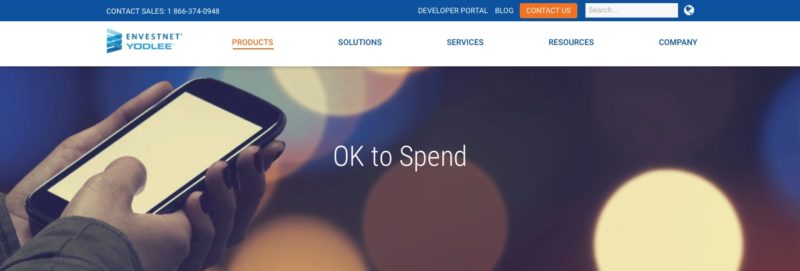

After developing a two-time, Best of Show-winning PFM technology, Envestnet | Yodlee has introduced the next evolution in its emphasis on financial wellness. Launched last week at the Digital Banking Summit, the Personal Financial Wellness Solution is a new suite of apps and APIs that apply machine learning and AI to Envestnet | Yodlee’s vast trove of transaction data and analytics. The initial solutions from the suite, OK to Spend and Save for a Goal, give consumers actionable insights into their spending and saving behaviors, and provide a straightforward way to see, understand, and improve financial well-being.

In an interview previewing the announcement, Envestnet | Yodlee VP of Product Applications Katy Gibson pointed out how the new solution was an important development away from the conventional approaches to savings solutions. She credited a deeper understanding of how the average person relates to their individual financial status as key to this pivot. “The previous PFM model was well-suited for a certain type of consumer who was financially-engaged and financially-literate,” Gibson explained. “We needed to figure out how to better serve the 70-80% who care (about their finances), but feel anxiety, and are not very financially literate.”

Pictured: Envestnet | Yodlee VP of Product Applications Katy Gibson demonstrating the company’s financial guidance solution at FinovateFall 2016.

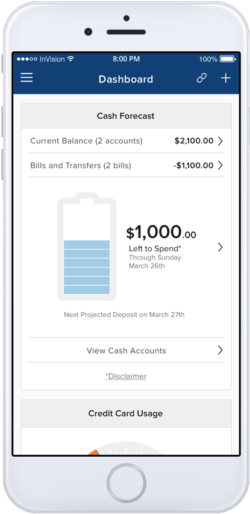

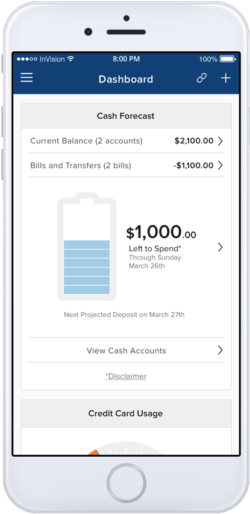

OK to Spend leverages data analytics to review and examine spending habits. The solution runs machine learning algorithms to create a holistic financial forecast that helps the user become and remain financially organized. Available as both an app as well as via RESTful API, OK to Spend anticipates future and recurring income and expenses and provides regular notifications and updates. Gibson praised the “single number simplicity” of the  solution. “People are drowning in data,” she said. “The last thing I want to do is scroll through my transaction data to see what’s coming.” Instead, OK to Spend provides weekly and monthly communications, along with a calendar of upcoming income and spending. With Save for a Goal, consumers can manage and track savings goals across a variety of accounts and timeframes. The interface relies on visual aids like progress bars and graphs, as well as alerts, to keep consumers engaged with their savings success.

solution. “People are drowning in data,” she said. “The last thing I want to do is scroll through my transaction data to see what’s coming.” Instead, OK to Spend provides weekly and monthly communications, along with a calendar of upcoming income and spending. With Save for a Goal, consumers can manage and track savings goals across a variety of accounts and timeframes. The interface relies on visual aids like progress bars and graphs, as well as alerts, to keep consumers engaged with their savings success.

Gibson emphasized the importance of customer engagement in a statement accompanying the product announcement. She sees the kind of “personalized user experiences” provided by solutions from Envestnet | Yodlee as an extension of the “relationship-based banking (that) has been the key to success and customer loyalty for financial institutions for years.” She added “helping consumers meet their financial goals is the best way to build lasting customer relationships.”

