Those attempting to read financial analysis from a PDF on their smartphone will understand the issue. How do institutions create financial content that is compatible for mobile users?

The answer is with MAPPS – Market Analysis Production and Publishing Solution. Operating from the cloud, MAPPS makes it simple to combine dynamic graphics with an audio message, enabling financial analysis and concepts to be delivered in concise, engaging videographic formats.

As client attention spans shorten—research indicates about 90 to 120 seconds is all the time you have to get a video message across—financial content needs to come in dynamic, bite-size formats that clients can easily digest. This is exactly what MAPPS delivers.

Meniga Launches Card-Linked Offers Solution

This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

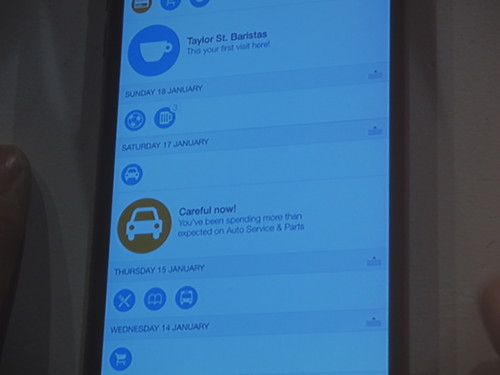

Meniga’s transaction-data analytics and enrichment engine enables it to deliver uniquely targeted and relevant offers to the consumers on its platform. Meniga puts offers, insights, and notifications into the context of consumer financial management, integrated as part of new-generation PFM. A fun, engaging Facebook-like feed that transforms how people interact with their finances, and how banks interact with their customers.

Meniga’s Market Match is a data-driven card-linked offers (CLO) platform that allows financial institutions to provide merchant-funded offers to their online customers using the power of PFM. Meniga’s PFM Solution has received multiple awards for innovation, such as “Best of Show” at FinovateEurope in 2011 and 2013, and boasts market-leading adoption and retention metrics.

Presenters: CEO and Co-founder Georg Ludviksson; VP Product Management Einar GustafssonProduct launch: February 2015

Metrics: $8.5 million raised; 100+ employees; more than 20 million online banking users

Product distribution strategy: Direct to Business (B2B), through financial institutionsHQ: Reykjavík, Iceland

Founded: March 2009Website: meniga.com

Twitter: @meniga

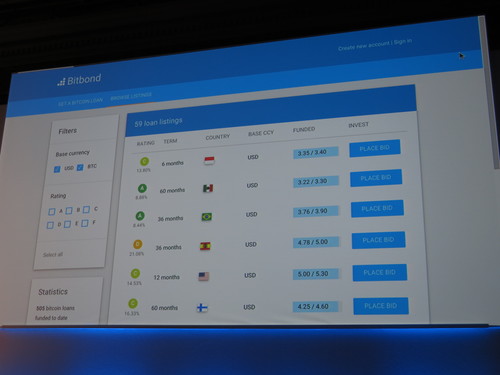

Bitbond Launches AutoInvest Feature for Bitcoin-Based Peer-to-Peer Lending Platform

Bitbond AutoInvest allocates funds on behalf of lenders according to their chosen investment profile. AutoInvest will create a loan portfolio according to predefined criteria. The criteria are: investment amount, risk category, base currency, and regions. The regions are North America, Latin America, the Caribbean, Europe, Central Asia, the Middle East, North Africa, Sub-Saharan Africa, Asia, and the Pacific.

The exciting thing about portfolio building according to a profile is that Bitbond allows you to invest automatically into a globally diversified loan portfolio at 0% fees.

WS Integration’s New Xceptor Version Adds Flexibility to Back Office Operations

This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

Xceptor v4.0 is the next generation of our platform product and is a significant step forward in terms of usability and functionality. Responding to client requests, we have improved many core pieces of the product, such as data-input methods, administration pages and analytics/reporting.

These changes increase the efficiency of setting up and maintaining new processes, adding further flexibility to the use of Xceptor within back and middle office operations.

