There is a reason why startups have captured approximately 0% of bank deposits a full two decades into the internet era. TRUST. Anyone hoping to get consumers to transfer thousands of dollars their way, must first win the trust battle. That means a killer combination of brand name, convenience, service, transparency, performance guarantees or measurable price/performance advantage.

I’m not saying you need to max out on all those variables, that’s not sustainable cost-wise. But you need to get to minimum levels on all and excel in one or two.

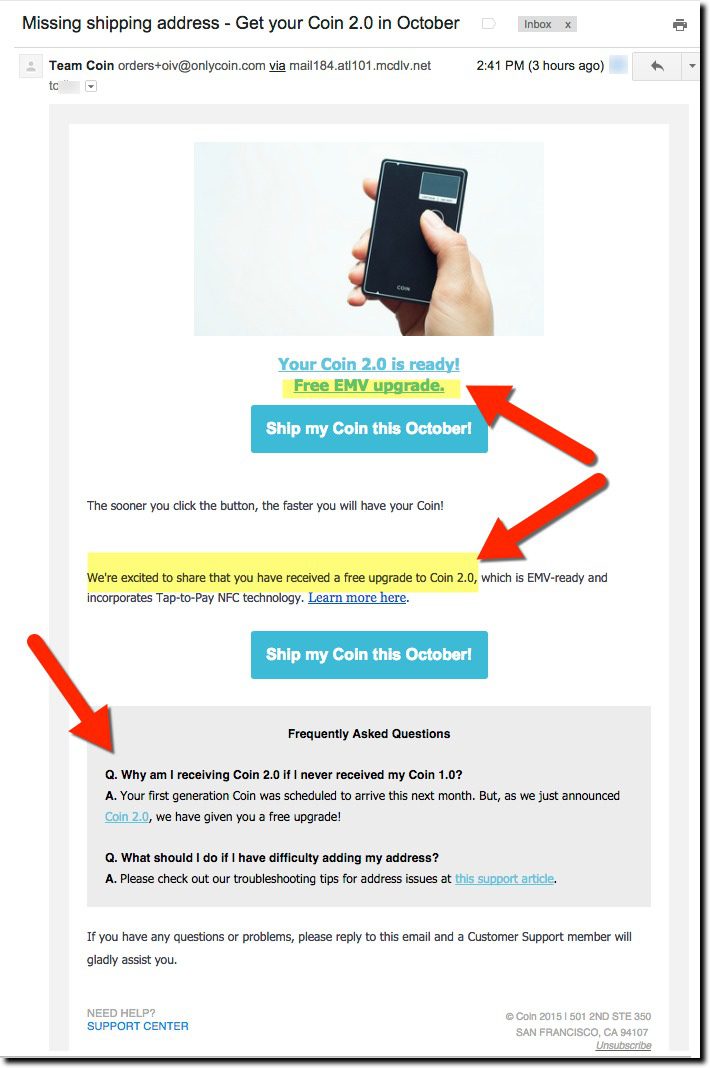

This isn’t news to anyone who’s been involved in the financial services space for more than a few months. But I was reminded of how newcomers are their own worst enemy sometimes when I got the following message from Coin today.

Now don’t get me wrong. I am a huge fan of the space (Dynamics is the pioneer in advanced cards, taking home yet another Best of Show award at Finovate two weeks ago, and we watched Stratos unveil their card at FinovateSpring). And I can understand that there will be delays when 400,000 people preorder your new hardware when you were expecting a tenth of that. But if you want me to entrust my cards to you, be forthcoming in all your communications.

Apparently, I’ll be getting my Coin in October, the last of the original 2013 preorders to ship (Coin’s website says new orders will begin shipping in November). The good news after the long wait is that I’m getting the next-gen EMV version, an important improvement over what I paid $50 for 22 months ago.

But I don’t think the company is doing itself any favors with the disingenuous FAQ on the email:

Q. Why am I receiving Coin 2.0 if I never received Coin 1.0?

(My translation: Why has it taken almost two years to get this thing?)A. Your first generation Coin was scheduled to arrive next month. But as we just announced, Coin 2.0, we have given you a free upgrade!

(My translation: It took so long to manufacture this thing, the world moved to a new standard, so we had to ship you the new one even though it cost us a bunch more to make.)

Bottom line: Coin has had a tough two years dealing with unprecedented demand (as far as new fintech is concerned) and not uncommon hardware delays. Now, they need to get back on track by telling their mostly patient customers the whole truth and nothing but the truth.

—————

Email from Coin to the last of its preorder customers (30 Sep 2015)

Photo credit: Flickr