Founded in 1999 and headquartered in Redwood City, California, Yodlee’s comprehensive transactional data network helps financial services providers deliver a wide range of financial planning and wealth management solutions via mobile and API. A multiple-time Best of Show winner, Yodlee was acquired by Envestnet for $660 million in August 2015, and made its most recent Finovate appearance as Envestnet | Yodlee this February at FinovateEurope 2017.

A month later, Envestnet | Yodlee unveiled its Risk Insight Suite, a set of risk reporting tools to help lenders improve upon the data gathered from traditional credit sources by factoring in consumer financial information. The company partnered with mobile banking startup, Varo Money earlier this year, and last December announced integration with Microsoft Dynamics 365 for Financials. Envestnet | Yodlee is also a veteran of our developers conferences, most recently presenting at FinDEVr Silicon Valley last fall. At the event, Director of Platform, Product Management Deviprasad Kocherry and Sr. Product Manager, Mobile Platform, Deven Maru, discussed “Fast Track API Integration with Envestnet | Yodlee.” In May, Jeff Cain Director of the Envestnet | Yodlee Incubator, participated in our webinar “How to Make It in the Fintech Industry: 3 Startup Success Stories.”

Envestnet is headquartered in Chicago, Illinois, and was founded in 1999. The company serves more than 55,000 advisors and 2,500 companies including 16 of the biggest banks in the U.S. and 38 of the biggest wealth management firms and brokerages. Publicly traded on the NYSE under the ticker symbol, ENV, the company announced first quarter 2017 results last month. Jud Bergman is chairman and CEO.

