For just the fourth time this year, weekly fintech fundings fell below the $100-million mark with 15 companies raising a total of $51 million.

For just the fourth time this year, weekly fintech fundings fell below the $100-million mark with 15 companies raising a total of $51 million.

The second-largest round of the week ($4 million), went to Finovate veteran Dana Bowers’ latest startup, Venminder. The Kentucky-based company has developed a vendor-management platform for banks and credit unions. Bowers is the founder of iPay Technologies, which demoed at the first Finovate in 2007, and was acquired by Jack Henry in 2010.

With just one holiday-shortened week remaining in the year, the total invested in private fintech companies YTD now stands at $18.8 billion.

Here are the deals by size from 19 Dec to 25 Dec 2015:

PokitDok

Person-to-person lender

Latest round: $35.1 million Series B

Total raised: $40.7 million

HQ: San Mateo, California

Tags: Enterprise, healthcare, payments, insurance, billing, API, developers

Source: Crunchbase

Venminder

Vendor management for financial services companies

Latest round: $4 million

Total raised: $6.3 million

HQ: Elizabethtown, Kentucky

Tags: Enterprise, risk management, compliance, operations

Source: Crunchbase

Prestiamoci

Person-to-person consumer lender

Latest round: $2.2 million Series

Total raised: $3.5 million

HQ: Milan, Italy

Tags: Consumer, lending, underwriting, sub-prime, loans, P2P, investing

Source: Crunchbase

Streami

Blockchain-based remittances

Latest round: $2 million Seed

Total raised: $2 million

HQ: Seoul, South Korea

Tags: Blockchain, bitcoin, cryptocurrency, payments, remittances

Source: Crunchbase

Snapcard

Bitcoin exchange

Latest round: $1.5 million

Total raised: $4.45 million

HQ: San Francisco, California

Tags: SMB, consumer, blockchain, cryptocurrency, payments, wallet, bitcoin

Source: Crunchbase

BTCS (aka Bitcoin Shop)

Blockchain technology

Latest round: $1.4 million Post-IPO equity

Total raised: $4.2 million

HQ: Troy, Michigan

Tags: Bitcoin, cryptocurrency, payments, blockchain

Source: Crunchbase

Sharesight

Investment portfolio management

Latest round: $1.35 million Seed

Total raised: $1.35 million

HQ: Wellington, Australia

Tags: Consumer, investing, trading, aggregation, wealth management

Source: Crunchbase

BorsadelCredito.it

Person-to-person small business lender

Latest round: $1.1 million

Total raised: $1.1 million

HQ: Milan, Italy

Tags: SME, lending, alt-credit, underwriting, sub-prime, loans, P2P, investing

Source: Crunchbase

Chronos Technologies

F0rex trading technology

Latest round: $1 million

Total raised: $1 million

HQ: Scottsdale, Arizona

Tags: Forex trading, investing, fx

Source: Crunchbase

Minkasu

Mobile and online payments

Latest round: $1 million Seed

Total raised: $1.75 million

HQ: Milpitas, California

Tags: Consumer, mobile wallet, security, payments

Source: Crunchbase

The PayPro

International payments

Latest round: $450,000 Seed

Total raised: $450,000

HQ: London, England, United Kingdom

Tags: SMB, payments, billpay, fx, international payments, billpay, remittances

Source: Crunchbase

Bee

Mobile bank/card

Latest round: Not disclosed

Total raised: $4.6 million

HQ: New York City, New York

Tags: Consumer, prepaid debit card, neo-bank, challenger bank, mobile, AXA (investor)

Source: Crunchbase

Depo

Escrow and renter-deposit management

Latest round: Not disclosed

Total raised: Unknown

HQ: Sweden

Tags: Payments, renting, escrow, deposits, homes

Source: Crunchbase

GoldBean

Helping consumers get started in investing

Latest round: Not disclosed

Total raised: Unknown

HQ: New York City, New York

Tags: Consumer, investing, personal finance, spending, PFM, AXA (investor)

Source: FT Partners

Payable

Contractor payables solution

Latest round: Not disclosed

Total raised: $2.1 million

HQ: Sunnyvale, California

Tags: SMB, payments, invoicing, billing, billpay, accounts payable, payroll

Source: FT Partners

——–

Image licensed from 123rf.com

Soundpays

Soundpays week. The Toronto-based startup’s board of directors selected Steve Doswell (pictured right) to succeed Peter Misek as CEO.

week. The Toronto-based startup’s board of directors selected Steve Doswell (pictured right) to succeed Peter Misek as CEO.

