The first quarter ended with a flourish of funding as 13 companies raised new funds ranging from $810,000 to $60 million. The total intake was $123 million, of which about half was the $60 million in debt raised by FinovateSpring15 presenter Yapstone. In addition, two Finovate crowd favorites were acquired this week: Toopher by SalesForce and ReadyForZero by Avant.

All told, about $770 million poured into the sector in March, a heady $9 billion run-rate (see previous weekly funding reports).

Here are the deals from 28 March through 2 April 2015 ranked by deal size:

Yapstone

Online and mobile payments

HQ: Walnut Creek, California

Latest round: $60 million (debt)

Total raised: $113.4 million ($53.4 million equity, $60 million debt)

Tags: Payments, mobile, Comerica Bank (investor/lender), FinovateSpring 2015 presenter

Source: Finovate

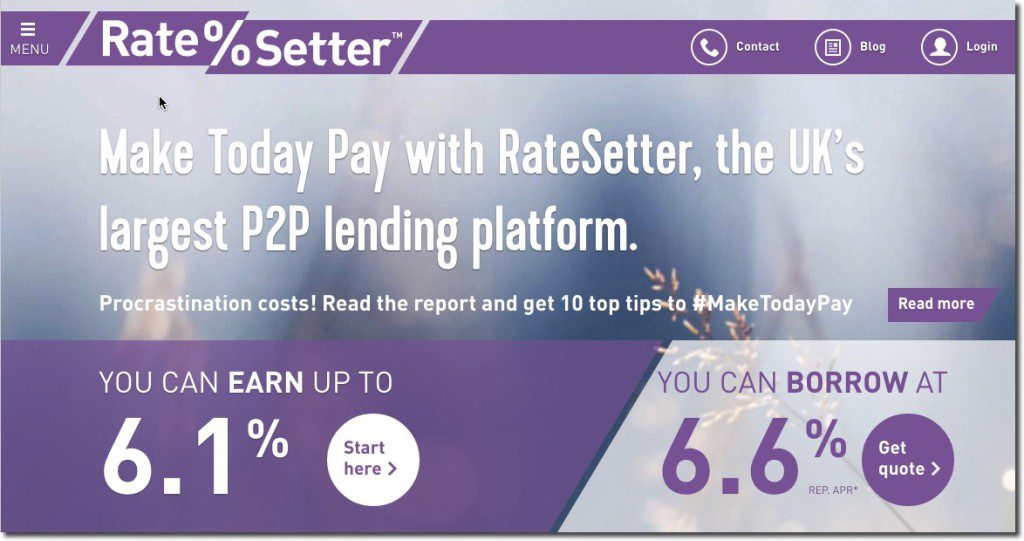

RateSetter

Consumer marketplace lender

HQ: London, United Kingdom

Latest round: $30 million

Total raised: $45 million

Tags: P2P, peer-to-peer lending, credit, underwriting, investing

Source: Crunchbase

Companisto

German equity crowdfunding platform for startups

HQ: Berlin, Germany

Latest round: $8 million

Total raised: $13 million

Tags: Crowdfunding, investing, SMB, startups

Source: Crunchbase

MyCheck

Automatic payment system catering to restaurant customers

HQ: Tel Aviv, Israel

Latest round: $5 million

Total raised: $11.1 million

Tags: Payments, mobile, SMB, restaurants

Source: Crunchbase

PeerNova

Blockchain technology

HQ: San Jose, California

Latest round: $5 million

Total raised: $19 million (includes unspecified amount of debt)

Tags: Bitcoin, virtual currency, cryptocurrencies, Overstock.com (investor)

Source: FT Partners

EZBOB

Online small business lender

HQ: London, United Kingdom

Latest round: $4.5 million

Total raised: $26 million

Tags: Loans, credit, SMB, underwriting, Finovate alum

Source: Finovate

Lendix

French marketplace lender for business loans

HQ: Paris, France

Latest round: $3.5 million

Total raised: $3.5 million

Tags: SMB, peer-to-peer lending, underwriting, credit, investing

Source: FT Partners

Bitt

Caribbean cryptocurrency exchange

HQ: Christ Church, Barbados

Latest round: $1.5 million

Total raised: $1.5 million

Tags: Bitcoin, blockchain, virtual currency

Source: Crunchbase

Scutify

Social network for investors

HQ: New York City, New York

Latest round: $1.5 million

Total raised: $2.5 million

Tags: Investing, information, traders, advice

Source: Crunchbase

Ittavi

Automates child-care payments with its SupportPay service

HQ: Santa Clara, California

Latest round: $1.5 million

Total raised: $2.6 million

Tags: Payments, automation, billpay, legal

Source: FT Partners

Gem

Bitcoin API provider

HQ: Venice, California

Latest round: $1.3 million

Total raised: $3.6 million

Tags: Cryptocurrency, developers, bitcoin

Source: Coinbase

PayNova

Swedish online payments provider

HQ: Stockholm, Sweden

Latest round: $810,000

Total raised: $810,000

Tags: Payments, mobile, online

Source: FT Partners

PPDai

Chinese-consumer marketplace-lender

HQ: Shanghai, China

Latest round: Undisclosed

Total raised: At least $70 million

Tags: Loans, consumer, lending, underwriting, P2P, peer-to-peer, investing

Source: Crunchbase