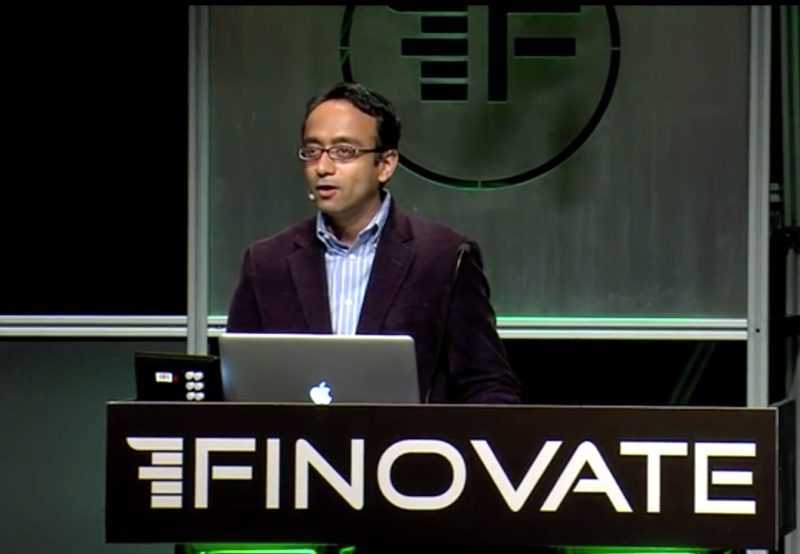

There are many great ways to kick off a global launch. We like to think demonstrating your technology live on stage at a Finovate conference is one.

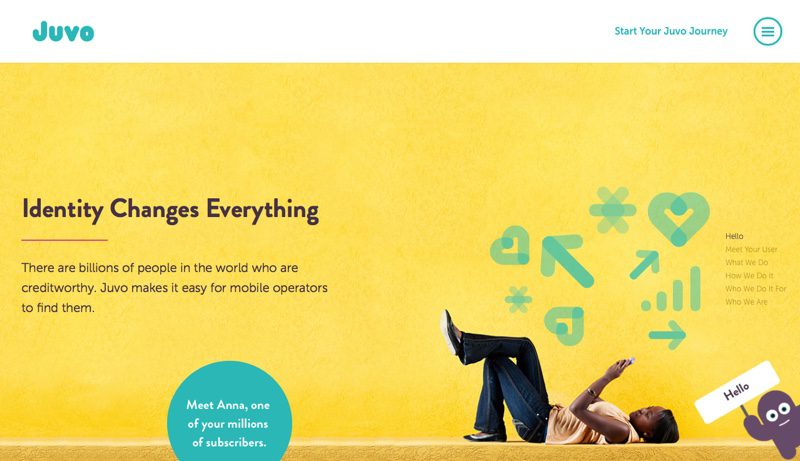

But we’ll concede that announcing a $14 million funding-round featuring participation from the former CEOs at companies like AT&T Wireless, Telefonica International, and Vodafone Group is pretty good, too.

“Only Juvo can deliver financial services to millions of underserved consumers around the world instantly,” former NYSE CEO and Juvo investor, Duncan Niederauer said. He praised both the company’s leadership and its track record, saying Juvo was in a strong position to help mobile operators transition to digital technology as well as respond to “the wider socioeconomic issues around financial inclusion for all.”

CEO and founder Steve Polsky and VP of Product Development Jason Robinson demonstrated Juvo Identity Scoring at FinovateFall 2016.

Juvo’s Identity Scoring technology leverages data science, machine learning, and game mechanics to provide financial identities to underserved populations around the world. Founded by CEO Steve Polsky, Juvo has a market footprint in 23 countries across four continents, giving the technology a reach of more than 100 million. Identity Scoring analyzes both subscriber and usage data in real-time to give mobile operators the consumer data they need to improve engagement and support growth. The company says that mobile operators using the solution have seen gains of 10% to 15% in average revenue per user, and has enabled them to offer high-value financial services.

“Juvo starts by reimagining the prepaid experience and encouraging identity-based relationships between subscribers and their mobile operators,” Polsky explained. “Juvo helps turn a previously ‘invisible’ customer into a ‘visible’ one,” he said, “opening doors for the customer, the mobile operator, and financial service provider alike, and bringing us closer to our vision of financial inclusion for all.”

Founded in March 2014 and headquartered in San Francisco, California, Juvo demoed its Identity Scoring solution at FinovateFall 2016 last week. Juvo’s investors include Wing Venture Capital, Freestyle, and Seed-Resolute.

Our conferences maximize networking opportunities for attendees, presenters, sponsors, and partners alike. We are equally interested in helping the press get to know our industry, and for our presenters to meet journalists who are eager to bring the good news of fintech innovation to the world. As someone who spends about half of every Finovate in the press area, I can attest to the quality of the conversations between those who present at, and those who report on, our events.

Our conferences maximize networking opportunities for attendees, presenters, sponsors, and partners alike. We are equally interested in helping the press get to know our industry, and for our presenters to meet journalists who are eager to bring the good news of fintech innovation to the world. As someone who spends about half of every Finovate in the press area, I can attest to the quality of the conversations between those who present at, and those who report on, our events.