We’re busy working on next month’s FinDEVr Silicon Valley developer’s conference (tickets still available), so we were thrilled to hear news of a major investment in Avalara, one of our FinDEVr alums from last year’s event.

Avalara, an innovator in automated tax management for small businesses, raised $96 million in new funding from a group of investors including Warburg Pincus, Sageview Capital, and Technology Crossover Ventures this week. Moreover, the company hinted it may be considering an initial public offering in the near future.

Quoted in GeekWire, company CEO Scott McFarlane called the possible IPO a “terrific outcome for Avalara someday if all the cards came together.” Avalara will use $50 million of this week’s investment to support acquisitions and growth—particularly its Compliance Cloud platform. The balance will be used to buy back shares from the company’s early investors. “This financing offers some long-term individual shareholders a liquidity event, while enabling more recent institutional investors to increase their stake,” McFarlane said. Avalara’s total capital raised is more than $318 million.

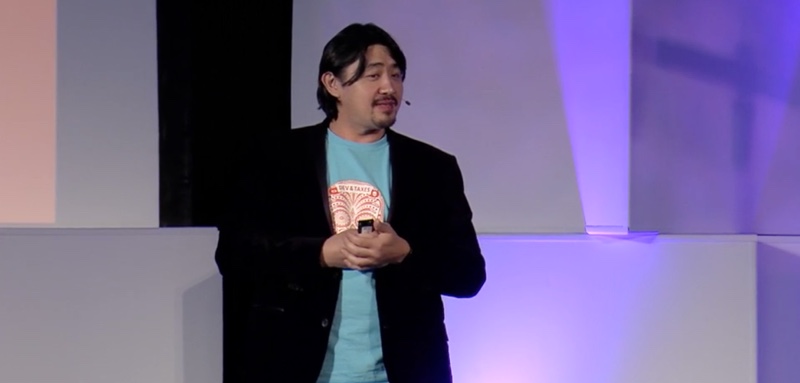

Loke Uei Tan discussed Avalara’s APIs during his presentation “The Wacky World of Sales Tax” at FinDEVr Silicon Valley 2015.

Justin Sadrian, managing partner at Warburg Pincus, called Avalara “the ideal platform company” his firm seeks for investment. Ned Gilhuly, founding partner at Sageview Capital, praised the automated tax-management specialist’s revenue growth since he began investing in Avalara, adding “going forward, we are as bullish as ever on the company’s growth prospects.”

Founded in 2004 and headquartered in Seattle, Washington, Avalara presented “The Wacky World of Sales Tax” at FinDEVr Silicon Valley 2015. Loke Uei Tan, senior manager for developer relations, showed how APIs help developers solve the problem of delivering accurate transitional tax information from more than 12,000 tax jurisdictions in the U.S.

Last month, Avalara added a number of new enhancements to its compliance document-management solution, CertCapture. In June, Avalara announced both a new integration with Stripe as well as earning recognition at the American Business Awards. Avalara calculates $100 million in taxes daily, and remitted $14.4 billion in taxes in 2015.

FinDEVr Previews highlight companies presenting new developer tools, platforms, and integrations at FinDEVr Silicon Valley 2016, October 18 & 19. Early-bird savings end Friday, so pick up your ticket to save your spot today.

FinDEVr Previews highlight companies presenting new developer tools, platforms, and integrations at FinDEVr Silicon Valley 2016, October 18 & 19. Early-bird savings end Friday, so pick up your ticket to save your spot today.