We¬†have a great speaker lineup for¬†FinDEVr London¬†which will take place on June¬†12 & 13. As part of our FinDEVr Feature series,¬†which highlights¬†some of the speakers you will see on stage at the event, we recently interviewed the CEO¬†of one of the presenting companies, Harborx. You can save 20% on your FinDEVr ticket when you register with Harborx’s promo code Harborx20LD17.

Here’s our interview with Wissam Sabbah, CEO of Harborx:

Where did you start your career and how did you gain the experience needed  to run the tech side of your company?

to run the tech side of your company?

Sabbah: I graduated with a bachelor’s degree in Computer Science and an associate degree in Finance from the American University of Beirut. I worked as a developer, and after a year, entered the field of corporate banking. I fell in love with currency trading and had a blast as a dealer. But banking and trading are too traditional of an industry, so while I loved what I did, I didn’t enjoy much the corporate environment and craved for a change.

In the early 2010s, startups were happening everywhere, so this idea of taking currency trading, shaking it up and making it accessible to everyone in the form of a game-like mobile app came around, although, having a fully-mobile trading platform with no desktop version was unheard of at the time. I am passionate about trading, global markets and technology, and I was lucky enough to connect with Harborx co-founder and good friend Cyrus Wen, who shared my vision. Cyrus and his partners helped assemble a team of talented developers who loved our idea. This is how Harborx was born.

Every day, we learn from each other how to combine the best of both worlds – the drive and fun of the ever-moving financial markets with development solutions to build our own trading platform. Basically, we have developed a mobile app that we ourselves would like to play and learn something new every day.

From a technologist’s perspective, what’s unique and game-changing about your technology?

From a technologist’s perspective, what’s unique and game-changing about your technology?

Sabbah: Traditional forex brokers use a tried and tested third-party desktop-first solution which is reliable but lacks flexibility. It couldn’t work for us since we’re a fully mobile-oriented trading platform. Thus, to support the gaming features, we leverage the actor pattern (Scala/Akka) to build a distributed trading system of our own. Thanks to our decoupled architecture, which was developed in-house, we were able to adapt faster. Our event-driven programming paradigm allows us to decouple the core trading functionality from the gaming features through internal Remote Procedure Calls (RPC) and Publish/Subscribe patterns.

Tell us about your favorite implementation of your solution/technology.

Sabbah: I love the Leaderboard, one of our latest features. This is an ongoing competition where app users are ranked based on their trading success. The Leaderboard makes Harborx an addictive app and users are ranked in real time as they trade in real time.

In addition to being a competitive mobile app, Harborx is a live trading environment, where you have lightning-speed price feeds and extremely low latency. While the speed is a must-have for most games these days, this requirement increases tenfold when people trade with their real funds. At Harborx, we stream price feed data to our users by leveraging the power of Message Queue Telemetry Transport, aka MQTT, i.e. the same technology behind Facebook Messenger.

The Leaderboard is the project where the live trading environment weaves with a live game, a synthesis of everything we’ve learned over the years. The team worked hard on the Leaderboard, and we are happy with the result.

FinDEVr London 2017 is sponsored by TestDevLab.

FinDEVr London 2017 is partnered with Aite Group, Banking Technology, BayPay Forum, BiometricUpdate.com, Brave New Coin, Breaking Banks, Byte Academy, The Canadian Trade Commissioner Service, Celent, Cointelegraph, Colloquy, Cooper Press, Distributed, Economic Journal, Empire Startups, Femtech Leaders, Finmaps, Fintech Finance, Global Data, Harrington Starr, Holland Fintech, Level39, London Tech Week, Mapa Research, Mercator Advisory Group, The Paypers, Plug and Play, SecuritySolutionsWatch.com, SME Finance Forum, Startupbootcamp, Swiss Finance + Technology Association, and Women Who Code.

From a technologist’s perspective, what’s unique and game-changing about your technology?

From a technologist’s perspective, what’s unique and game-changing about your technology?

From a technologist’s perspective, what’s unique and game-changing about your technology?

