This post is part of our live coverage of FinovateSpring 2015.

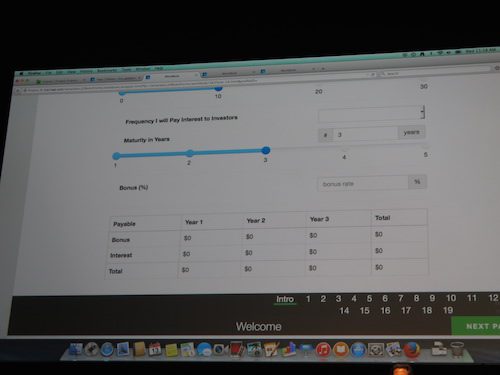

![]() FundAmerica is demonstrating its SaaS compliance solution for emerging crowdfunders.

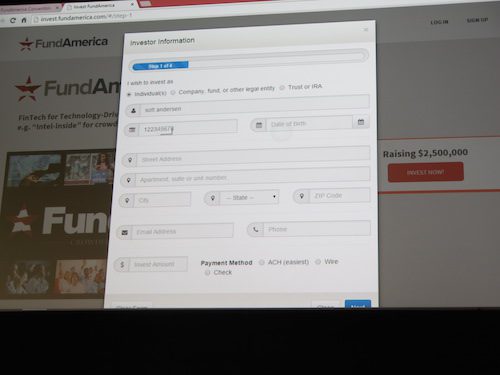

FundAmerica is demonstrating its SaaS compliance solution for emerging crowdfunders.

FundAmerica is a technology, software-as-a-service, and compliance solutions provider to the emerging crowdfunding industry. Our back-end compliance tools, including escrow, AML, payment processing and state dealer representation enable investment advisers, broker-dealers, listing services, and other platform types to operate legally and efficiently in their business of technology-driven capital formation pursuant to rules 506(c), 506(b) and, eventually, Reg A+ and rule 4(a)(6) crowdfunding.

Presenters: Scott Purcell, CEO and founder, and Scott Anderson, general counsel

Product Launch: December 2014

Metrics: $2.25M angel funding to date; 9 employees; 125 crowdfunding platforms signed up; 40+ escrows opened in first 3 months

Product distribution strategy: Direct to Business (B2B), through financial institutions, through other fintech companies and platforms

HQ: Las Vegas, Nevada

Founded: November 2011

Website: fundamerica.com

Twitter: @FundAmerica