This post is part of our live coverage of FinovateFall 2015.

This post is part of our live coverage of FinovateFall 2015.

The team from Novabase is up next.

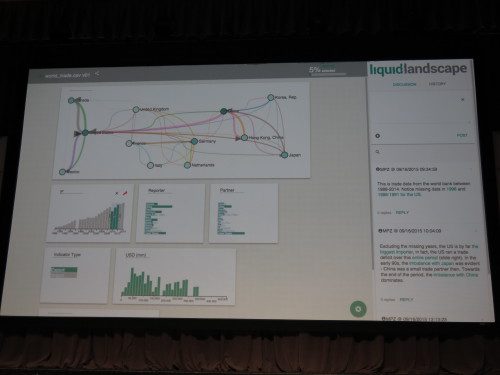

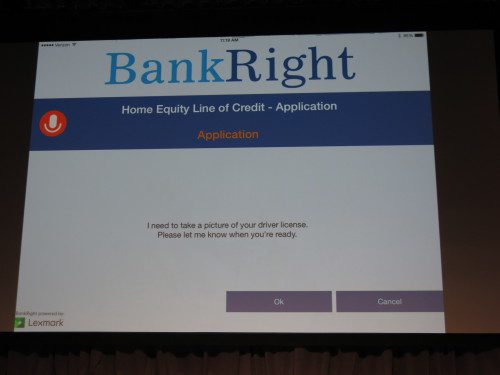

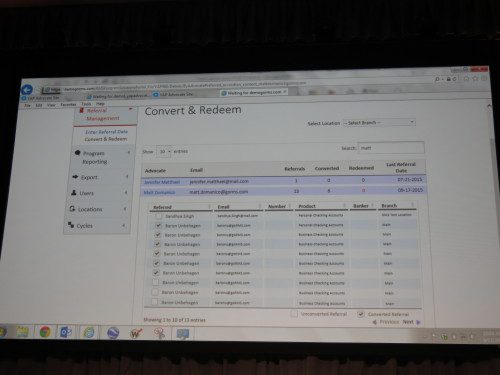

MyWizzio, powered by IBM Watson, is a smart machine for financial advisers that provides a unique approach to drive sales and productivity. Built as an intelligent ecosystem of apps designed to leverage your existing tools and third parties, the solution adapts around each user’s context, using cognitive computing to achieve a higher level of performance when managing research, relationships, and sales. MyWizzio extends this tailored experience to the end-clients, creating a more holistic landscape with the right mix of self-service and direct-to-adviser engagement.

Presenters, left to right: Pedro Gaspar, director of innovation; Jay Wong, senior business developer

Product launch: MyWizzio is launching September 2015 at FinovateFall

Product distribution strategy: Direct to business (B2B)

HQ: Lisbon, Portugal

Founded: 1989

Website: wizzio.novabase.pt

Twitter: @wizzio_Novabase