While I have

While I have

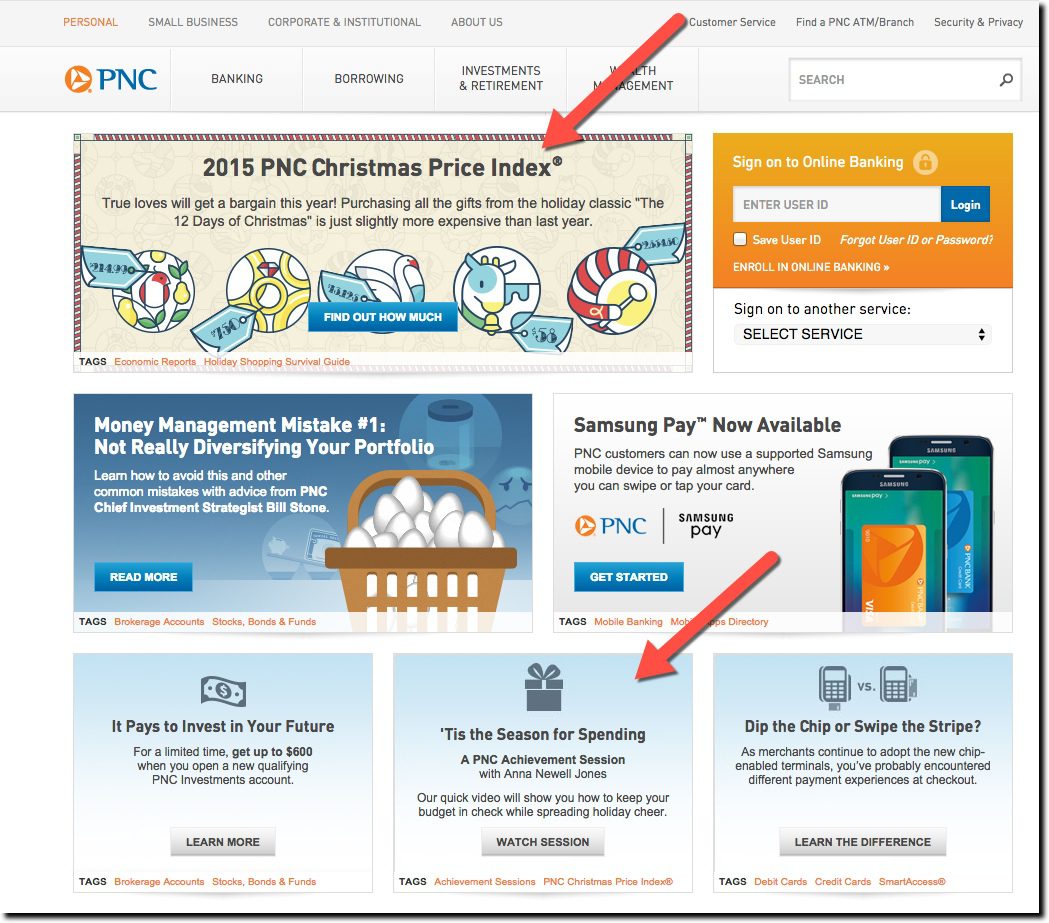

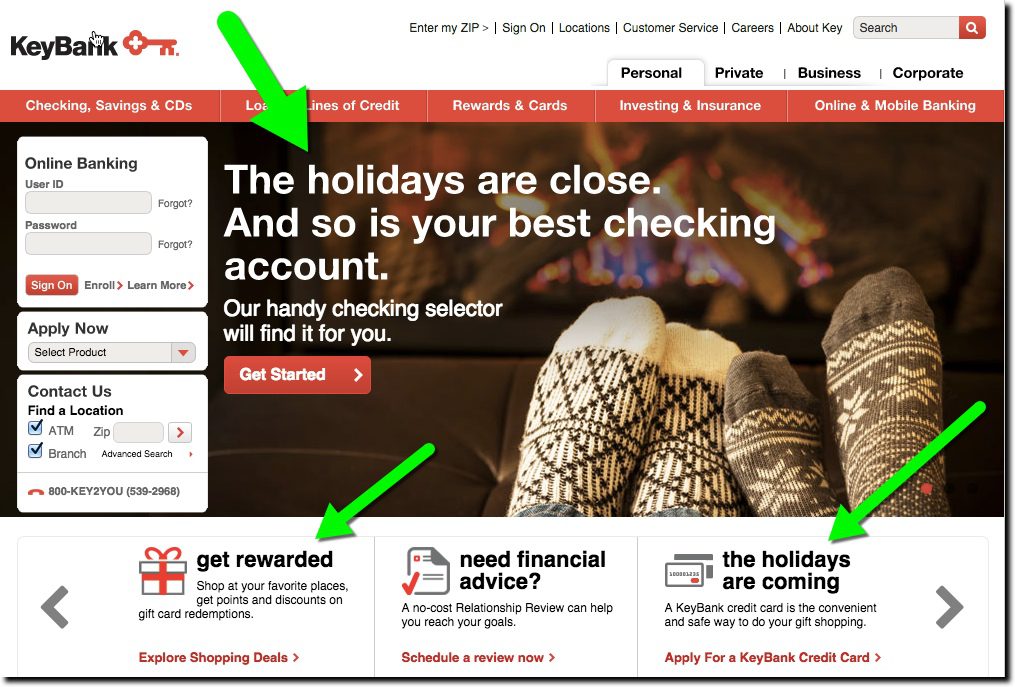

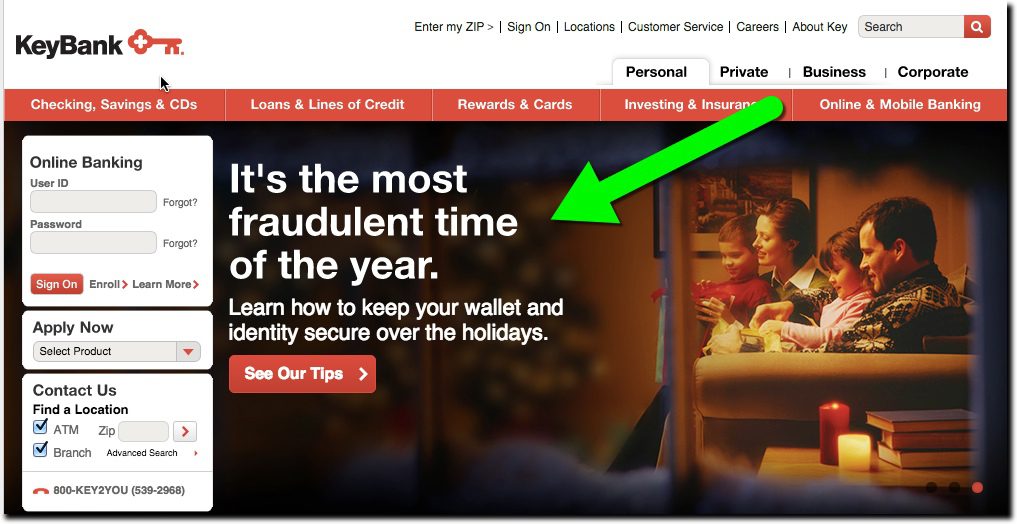

