According to Narrative Science, wealth managers today are challenged to provide better results for their clients, at a faster rate, and under tighter regulatory scrutiny than ever before.

Fortunately, help is on the way in the form of Quill Portfolio Review, a new solution from Narrative Science made available this week. Quill Portfolio Review leverages the company’s core technology to make it easier for wealth managers to engage with their customers in a far more personalized, efficient way.

Narrative Science CEO Stuart Frankel said, “With Quill, leading financial organizations are providing automated, fully compliant and custom communications for millions of clients that give them the power to understand investments and make financial decisions about their futures.”

From left: Tim Bixler, Credit Suisse managing director and global head of HOLT; Kris Hammond, Narrative Science chief scientist, demonstrated Quill at FinovateFall 2013.

Quill, the core technology behind the solution, was first introduced to Finovate audiences at FinovateSpring 2013. Quill takes structured data and “mines it for meaning and insight.” The platform then renders those insights in a natural language document that can be anything from a tweet to a major research document.

“As a horizontal platform, Quill is subject-matter agnostic,” Frankel explained. “Now we are focused on building specific products for specific problems.”

In the financial services space, Quill technology is being used to create institutional portfolio commentary, a solution they’ve been selling to large mutual funds and asset managers for the past year or so. Creating this material on a quarterly basis has been historically both very expensive and time-consuming. But Quill has turned this process from a matter of weeks to a matter of seconds. “It used to take an army of people” to put these together every quarter, Frankel explained.

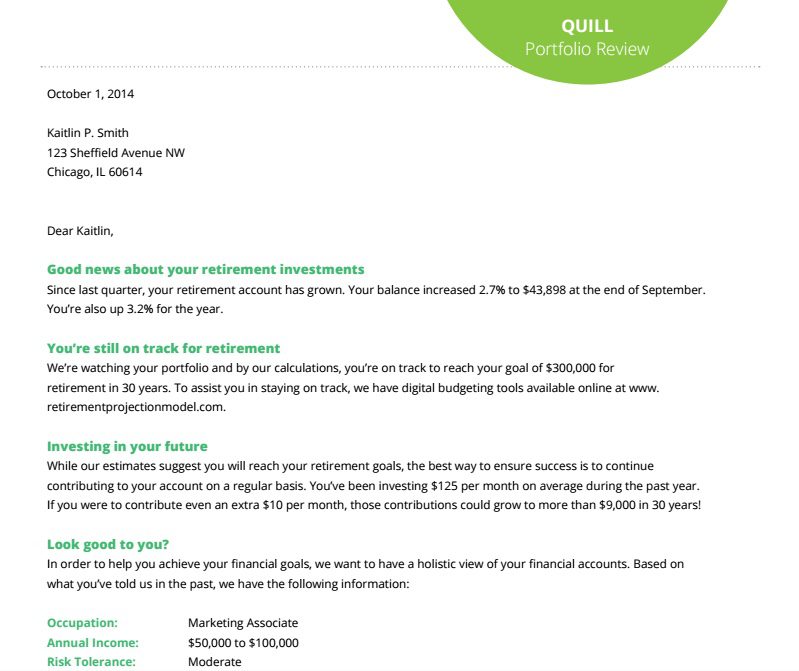

Pictured: A sample client letter from Quill Portfolio Review.

Narrative Science is now ramping up development of tools like the wealth-management-reporting solution being used for institutional portfolio commentary. Quill Portfolio Review is the latest example.

Frankel argued that the fundamental problem addressed by Quill and Narrative Science is how to turn all the data that we collect into truly actionable information. While infographics and 3-D visualizations can be illuminating, there is still no better way to convey data than through a story, a narrative. And that’s precisely what Narrative Science’s technology does.

“Compare that with what happens today,” Frankel said. “You log into some proprietary interface, see a table, closing prices, up arrows, down arrows, pie charts, indices … And you either feel good or bad compared to a benchmark that you probably don’t understand.”

“Compare that with what happens today,” Frankel said. “You log into some proprietary interface, see a table, closing prices, up arrows, down arrows, pie charts, indices … And you either feel good or bad compared to a benchmark that you probably don’t understand.”

The result is the very definition of a poor user experience. “The idea to make consumers do more work doesn’t make a lot of sense,” said Frankel. Instead, he suggests, “Why not actually pull out the information that the individual investor needs to make individual decisions and give it to them in a natural language document?”

As such, Quill Portfolio Review can be thought of as having two parts. The first is the personalized narrative communications for the client. The second is the portfolio analysis conducted in natural language for financial advisers. And in the same way that a better user experience is key to better engagement with the client, providing performance analyses and goal-based portfolio summaries is a major productivity enhancement for advisers.

There is a real compliance aspect to this solution, as well. He pointed out that financial advisers are talking with clients and each other on an ad hoc basis all the time, all day. “That’s a lot of interactions taking place outside the walls of the institution that could be running up against rules and regulations about various disclosures, privacy, etc,” Frankel said. Quill can be configured in a compliant way, reducing institutional risk.

Narrative Science will present Quill Portfolio Review at In|Vest with customer and investor, USAA, on Thursday, 18 July 18 2015 at the New York Hilton Midtown.

Founded in 2010 and headquartered in Chicago, Illinois, Narrative Science was last on the Finovate stage in the fall of 2013. Chief Scientist Kris Hammond was joined by Credit Suisse Managing Director Tim Bixler in demonstrating Quill.

For his part, Rouse called Klarna “the most exciting company in payments.” He pointed to the company’s ability to “leverage data from more than 35 million consumers” as key to Klarna’s ability to develop solutions that will improve the shopping experience for consumers and boost conversion rates for retailers.

For his part, Rouse called Klarna “the most exciting company in payments.” He pointed to the company’s ability to “leverage data from more than 35 million consumers” as key to Klarna’s ability to develop solutions that will improve the shopping experience for consumers and boost conversion rates for retailers.