This post is part of our live coverage of FinovateFall 2015.

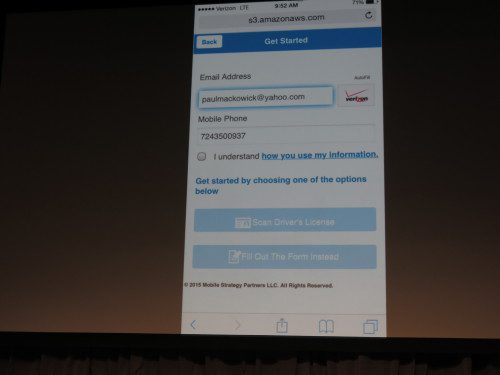

CellTrust demonstrated how SecureLine creates a separate persona for work communications on a mobile device:

CellTrust demonstrated how SecureLine creates a separate persona for work communications on a mobile device:

CellTrust SecureLine™ is a leading enterprise solution for secure voice and secure SMS that empowers the workforce with seamless mobile communications that can be secured, traced and archived. The CellTrust SecureLine app creates a dual persona on the device by clearly separating work and personal mobile communications by issuing a separate Mobile Business Number (MBN).

The MBN contains all business communications, allowing corporations to have access only to specific work-related data and not the employee’s personal data. This ultimately gives employees the freedom to have secure on-the-go business communications without compromising their personal information while allowing corporations to secure and maintain sensitive business data on a single device. The powerful app supports enterprise mobile communication, eDiscovery and compliance to give leading organizations a competitive advantage by balancing mobile productivity, risk and control.

Presenters: Brian Panicko, SVP, global sales strategy; Dragan Marceta, director, sales engineering

Product Launch: May 2014

Metrics: $10.1 million Series A funding, December 2014

Product distribution strategy: Direct to Business (B2B) and through our integrated ecosystem of partners including leading device, MDM, EEM, carriers, archivers and resellers to drive rapid growth and give customers the best mobility solution at the lowest total cost of ownership

HQ: Scottsdale, Arizona

Founded: December 2006

Website: celltrust.com

Twitter: @celltrust

![]() This post is part of our live coverage of FinovateFall 2015.

This post is part of our live coverage of FinovateFall 2015.