This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

Our final presentation of Day One of FinovateSpring 2013 comes courtesy of

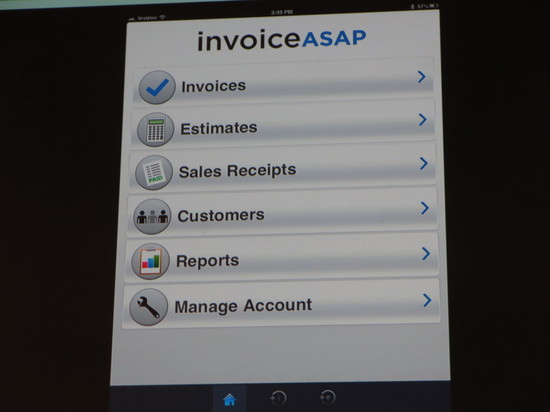

InvoiceASAP, who is bringing mobile and cloud-based innovation to the world of business invoicing.

“InvoiceASAP is showing how the platform works with QuickBooks Online, Capital One Spark Payments for mobile payments, and mobile printing using the Zebra family of Bluetooth printers. InvoiceASAP is launching the Zebra printer integration on stage as well as our open API for Enterprise developers.”

Product Launched: May 2011

HQ Location: San Francisco, California

Company Founded: November 2010

Metrics: $435,000 raised; 120,000 registered accounts; $20,000 in monthly revenues; 3.5 employees

Twitter: @invoiceasap

Presenting Paul Hoeper (CEO) and Anne Maxwell (CTO)

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.