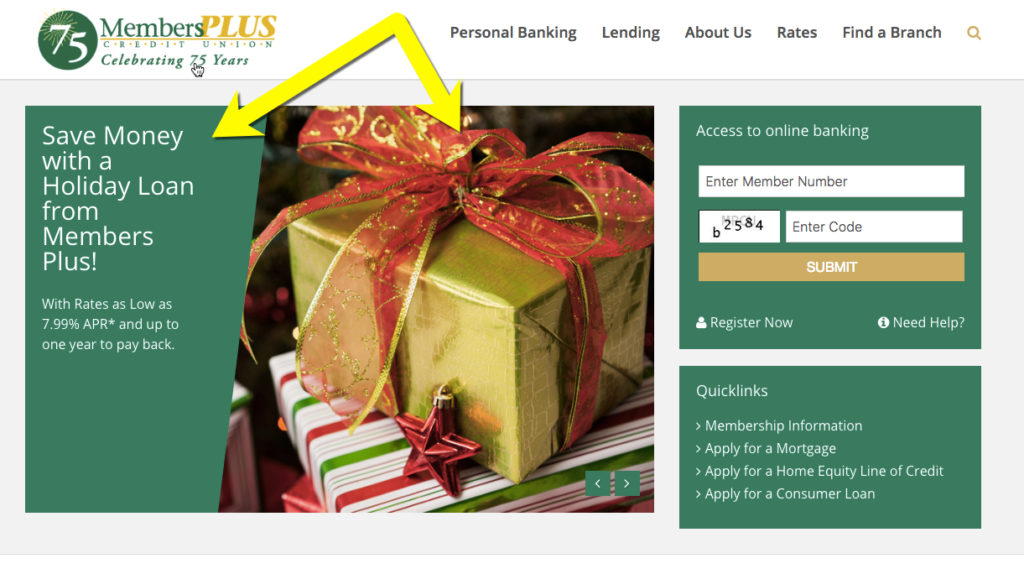

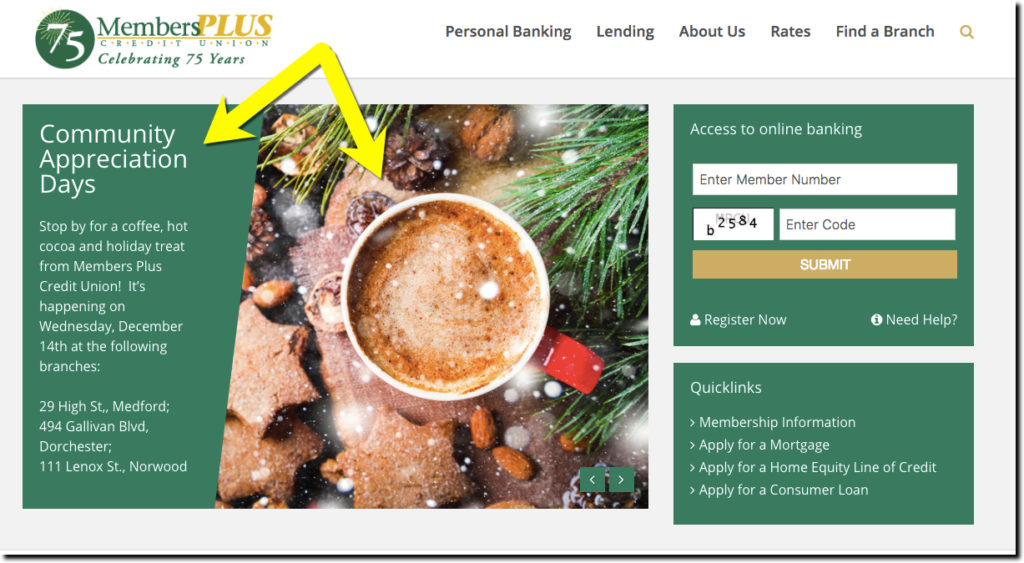

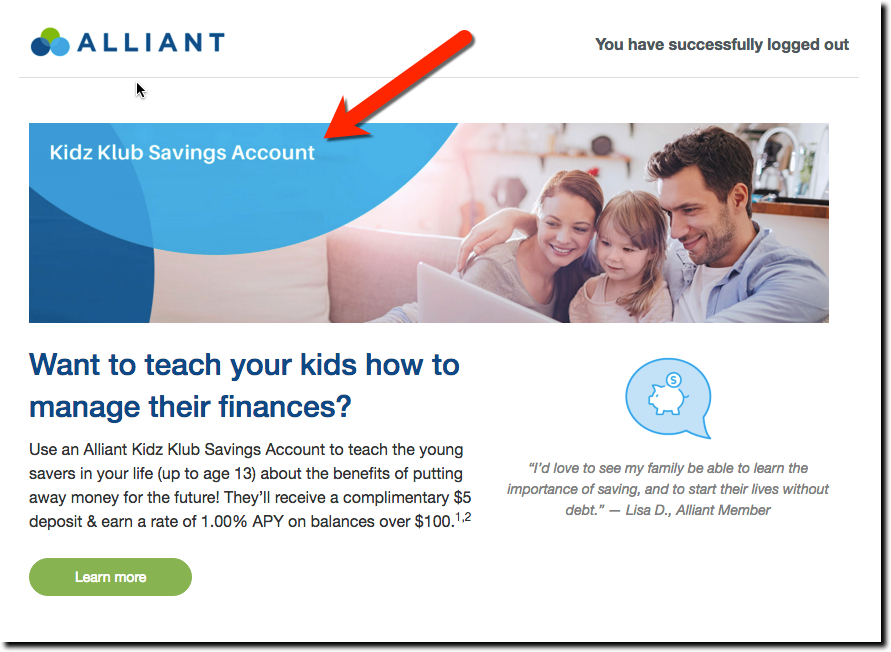

Happy holidays everyone! The holiday spirit is everywhere, except it seems, at the big U.S. banks. I get that budgets are busted, employees on vacation, and you don’t want to offend anyone by mentioning (or NOT mentioning) Christmas. Still, how hard would it be to throw a couple non-denominational snowflakes on top of your logo and wish everyone a happy holiday? Or better yet, how about a little bonus, like the holiday skip-payment offer similar to that featured on

Happy holidays everyone! The holiday spirit is everywhere, except it seems, at the big U.S. banks. I get that budgets are busted, employees on vacation, and you don’t want to offend anyone by mentioning (or NOT mentioning) Christmas. Still, how hard would it be to throw a couple non-denominational snowflakes on top of your logo and wish everyone a happy holiday? Or better yet, how about a little bonus, like the holiday skip-payment offer similar to that featured on

While I have

While I have