Summarizing four days of fintech content can be done using a four-letter word: data. That simple term and its many uses was the overarching theme of FinovateEurope last week in London.

The use of data is not new to the industry, but advanced AI models have helped data evolve from the early days of “Big Data” in fintech. Leveraging large data sets for a variety of uses has become an industry standard, but players who make the most of their data will win.

Below, I’ve categorized a variety of data uses, all shown and discussed at FinovateEurope last week. Remember– it’s not how much data you have– it’s how you use it.

AI

When talking about data, artificial intelligence seems like a good place to start. It is AI, after all, that offers deep insight into data.

In his keynote presentation, futurist Rohit Talwar discussed the AI revolution and the road to superintelligence. In the speech, Talwar explained six types of AI:

- Domain specific: the AI knows a lot about the problem, but not about the world surrounding it

- Context-aware: the AI is able to retain information for later use

- Theory of mind: the AI has the capacity to reason like a human

- Self-aware: the AI has an understanding of human emotions

- Superintelligence: the AI is capable of out-thinking humans

- Singularity: the AI has achieved enlightenment and transcendence

Credit scoring and risk underwriting

Data has turned traditional credit scoring upside down– and that’s a good thing. During the demo sessions, ApPello showed how it is using data to transform credit scoring and risk underwriting. The company’s risk assessment technology helps underwrite business loans with thin credit files.

The topic was also breached during the panel discussions, when Hari Ramamurthy, CTO & Technical Architect of Kuflink and Jaidev Janadana, CEO of Zopa each talked about data’s importance in making lending decisions.

Banking the underbanked

This topic is tangential to leveraging non-traditional data sources for credit and scoring. Because unbanked and underbanked individuals have little-to-no credit history, data is the key to providing services to these individuals.

In Friday’s fireside chat with Bernadetta Arese Lucini, Oval Money CEO, Lucini discussed how Oval Money leverages the bank account data of underserved individuals to help them achieve savings goals. Additionally, Sheraz Dar, CEO of CreditLadder explained how CreditLadder uses monthly rental payment information to help users build their credit score by paying their rent on time.

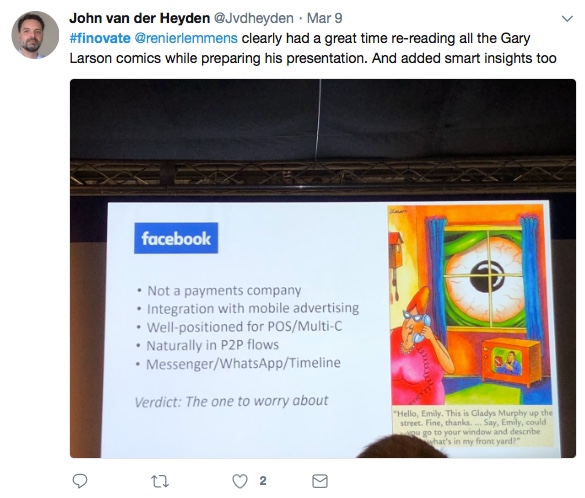

Open your bank

Being in the EU, there was plenty of talk about PSD2. Throughout these discussions, many touted the benefits of consumer data-sharing through the use of APIs. Allowing third parties to leverage data ultimately offers the best experience and provides more options for your customers.

Specifically, Tesobe’s Open Bank Project demoed a portion of its large catalogue of APIs, along with its network of more than 8,000 fintech developers across the globe.

Secure your site

Data gathered about how consumers navigate a website or a mobile app can help flag fraudulent activity. Two demo companies exemplified this use case.

First, Fortytwo Data showed how data can help banks comply with anti-money laundering regulations and leverage behavioral analytics and transaction monitoring to meet compliance standards and keep the client’s account secure.

Next, HooYu demoed how it leverages customer data to help onboard customers and ultimately meet security and compliance needs.

Personalizatoin

Personalization is a huge use case for consumer data. By tailoring the user experience based on the client’s specific needs, banks and fintechs stand to gain more customers and sell more products, ultimately improving the user experience. Three companies exemplified this in their demos.

First, Efigence debuted EFI4 Analytics, which converts data into insights and automatically recommends banking products based on those insights in real time.

Next, DataSine showed how it uses psychology and machine learning to tailor the customer experience and segment the audience by personality type at scale.

Finally, W.UP takes a range of customer data– including photos on their camera roll, fitness data, and geolocation– analyzes it using AI, and leverages those insights to create a personalized user experience.

Regulation

With the GDPR deadline looming, data protection is on the minds of many banks and fintechs across the globe. This topic emanated in almost all discussions throughout the conference.

Analytics Marketing

Offering loyalty and rewards to consumers is a great way to differentiate a payments offering. This topic was quite popular in 2011 but faded after mobile wallets struggled to gain ground. With the advent of more powerful analytics thanks to AI, however, loyalty and rewards offerings are experiencing another surge in interest. Four companies in last week’s show demonstrated how consumer data can be analyzed to improve marketing efforts.

First, CASHOFF uses consumer transaction information to create a white-labeled, gamified loyalty rewards program that is tailored consumer preferences.

Second, Yoyo offers a payment and loyalty platform that leverages behavioral analytics and marketing tools to effectively reach consumers, increase their transactions, and offer them spending insight via receipt analysis.

Finally, Touche showed how it analyzes consumers’ historic activity and predicts behavior in order to offer merchants insights for loyalty programs and targeted marketing campaigns.

Investing

Robo advisory services stand to win big if they leverage data correctly. By analyzing large data sets about consumer confidence and market sentiment, algorithmic investing models can win over consumers. On the human side, financial advisors also benefit by gaining the ability to better manage more portfolios at scale. Two companies exemplified this during the demo session.

First, YUKKA Labs showcased its language intelligence capabilities that evaluate financial news to help advisors and individual investors make better investment decisions.

Second, aixigo demoed how it leverages data to help advisors scale their offerings and manage millions of portfolios.

“Banks need to ask themselves whether they are flexible and sensitive enough to adapt to the rapidly changing context.” Harrie Vollaard, Head of FinTech Ventures at Rabobank, has established several partnerships with startups, manages the Fintech investments for the Rabobank, is involved in Fintech accelerator programs around the globe, and created several spinoffs. Speaking at FinovateEurope 2018 about

“Banks need to ask themselves whether they are flexible and sensitive enough to adapt to the rapidly changing context.” Harrie Vollaard, Head of FinTech Ventures at Rabobank, has established several partnerships with startups, manages the Fintech investments for the Rabobank, is involved in Fintech accelerator programs around the globe, and created several spinoffs. Speaking at FinovateEurope 2018 about