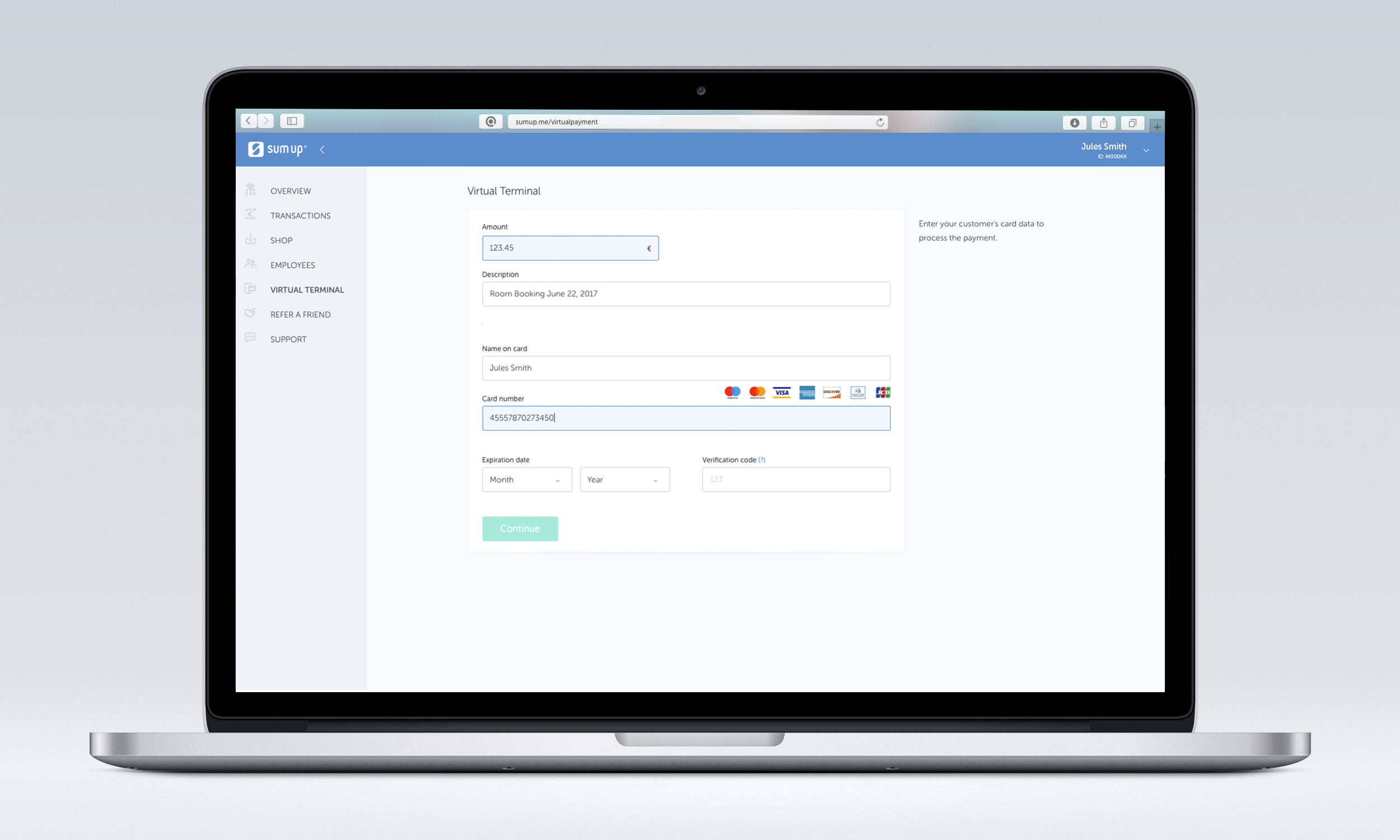

made via SMS. The merchant enters the amount due in the SumUp app, which sends the customer an SMS text with a link to a basic online form to enter their payment credentials. There is no card reader required.

made via SMS. The merchant enters the amount due in the SumUp app, which sends the customer an SMS text with a link to a basic online form to enter their payment credentials. There is no card reader required.

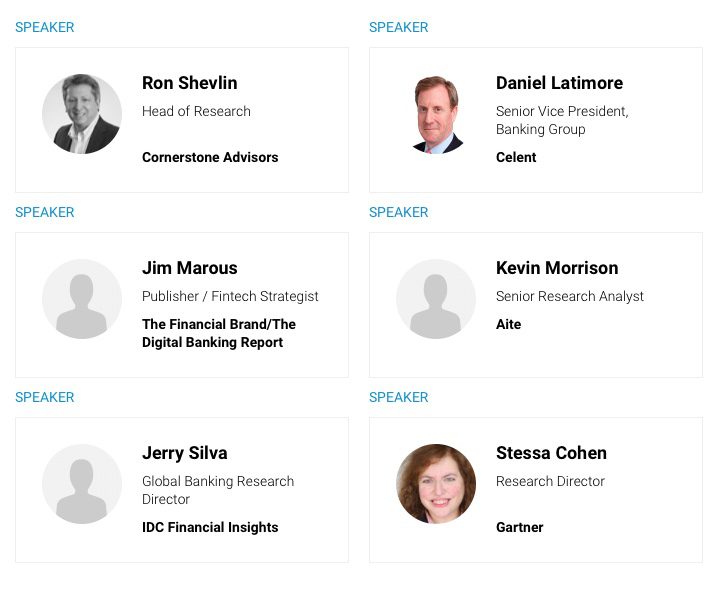

Industry analyst specializing in financial services marketing strategy.

Industry analyst specializing in financial services marketing strategy. Leads a world-class team of analysts focused on the banking industry. Celent is a research and consulting firm that provides technology and business strategy advice to the global financial services industry. Celent provides unbiased insight into industry trends, competitors in the market, and market sizes.

Leads a world-class team of analysts focused on the banking industry. Celent is a research and consulting firm that provides technology and business strategy advice to the global financial services industry. Celent provides unbiased insight into industry trends, competitors in the market, and market sizes. Named as one of the most influential people in banking and a Top 5 Fintech Influencer to Follow, Jim Marous is an internationally recognized financial industry strategist, co-publisher of The Financial Brand and the owner and publisher of the Digital Banking Report. Marous advises on innovation, portfolio growth, customer experience, marketing strategies, channel shift, payments and digital transformation within the financial services industry.

