![]() FinDEVr Silicon Valley was a success! Tickets for upcoming FinDEVr London and FinDEVr New York are at their lowest prices now. Register today for London or New York to save your spot!

FinDEVr Silicon Valley was a success! Tickets for upcoming FinDEVr London and FinDEVr New York are at their lowest prices now. Register today for London or New York to save your spot!

On FinDEVr.com

- Avalara Adds New CMO Jeremy Korst.

The latest from FinDEVr Silicon Valley presenters

- Finovate Debuts: Sindeo Revamps the Mortgage Application Process.

Alumni updates

- Flybits CEO Hossein Rahnama interviewed in TechRepublic feature on IoT trends in 2017.

- ScientiaMobile recognized by CIOReview as one of the most promising CDN solution providers of 2016.

- AFK Insider lists Craft Silicon’s Uber-challenging app, Little, in its look at major technology developments in Africa in 2016.

- FinDEVr alum Streamdata.io joins Google Technological Partner program.

- Inc. lists Xero and PayPal among 8 business apps that will crush it in 2017.

- LTP: Trulioo CEO Stephen Ufford writes about the problem of gift card fraud.

Stay current on daily news from the fintech developer community! Follow FinDEVr on Twitter.

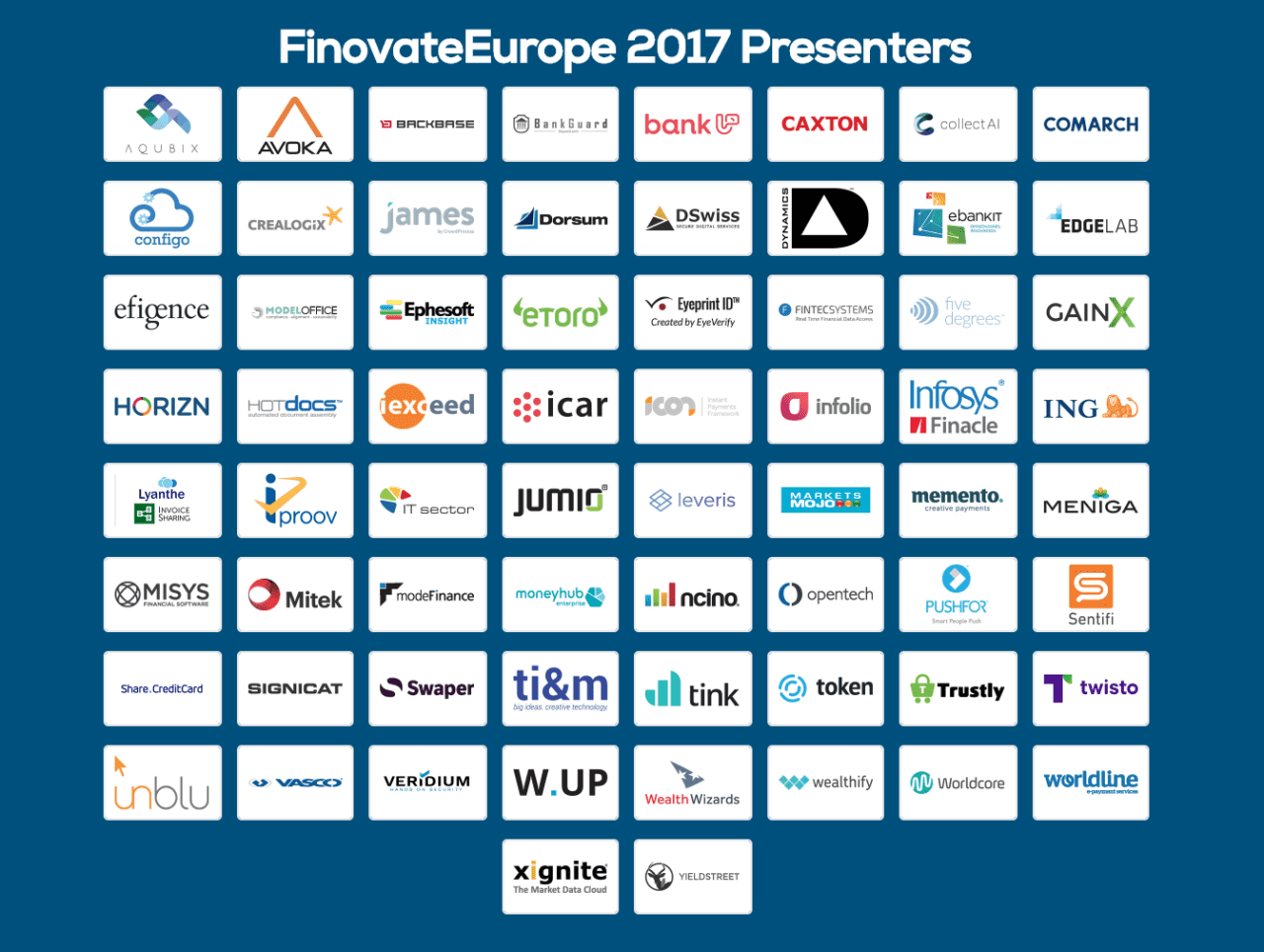

Presenters

Presenters Luc Haldimann, CEO, unblu

Luc Haldimann, CEO, unblu

Presenters

Presenters Peet Denny, Chief Technology Officer

Peet Denny, Chief Technology Officer

Korst (pictured) arrives at Avalara after several years at Microsoft where he led planning and execution of the global launch of Windows 10. Previous to Microsoft, Korst served as vice president and general manager at T-Mobile, and senior product marketing manager at AT&T Wireless/Cingular. A member of the board of a number of companies including Shoelace Wireless and 9104 Studios, Korst is a mentor for Seattle-area technology accelerator, 9Mile Labs. He has a BA in Economics, Politics, and Government from the University of Puget Sound, and a MBA from the Wharton School, University of Pennsylvania.

Korst (pictured) arrives at Avalara after several years at Microsoft where he led planning and execution of the global launch of Windows 10. Previous to Microsoft, Korst served as vice president and general manager at T-Mobile, and senior product marketing manager at AT&T Wireless/Cingular. A member of the board of a number of companies including Shoelace Wireless and 9104 Studios, Korst is a mentor for Seattle-area technology accelerator, 9Mile Labs. He has a BA in Economics, Politics, and Government from the University of Puget Sound, and a MBA from the Wharton School, University of Pennsylvania.

