This post is part of our live coverage of FinovateFall 2015.

This post is part of our live coverage of FinovateFall 2015.

The team for Bleu is up next, demonstrating its Point of Sale Network solution.

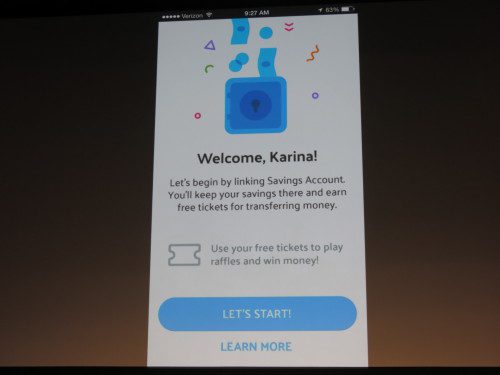

Bleu facilitates mobile transactions by using Bluetooth low-energy beacons in our PoS Network. A beacon is a tiny wireless device that sends a Bluetooth signal to a customer’s Bleu app when they enter a store. The beacon connects the customer to the store and when the customer is ready to pay, they select their form of payment and the transaction is automatically completed. Bleu has patented a mobile transaction process using Bluetooth low-energy beacons, and has developed a proprietary mobile point-of-sale and consumer application. This fully integrated solution conducts transactions from any registered payment instrument.

Presenters: bleu CEO Sesie Bonsi and Brett Howell, VP, business development

Product launch: September 2015

Product distribution strategy: Direct to consumer (B2C); direct to business (B2B); through financial institutions; through other fintech companies and platforms

HQ: Los Angeles, California

Founded: October 2014

Website: bleuco.com