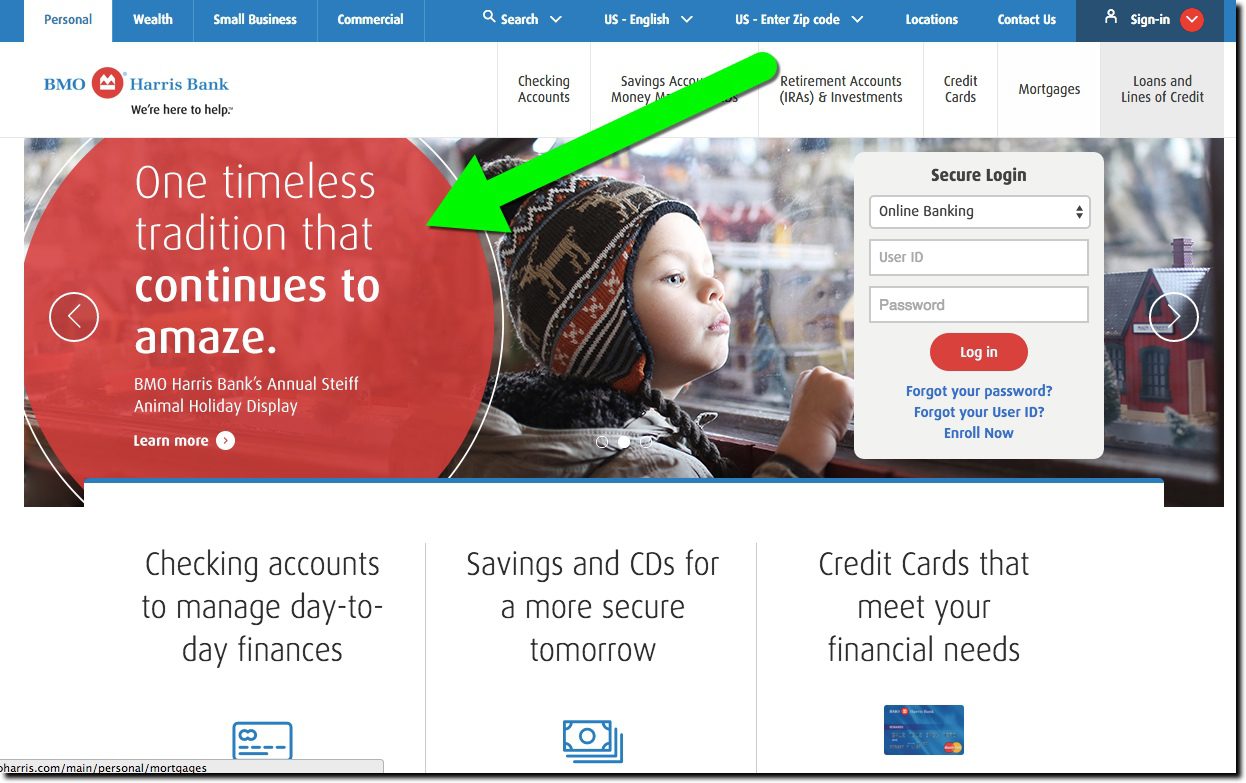

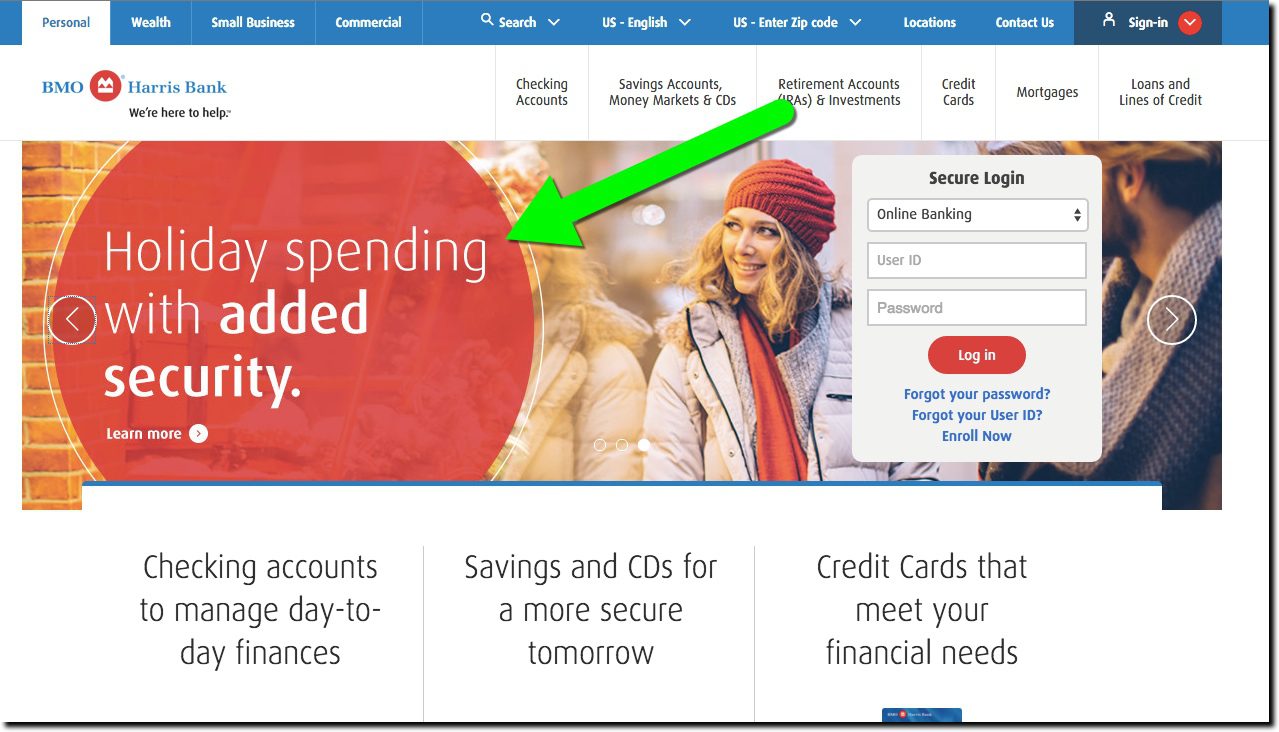

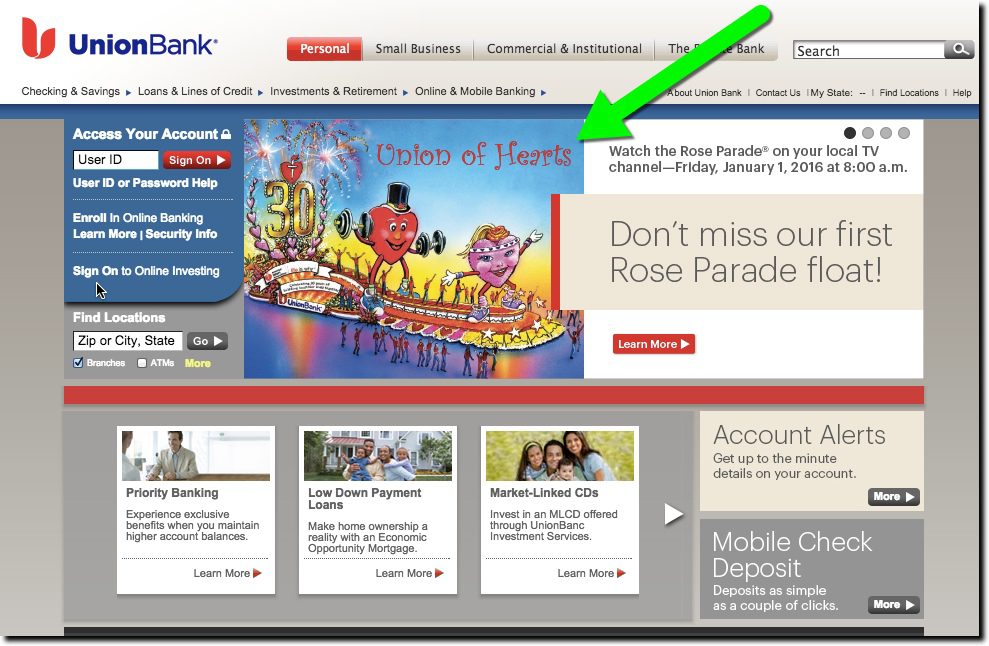

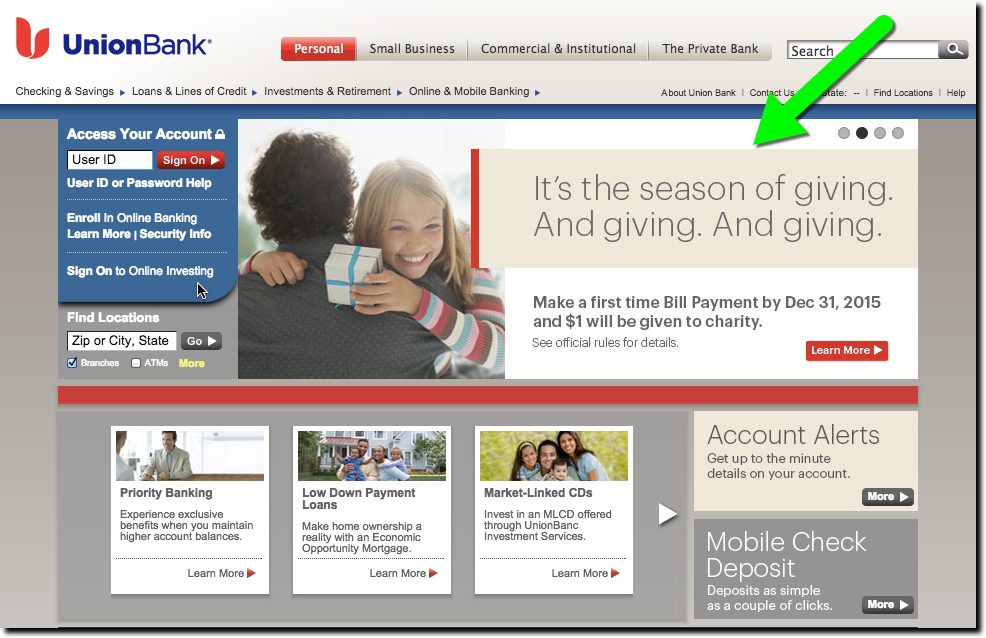

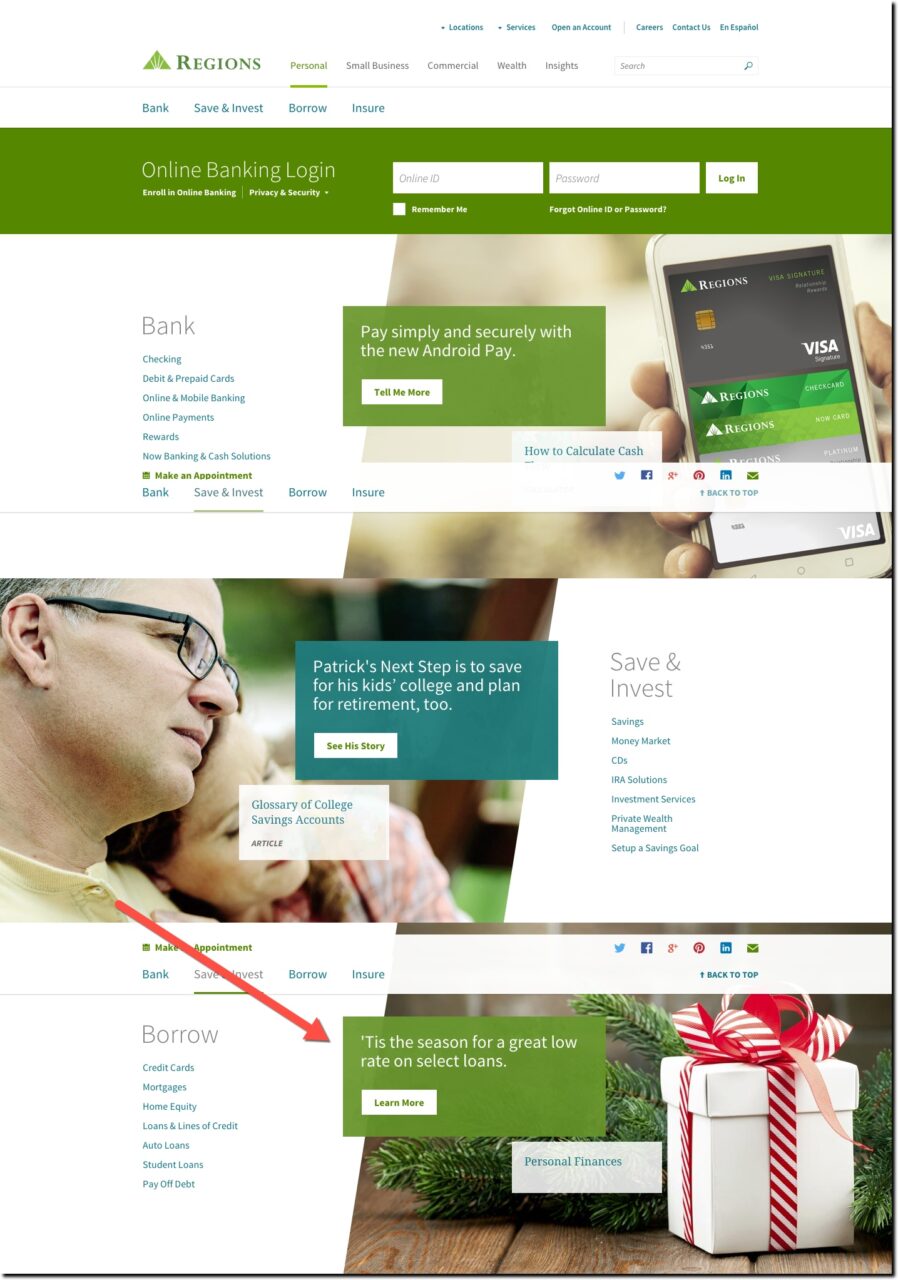