Named as one of the most influential people in banking and a Top 5 Fintech Influencer to Follow, Jim Marous is an internationally recognized financial industry strategist, co-publisher of The Financial Brand and the owner and publisher of the Digital Banking Report. Marous advises on innovation, portfolio growth, customer experience, marketing strategies, channel shift, payments and digital transformation within the financial services industry. Internationally recognized expert on the digital transformation of the global consumer banking industry. Extensive network, skill with research methods, and tacit knowledge. Counsels financial services companies, technology firms, and investors on product, solution, and investment strategies.

Internationally recognized expert on the digital transformation of the global consumer banking industry. Extensive network, skill with research methods, and tacit knowledge. Counsels financial services companies, technology firms, and investors on product, solution, and investment strategies. Experienced technology executive in the financial services industry. Trusted advisor and strategist to banks and technology providers in the areas of technology strategy and deployment, product management, marketing, and business development.

Experienced technology executive in the financial services industry. Trusted advisor and strategist to banks and technology providers in the areas of technology strategy and deployment, product management, marketing, and business development.  Payments/Banking Professional with a focus on Innovation

Payments/Banking Professional with a focus on Innovation

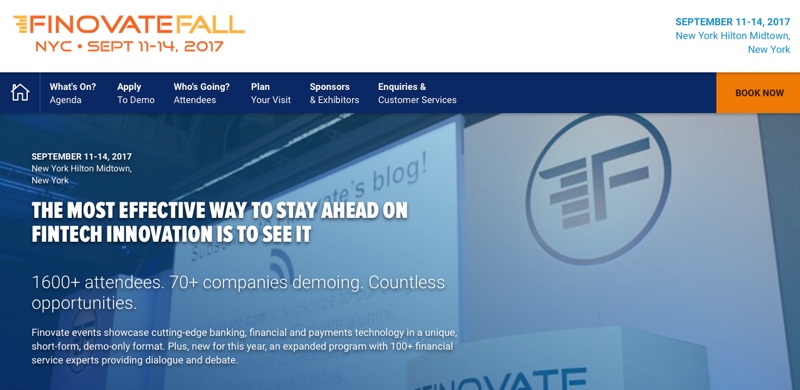

Over the course of the next few months, we’ll take a closer look at the new elements of FinovateFall. The blog will get up close and personal with panelists, preview current events in each of the six summit topics, announce keynote speakers, and of course, give a sneak peek of what the demoing companies will unveil on stage in Finovate’s signature demo format on days one and two.

Over the course of the next few months, we’ll take a closer look at the new elements of FinovateFall. The blog will get up close and personal with panelists, preview current events in each of the six summit topics, announce keynote speakers, and of course, give a sneak peek of what the demoing companies will unveil on stage in Finovate’s signature demo format on days one and two.

Highlighting the company’s history as a e-commerce innovator and its future as a “consumer-oriented, product driven, and technology intensive bank,” Siemiatkowski trained his sights on retail banking itself. “We will … (provide) solutions that ensure a smooth customer experience, help people streamline their financial lives and continue to support businesses by solving the complexity in handling payments,” he said, adding, “the opportunities are tremendous, it is a thrilling prospect.”

Highlighting the company’s history as a e-commerce innovator and its future as a “consumer-oriented, product driven, and technology intensive bank,” Siemiatkowski trained his sights on retail banking itself. “We will … (provide) solutions that ensure a smooth customer experience, help people streamline their financial lives and continue to support businesses by solving the complexity in handling payments,” he said, adding, “the opportunities are tremendous, it is a thrilling prospect.”

solution. “People are drowning in data,” she said. “The last thing I want to do is scroll through my transaction data to see what’s coming.” Instead, OK to Spend provides weekly and monthly communications, along with a calendar of upcoming income and spending. With Save for a Goal, consumers can manage and track savings goals across a variety of accounts and timeframes. The interface relies on visual aids like progress bars and graphs, as well as alerts, to keep consumers engaged with their savings success.

solution. “People are drowning in data,” she said. “The last thing I want to do is scroll through my transaction data to see what’s coming.” Instead, OK to Spend provides weekly and monthly communications, along with a calendar of upcoming income and spending. With Save for a Goal, consumers can manage and track savings goals across a variety of accounts and timeframes. The interface relies on visual aids like progress bars and graphs, as well as alerts, to keep consumers engaged with their savings success.