This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

Representatives of

Escardgot are coming to the stage now. The company’s technology makes it easier for cardholders to use the right card for the right transaction.

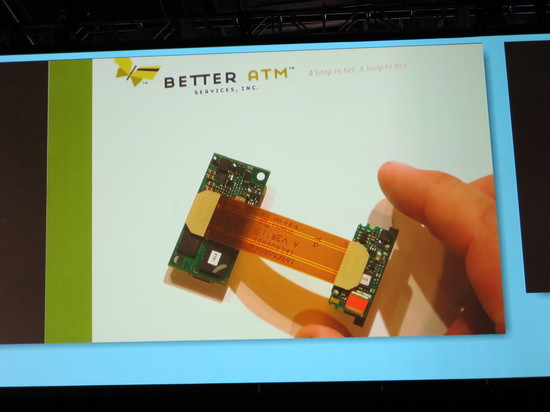

“The patented Helix SCard, combined with the SCard-GO mobile app, allows a consumer to reduce their wallet-full-of-cards down to a single, secure card. The innovative technology inside the Helix SCard allows it to become any magnetic stripe card – for example, a credit or debit card.

In addition to selecting different cards, SCard-GO mobile app allows a consumer to make transactions, review transactions, and receive electronic offers from merchants. The Helix SCard works with existing POS technology and does not require a hardware upgrade like NFC does. And because it does not require a transaction fee, it is transparent to the credit industry, unlike Square. It is also transparent for the end consumer, as the Helix SCard has the same form factor, appearance, and behavior as a standard credit card.”

Product Launched: May 2013

HQ Location: Sacramento, California

Company Founded: October 2011

Metrics: 3 founders and 5 part-time employees

Twitter: @Escardgot

Presenting Tom Humphrey (COO) and Garrett Unglaub (Director, Marketing)

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This post is part of our live coverage of FinovateSpring 2013.

This is part of our live coverage of FinovateSpring 2013.

This is part of our live coverage of FinovateSpring 2013.