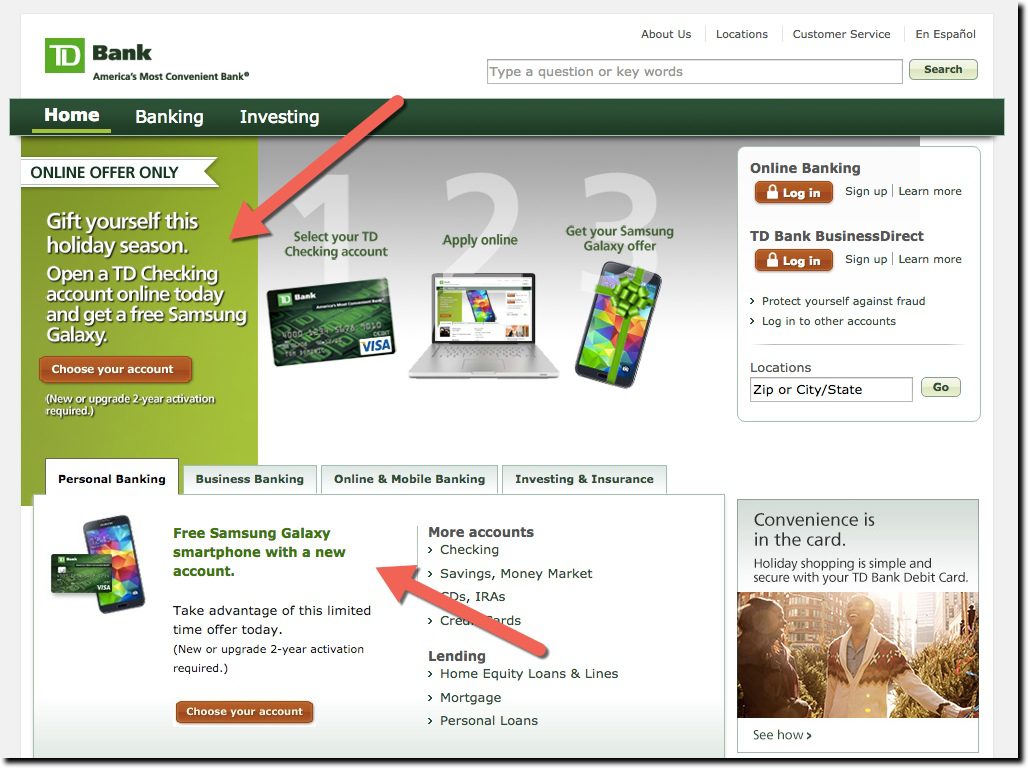

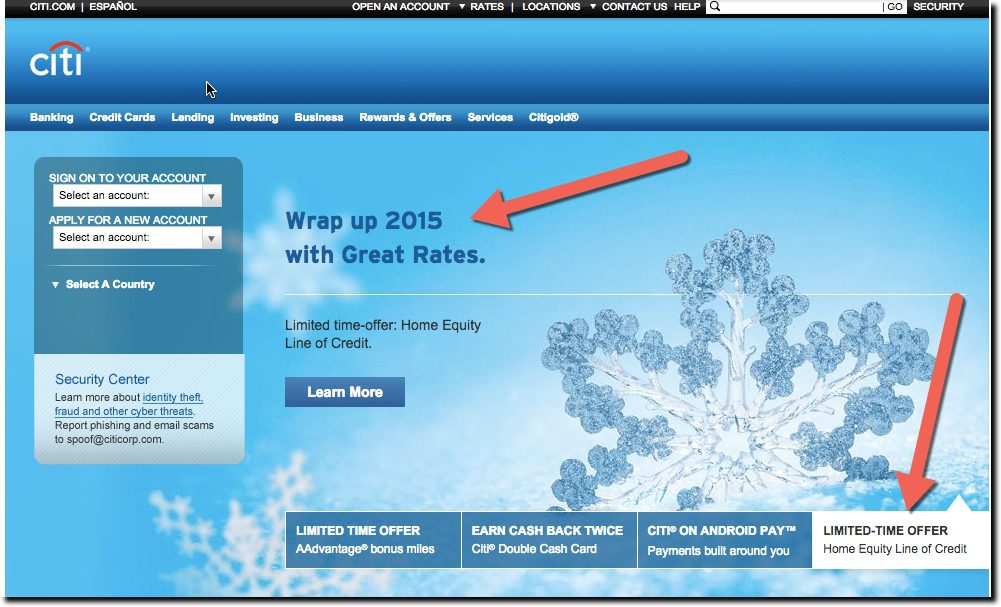

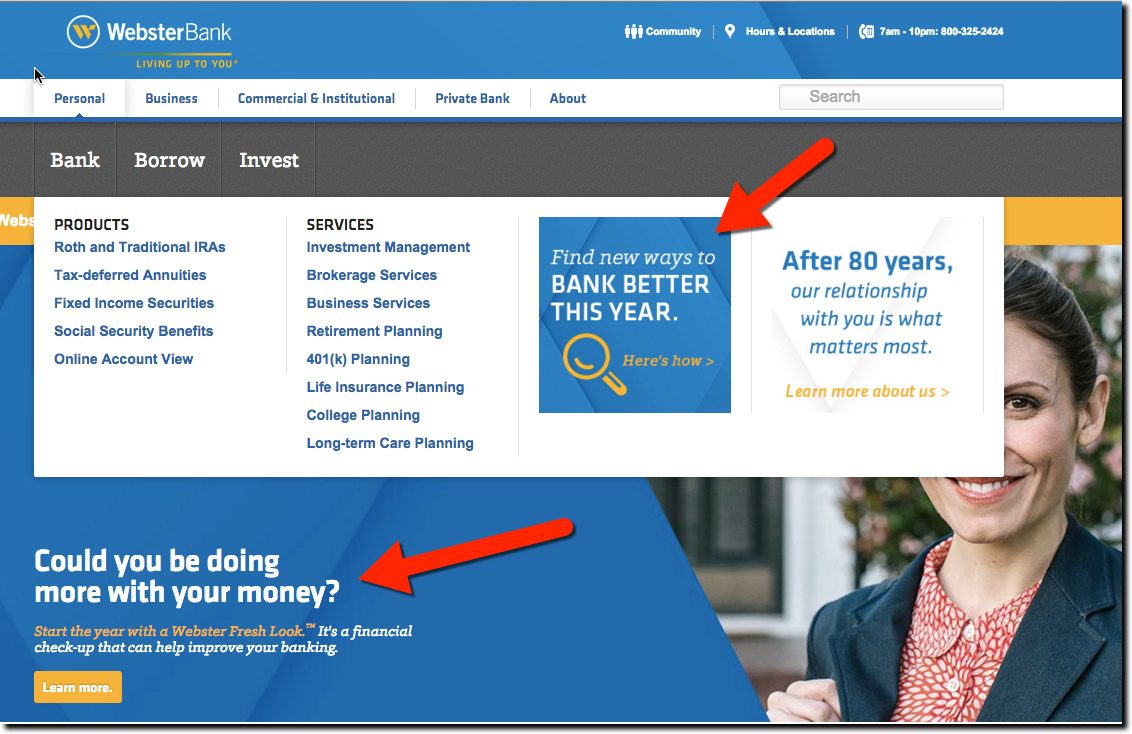

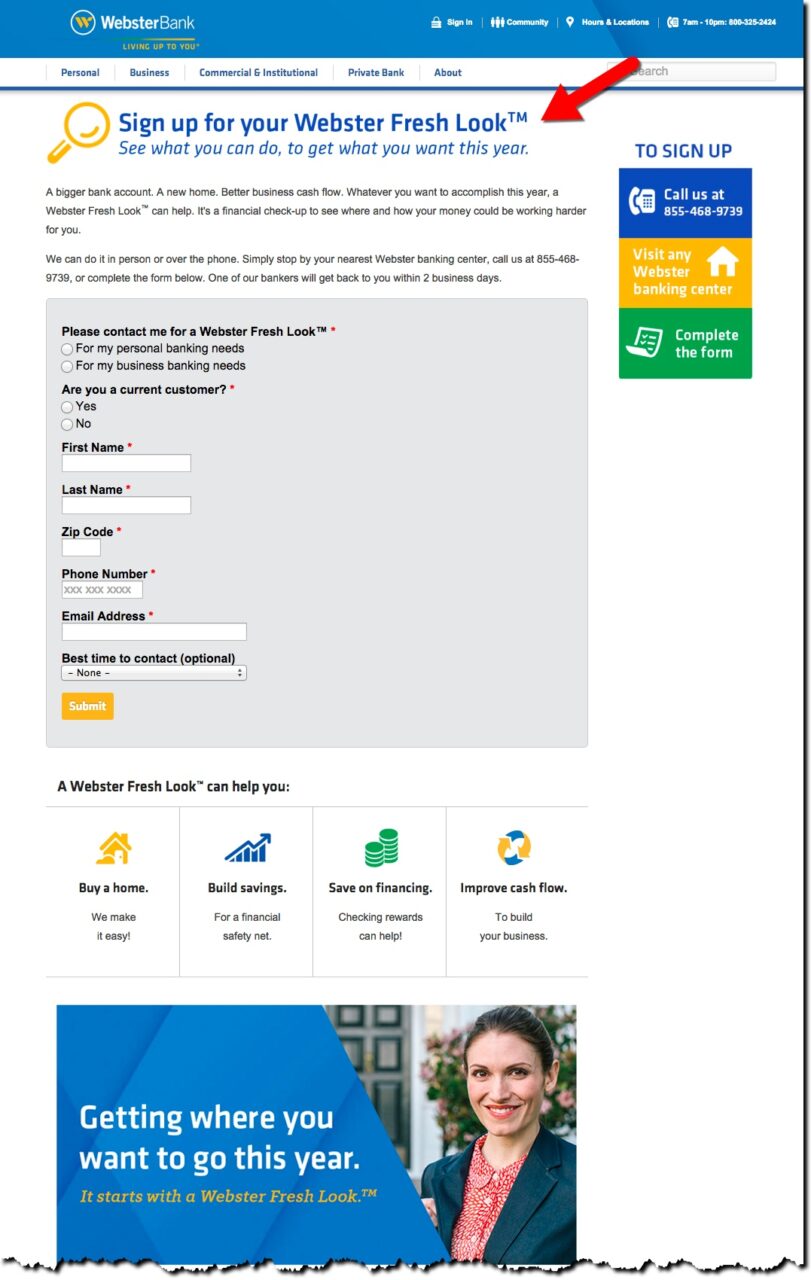

The end of the year provides a unique challenge to banks. Customers are busy buying gifts, finishing year-end projects at work, and preparing for holiday travel, meal prep and/or extended family time. There isn’t an abundance of deep thought about long-term financial plans, other than how to pay down inflated December credit card bills.

The end of the year provides a unique challenge to banks. Customers are busy buying gifts, finishing year-end projects at work, and preparing for holiday travel, meal prep and/or extended family time. There isn’t an abundance of deep thought about long-term financial plans, other than how to pay down inflated December credit card bills.