From a technologist’s perspective, what’s unique and game-changing about your technology?

Here’s our interview with Dr. Ricardo¬†Jimenez-Peris,

Here’s our interview with Dr. Ricardo¬†Jimenez-Peris,

Dr. Jason Mars, Founder and CEO, Clinc

Dr. Jason Mars, Founder and CEO, Clinc Jeff Cain, Director, Envestnet | Yodlee Incubator

Jeff Cain, Director, Envestnet | Yodlee Incubator Where did you start your career and how did you gain the experience needed to run the tech side of your company?

Where did you start your career and how did you gain the experience needed to run the tech side of your company?

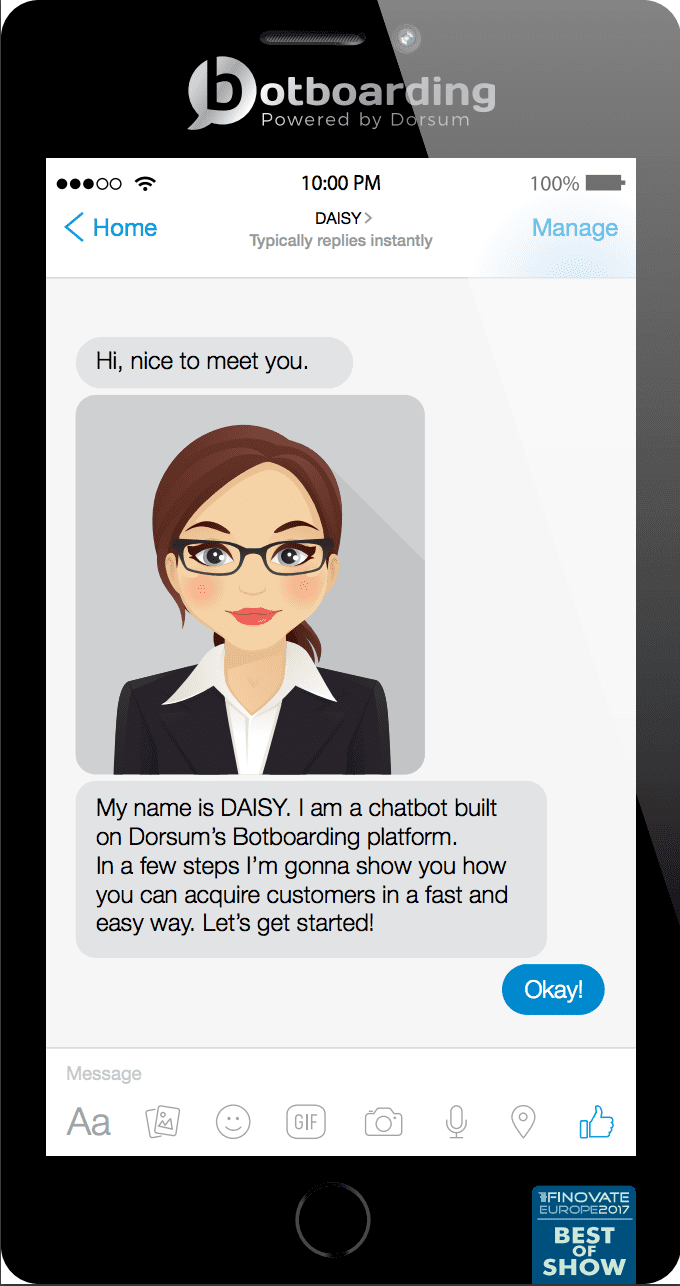

You can’t spell the name Daisy without AI, which is good because it’s the premise behind

You can’t spell the name Daisy without AI, which is good because it’s the premise behind

We interviewed¬†R√≥bert KŇĎ (pictured), Dorsum CEO, for a bit more insight into Dorsum and Daisy, it’s Botboarding chatbot.

We interviewed¬†R√≥bert KŇĎ (pictured), Dorsum CEO, for a bit more insight into Dorsum and Daisy, it’s Botboarding chatbot.