If you follow U.S. virtual banking (see note 1), you have likely heard that one of the biggest, at least in terms of venture funding ($15 mil), is closing its doors. Boston-based Perkstreet Financial is shutting down Sep 26 and will not be able to pay out the accumulated rewards balances held by its customers (rumored to be about $1 million, see note 2).

If you follow U.S. virtual banking (see note 1), you have likely heard that one of the biggest, at least in terms of venture funding ($15 mil), is closing its doors. Boston-based Perkstreet Financial is shutting down Sep 26 and will not be able to pay out the accumulated rewards balances held by its customers (rumored to be about $1 million, see note 2).

While I thought the startup had a great team (ex Capital One), I did not follow it as closely as Simple/Moven because it was not really a technology innovator. It was all about the rewards, which seemed like a good plan, especially since the money was paid out on merchant gift cards, presumably acquired below face (see our post on its launch). I never saw their business plan or heard their investor pitch, so this is all speculation.

I tweeted that they were done in by low interest rates, which made all those high balances (it took $5,000 on deposit to earn the top rewards tier) practically worthless. But they were founded in 2008 with $5 mil of VC funding in 2009 and $9 million in 2011. That was all done in the midst of the ultra low-rate environment, so clearly the low-rate deposit environment was no surprise to the bank and it’s investors. They were banking on rates going up, but like traders who place big bets on corn, oil or currency futures, commodity trading is a high-risk business.

Falling debit interchange rates didn’t help, but they were Durbin exempt, so that wasn’t as dramatic of a revenue hit as it was at the big banks. In fact, CEO Dan O’Malley told the NY Times last year that their interchange had remained unchanged.

My guess is they were done in by the problem that every financial startup faces: It’s really, really, really hard to get customers to send money to a web-based startup, especially when there is no immediate short-term gain. Their acquisition costs, especially in a low-rate environment, must have been unsustainable. ING Direct (which wasn’t really a startup) was able to attract billions of deposits, but that was because customers were transferring in $30,000+ balances in order to immediately gain $500+ in annual interest (back in the 5% APY days 10 years ago).

Also, while Perkstreet had a great consumer-advocacy positioning, “use debit, avoid credit,” that was a bit of a mis-match for the customers they were targeting, big-spending rewards junkies which could afford to park $5,000 at the startup. Most existing big spenders are fond of using credit card programs with similar rewards, so changing their behavior was a continual challenge.

Winners:

- Traditional banks: They have one less aggressive online competitor to worry about. It also could put a damper on VCs future bets in this area.

- Perkstreet customers who cashed out their VC-subsidized rewards prior to the Aug 12 shutdown.

- NY Times personal finance columnist Ron Lieber who was was skeptical in mid-2010 about the long-term viability of Perkstreet’s then-2% rewards rate.

Losers:

- Perkstreet customers who had yet to cash out a significant chunk of their rewards balances.

- Other virtual (aka neo) banks (Moven, Simple) may face increased skepticism from investors and prospective customers. However, their business plans are much different (no rewards for one thing), so this is probably a temporary setback.

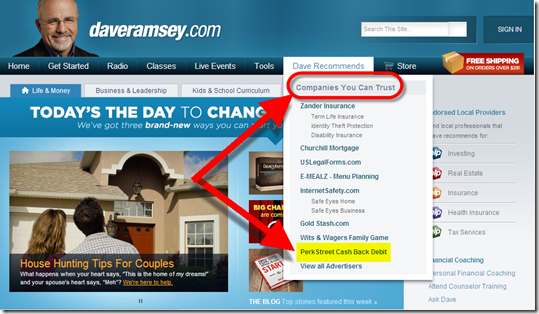

- The personal finance gurus who recommended Perkstreet (see Dave Ramsey ironic “companies we trust” screenshot below), especially those that pulled in affiliate dollars from the startup.

Bottom line: Perkstreet was a $15 million interest-rate bet that didn’t pan out (note 3). While I feel for their team, they are sharp and connected and knew they were in a high-risk business. For the most part, they will move on to next challenge with new-found insights. Had rates gone back to 3% or higher, Perkstreet would have likely been in good shape, enjoying its position of being highly recommended by Dave Ramsey and the other personal finance sites.

————————————-

DaveRamsey.com homepage (29 July 2013)

————————————–

Notes:

1. Our term for third-parties that function similarly to banks, but don’t hold the deposits, instead passing them through to FDIC-insured banks. We covered Perkstreet’s launch in 2009 here. We took an in-depth look at truly virtual banks (Personal Capital, Bank Simple, and PerkStreet) in our Oct 2011 Online Banking Report.

2. The $1 mil number was mentioned on Twitter from an unconfirmed source, so no claim to its accuracy. The company said previously it had paid out $4 mil in rewards. All deposits are held in FDIC-insured banks, Bancorp Bank or Provident Bank, and are safe and available to all Perkstreet customers. In better times, someone might have stepped in to honor the rewards and buy the company at a fire-sale. But paying $1 mil+ for a group low-margin customers was obviously a tough sell.

3. I’m sure the failure was a combination of hundreds of things and is way more complicated than I’ll ever know. I’m just addressing the big headwinds facing financial institutions, especially startups.

TSYS

TSYS