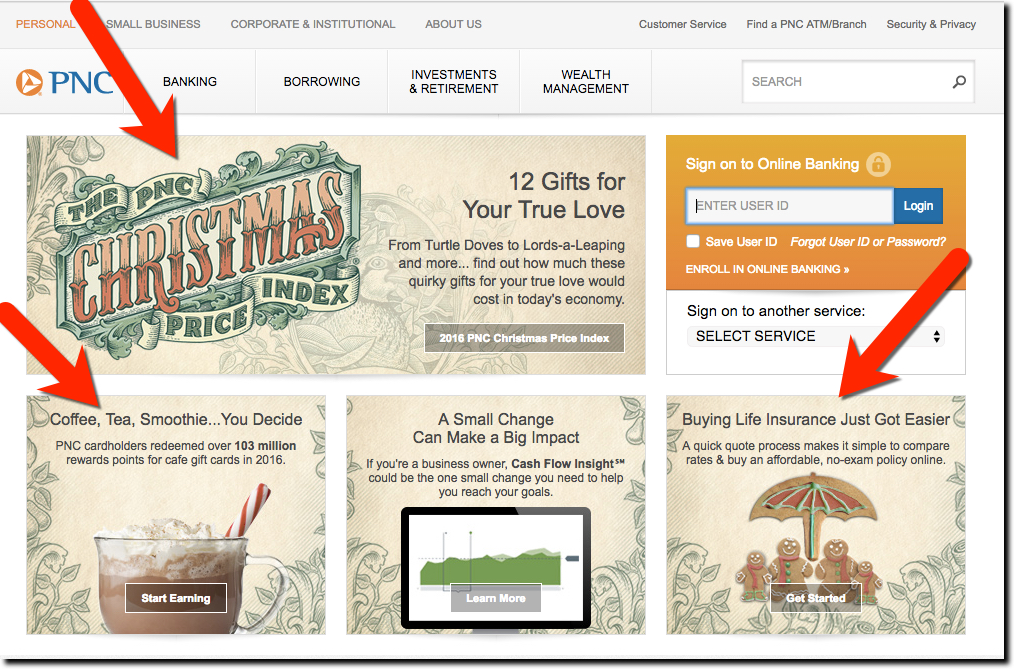

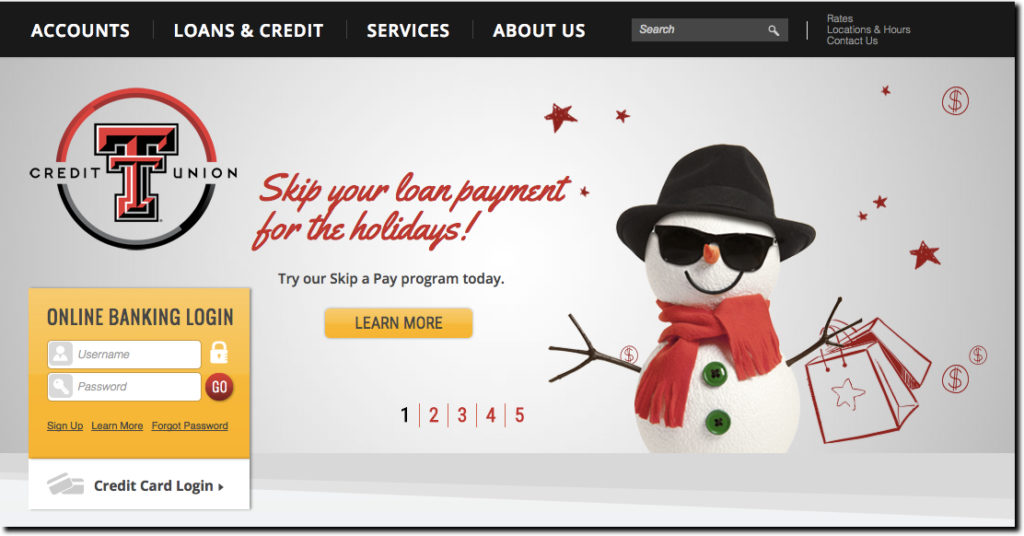

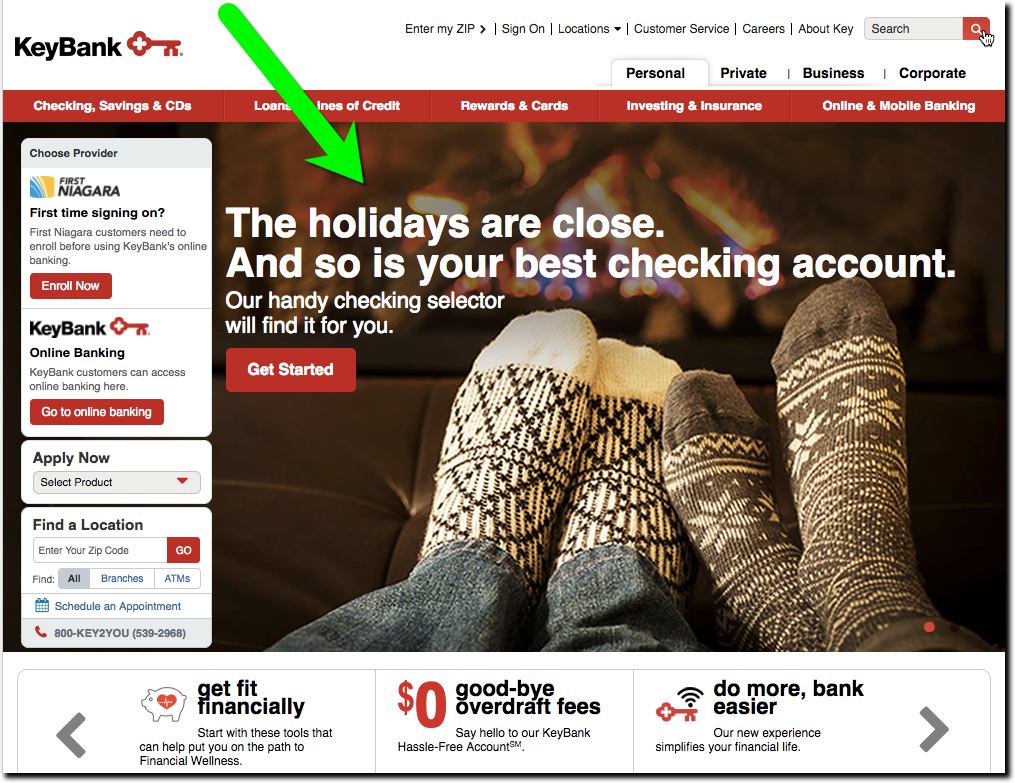

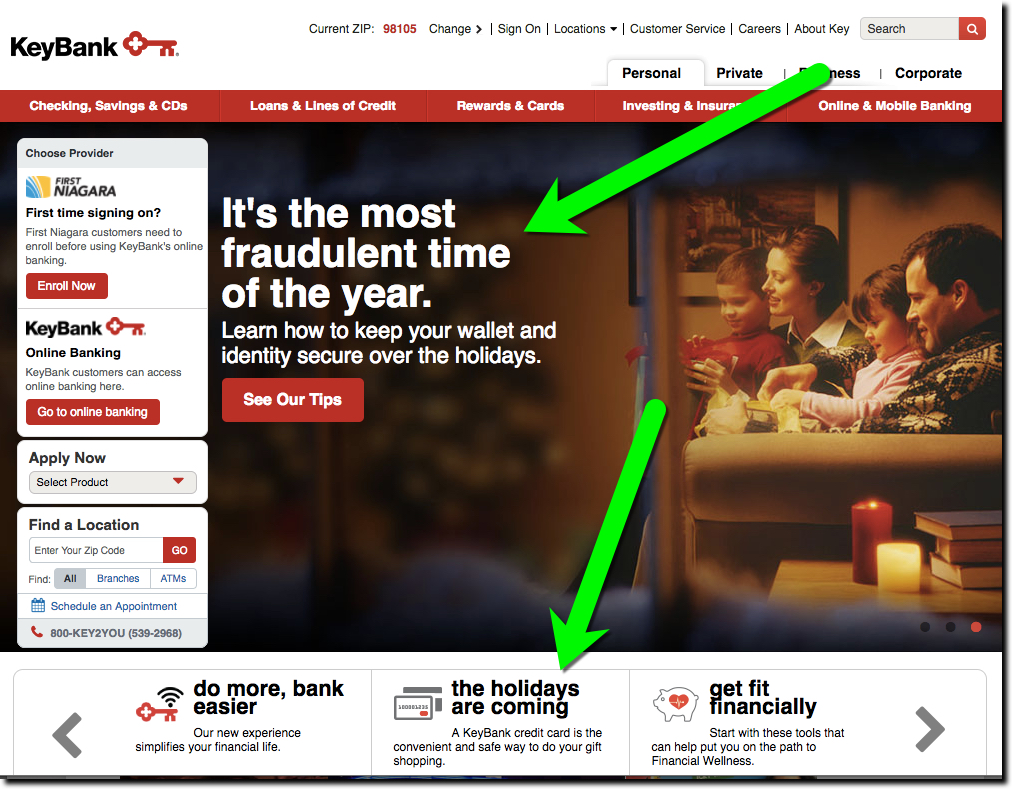

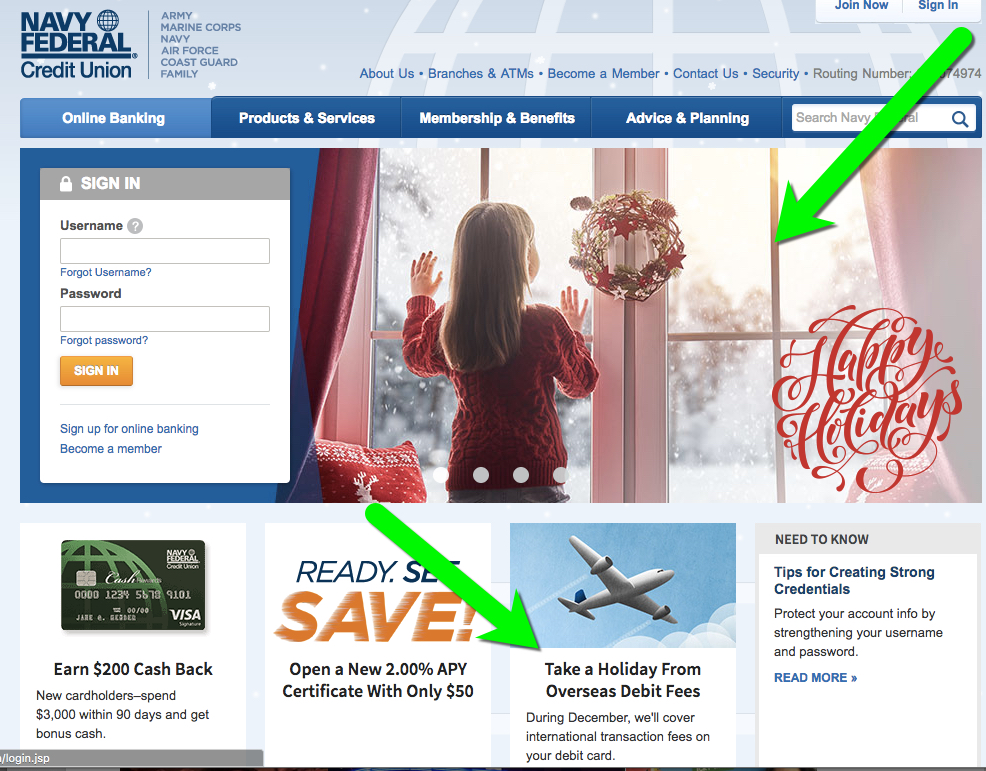

Happy holidays everyone! The holiday spirit is everywhere, except it seems, at the big U.S. banks. I get that budgets are busted, employees on vacation, and you don’t want to offend anyone by mentioning (or NOT mentioning) Christmas. Still, how hard would it be to throw a couple non-denominational snowflakes on top of your logo and wish everyone a happy holiday? Or better yet, how about a little bonus, like the holiday skip-payment offer similar to that featured on

Happy holidays everyone! The holiday spirit is everywhere, except it seems, at the big U.S. banks. I get that budgets are busted, employees on vacation, and you don’t want to offend anyone by mentioning (or NOT mentioning) Christmas. Still, how hard would it be to throw a couple non-denominational snowflakes on top of your logo and wish everyone a happy holiday? Or better yet, how about a little bonus, like the holiday skip-payment offer similar to that featured on

can’t wait to join the team and to work with Manolo to extend the success story of BBVA Compass.” Genç will replace Manolo Sanchez, who became CEO of BBVA Compass in 2008 and will transition into a new role of non-executive chairman.

can’t wait to join the team and to work with Manolo to extend the success story of BBVA Compass.” Genç will replace Manolo Sanchez, who became CEO of BBVA Compass in 2008 and will transition into a new role of non-executive chairman.