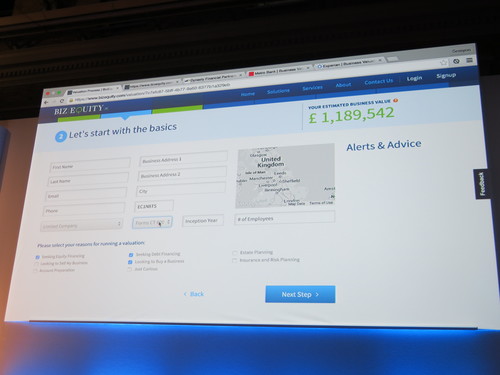

BizEquity Launches Valuation-as-a-Service Solution, BizEquity One UK

This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

New features of BizEquity One U.K. include: (1) Real-time dynamic valuation updated daily from our smart algorithm and multiple data sources for greater accuracy and client engagement rate (2) Zillow-esque feature on the homepage with a powerful search on more than two million pre-valued businesses in the United Kingdom to get a sense of how the business is doing and what it is worth (3) Useful advice and alerts about the business streamed in real-time as the user goes through the valuation process (4) Updated dashboard with an infographic-like view of each business’s value and key performance indicators, a bird’s eye view of business that’s simple to grasp for the average owner.

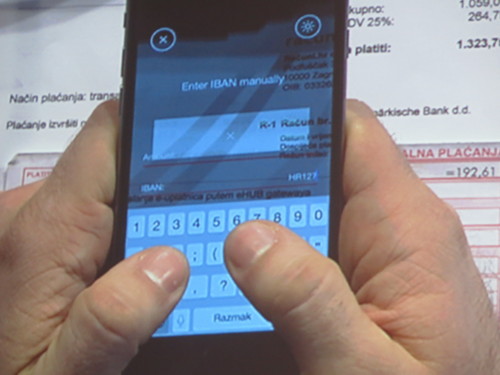

PhotoPay Debuts BlinkOCR to Replace Data Entry

![]() This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

PhotoPay showed how its blinkOCR replaces manual data entry.

PhotoPay’s blinkOCR is a camera text recognition SDK for mobile apps. blinkOCR allows real-time operation for customers to replace manual payment or other data entry. It uses a smart scan through a mobile-device camera in customers’ mobile-banking and payment apps.

Smart, contextual scanning works from nonstandardized paper, card or other onscreen documents and forms. blinkOCR contextually recognizes data often required to be manually typed in, such as IBAN, BIC/SWIFT, reference numbers, amounts, emails, URL or other data fields. blinkOCR reduces integration costs and risks by performing locally on the device without the use of an internet connection. Its simple API and small footprint makes it very easy to integrate.

Akamai Launches Client Reputation to Help FIs Make Better Security Decisions

This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

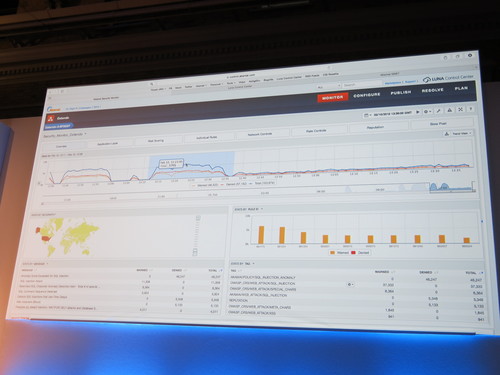

The Akamai Client Reputation service is designed to help financial services institutions improve their security decisions when the threat would otherwise be unclear. The service provides the ability to forecast intent and protect applications against Distributed Denial of Service and application layer attacks. It does this by identifying and sharing with customers the likelihood that particular IP addresses fall into one of four “malicious” categories: web attackers, Denial of Service attackers, web scrapers, and scanning tools.

MoneyHub Demonstrates its PFM Ecosystem

![]() This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

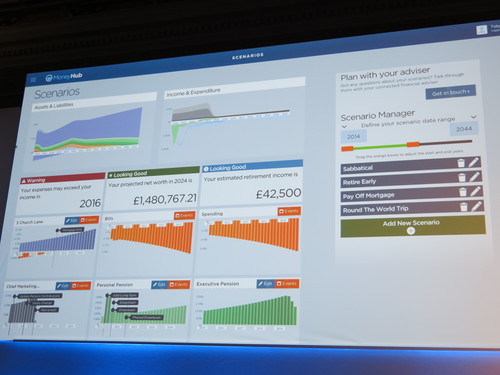

The MoneyHub ecosystem is a place where users can aggregate their own data and information, access financial advice, and connect with financial institutions and other services.

