This post is part of our live coverage of FinovateFall 2015.

This post is part of our live coverage of FinovateFall 2015.

Making their way to the stage next is the team from Capriza.

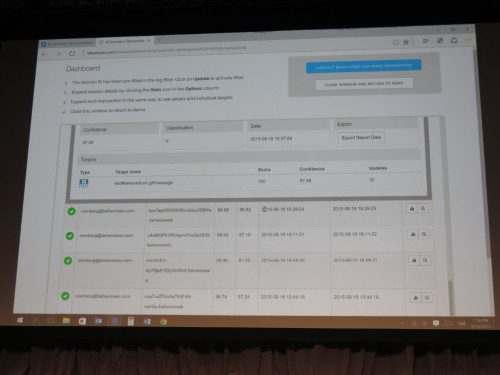

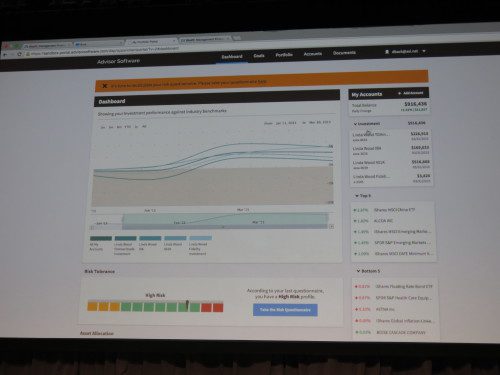

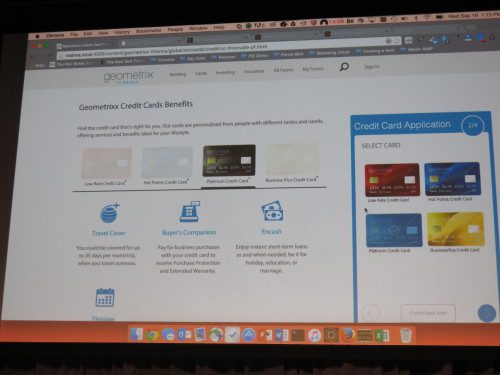

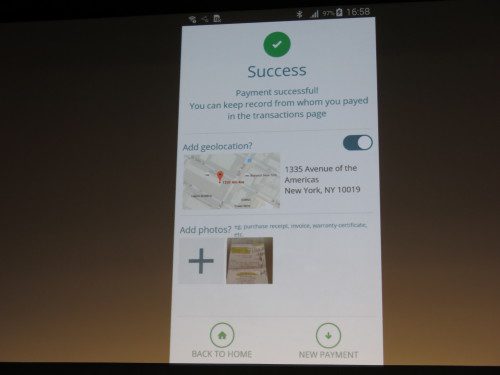

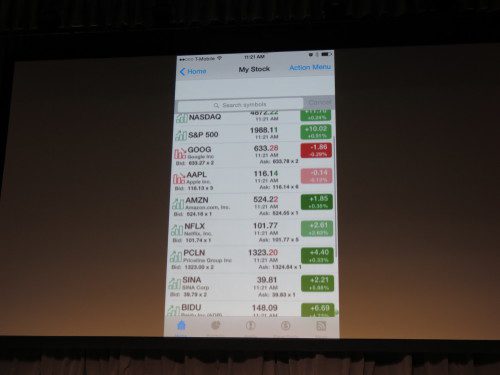

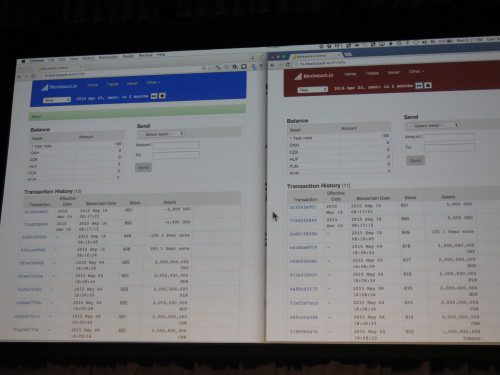

Capriza’s end-to-end simplification platform enables IT and lines of business to mobile-enable critical business workflows in a matter of days without any coding, APIs, or integration. The solution is applicable for packaged applications such as SAP, Oracle, Salesforce, as well as custom-built solutions. Capriza disrupts the speed and economics of the journey by extending the capability of legacy applications, in a simple and useable way, onto any smartphone, tablet, or desktop.

Presenters: Ivan Prafder, VP, regional business development, and Stephen Insdorf, senior solutions engineer, seated

Metrics: Capriza is venture-backed funded by Andreesson Horowitz, Charles River Ventures, and Tenaya Capital with a total raise to date of $53 million. Capriza has offices in North America and Europe, with 51-100 employees in each who are fluent in English, Mandarin, French, and Spanish.

Product distribution strategy: Direct to Business (B2B)

HQ: Palo Alto, California

Founded: July 2011

Website: capriza.com

Twitter: @Capriza