The MoneyHub ecosystem puts the user at the center of their financial universe, helping them make better choices for their financial future and manage their relationships with financial institutions more effectively.

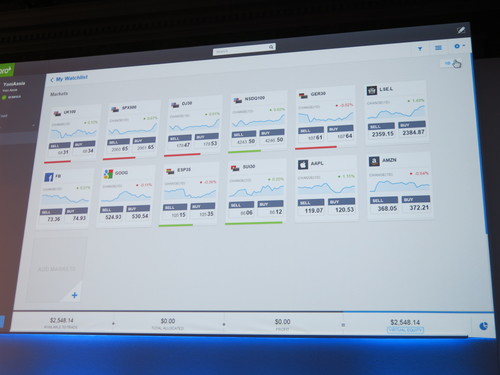

eToro Introduces Social Trading for Generation Y

The company that started out as a gamifier of trades, introduced the world to its social investing network, and created the concept of CopyTrading, is now reinventing its own domain. eToro is introducing a whole new way to trade for the Gen Y population – social trading like you’ve never seen before.

SOFORT Demonstrates its Banking Paycode to Ensure Secure Transactions

![]() This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

SOFORT Banking Paycode is an online link to the SOFORT payment form, which already contains all relevant information for the transfer. By using the link, the digital transfer form is automatically filled in and ready for the transfer. You’ll find the paycode on your invoice, which you receive from the merchant via email, mail or SMS. The paycode can be entered either via the website of the merchant or at sofort.com. Alternatively, you can use the code link that leads you directly to our encrypted SOFORT Banking payment form. The transfer can then be carried out easily via SOFORT Banking.

- Turnover 2014: approx. 25 million euro (increase in sales as compared to 2013: more than 30% across Europe)

- External revenue with SOFORT Banking 2014: approx. 3.3 billion euro

- Employees: 170 in 2014; 150, 2013

- On average, 3,000 consumers use SOFORT Banking at least once

- More than 18 million users have already used SOFORT Banking at least once

- More than 100 million transactions since the company was founded

- More than30,000 e-commerce shops use SOFORT Banking

Backbase Launches Omnichannel Journey Manager

![]() This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

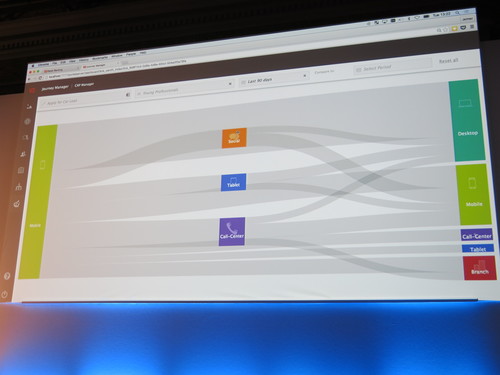

Backbase is launching the latest version of the Backbase Customer Experience Platform at FinovateEurope 2015, with a strong focus on the omnichannel customer journey and journey management.

Completely new in this release of Backbase CXP is the Backbase Omnichannel Journey Manager, giving direct insight in the multiple touchpoints in a customer’s typical journey, with the option to directly dive in and fix inconsistencies.

A lot of digital banking providers and software vendors talk omnichannel. We make it real and visible. With the new Backbase Journey Manager, we give Channel Managers at Financial Institutions direct insight into how multiple channels are being used and where the most common handover points are (the moments of truth).”

InvoiceSharing Launches its White Label, Electronic Invoice Distribution Platform for Banks

This post is part of our live coverage of FinovateEurope 2015.

This post is part of our live coverage of FinovateEurope 2015.

We learned that banks need a white-label version of the InvoiceSharing platform for five reasons:

- Reduce cost of capital (cost of unused lines of credit)

- Bring added value to clients and upsell more

- Distribute cash to companies in a new way

- Split transactions and services provided to customers

- Prove that banks do not over-credit companies

We are launching the first white-label version for banks to capture all the data they need to achieve these goals. Capturing all data from incoming and outgoing invoices and combining it with payment data and data from the company’s clients systems allows banks to lend more money with less risk at lower costs.